Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Goods market in an open economy. Consider the following open economy. The real exchange rate is fixed and equal to 1. Consumption is given

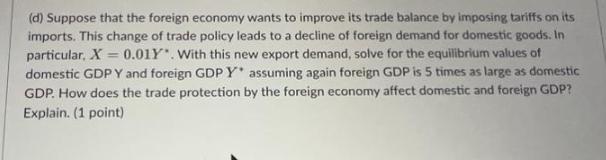

Goods market in an open economy. Consider the following open economy. The real exchange rate is fixed and equal to 1. Consumption is given by C= 100+ 0.5(Y-T), investment is I = 50, taxes are T = 10, and government spending is G = 15. Imports and exports are given by IM= 0.1Y and X 0.02Y where Y* is foreign GDP. = (a) Solve for the equilibrium Y in the domestic economy for any given Y*. (2 points) (b) What is the multiplier in this economy? If we were to close the economy- so exports and imports were identically zero - what would the multiplier be? Why are the open and closed economy multipliers different? (1 point) (c) Assume that foreign GDP is 5 times as large as domestic GDP. What is the equilibrium value of domestic GDP Y? If the foreign economy experiences a boom and its GDP increases by 10%, what is the new equilibrium value of domestic GDP Y? (1 point) (d) Suppose that the foreign economy wants to improve its trade balance by imposing tariffs on its imports. This change of trade policy leads to a decline of foreign demand for domestic goods. In particular, X= 0.01Y". With this new export demand, solve for the equilibrium values of domestic GDP Y and foreign GDP Y* assuming again foreign GDP is 5 times as large as domestic GDP. How does the trade protection by the foreign economy affect domestic and foreign GDP? Explain. (1 point)

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a To find the equilibrium output Y in the domestic economy we need to equate aggregate demand AD with aggregate supply AS In an open economy AD is given by AD C I G X IM Given that C 100 05Y T I 50 T ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started