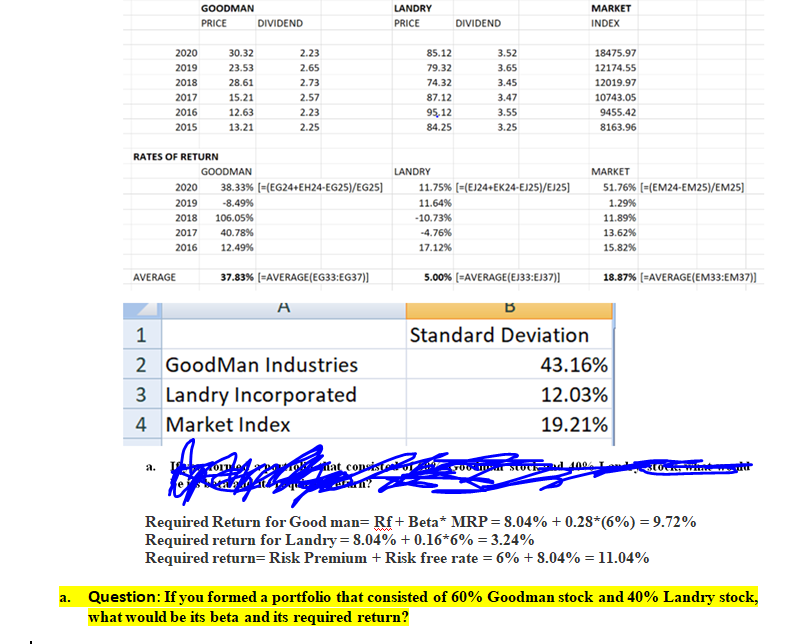

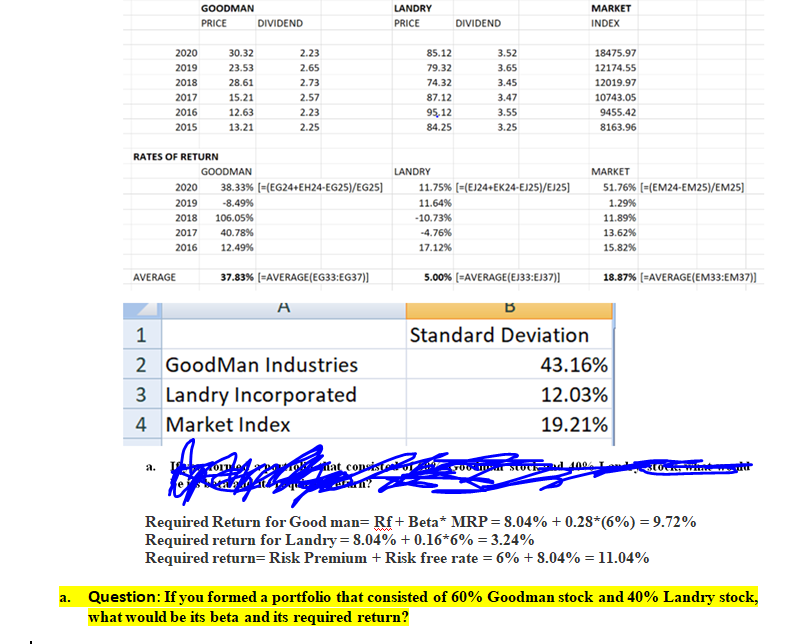

GOODMAN PRICE DIVIDEND LANDRY PRICE MARKET INDEX DIVIDEND 2020 2019 2018 2017 2016 2015 30.32 23.53 28.61 15.21 12.63 13.21 2.23 2.65 2.73 2.57 2.23 2.25 85.12 79.32 74.32 87.12 95,12 84.25 3.52 3.65 3.45 3.47 3.55 3.25 18475.97 12174.55 12019.97 10743.05 9455.42 8163.96 RATES OF RETURN GOODMAN 2020 38.33% (=(EG24+EH24-EG25)/EG25) 2019 -8.49% 2018 106.05% 2017 40.78% 2016 12.49% LANDRY 11.75% (=(EJ24.EK24-EJ25)/EJ25) 11.64% -10.73% -4.76% 17.12% MARKET 51.76% [-(EM24-EM25)/EM25) 1.29% 11.89% 13.62% 15.82% AVERAGE 37.83% (=AVERAGE(EG33:EG37)] 1 2 Good Man Industries 3 Landry Incorporated 4. Market Index 5.00% (=AVERAGE(E133:E137)] 18.87% (=AVERAGE(EM33:EM37)] B Standard Deviation 43.16% 12.03% 19.21% a. nat.com istom Required Return for Good man=Rf+ Beta* MRP=8.04% +0.28*(6%) = 9.72% Required return for Landry= 8.04% +0.16*6% = 3.24% Required return=Risk Premium + Risk free rate = 6% +8.04% = 11.04% a. Question: If you formed a portfolio that consisted of 60% Goodman stock and 40% Landry stock, what would be its beta and its required return? GOODMAN PRICE DIVIDEND LANDRY PRICE MARKET INDEX DIVIDEND 2020 2019 2018 2017 2016 2015 30.32 23.53 28.61 15.21 12.63 13.21 2.23 2.65 2.73 2.57 2.23 2.25 85.12 79.32 74.32 87.12 95,12 84.25 3.52 3.65 3.45 3.47 3.55 3.25 18475.97 12174.55 12019.97 10743.05 9455.42 8163.96 RATES OF RETURN GOODMAN 2020 38.33% (=(EG24+EH24-EG25)/EG25) 2019 -8.49% 2018 106.05% 2017 40.78% 2016 12.49% LANDRY 11.75% (=(EJ24.EK24-EJ25)/EJ25) 11.64% -10.73% -4.76% 17.12% MARKET 51.76% [-(EM24-EM25)/EM25) 1.29% 11.89% 13.62% 15.82% AVERAGE 37.83% (=AVERAGE(EG33:EG37)] 1 2 Good Man Industries 3 Landry Incorporated 4. Market Index 5.00% (=AVERAGE(E133:E137)] 18.87% (=AVERAGE(EM33:EM37)] B Standard Deviation 43.16% 12.03% 19.21% a. nat.com istom Required Return for Good man=Rf+ Beta* MRP=8.04% +0.28*(6%) = 9.72% Required return for Landry= 8.04% +0.16*6% = 3.24% Required return=Risk Premium + Risk free rate = 6% +8.04% = 11.04% a. Question: If you formed a portfolio that consisted of 60% Goodman stock and 40% Landry stock, what would be its beta and its required return