Google is considering a project to move a fraction of its workforce out of Silicon Valley to a cheaper, more efficient location. There are

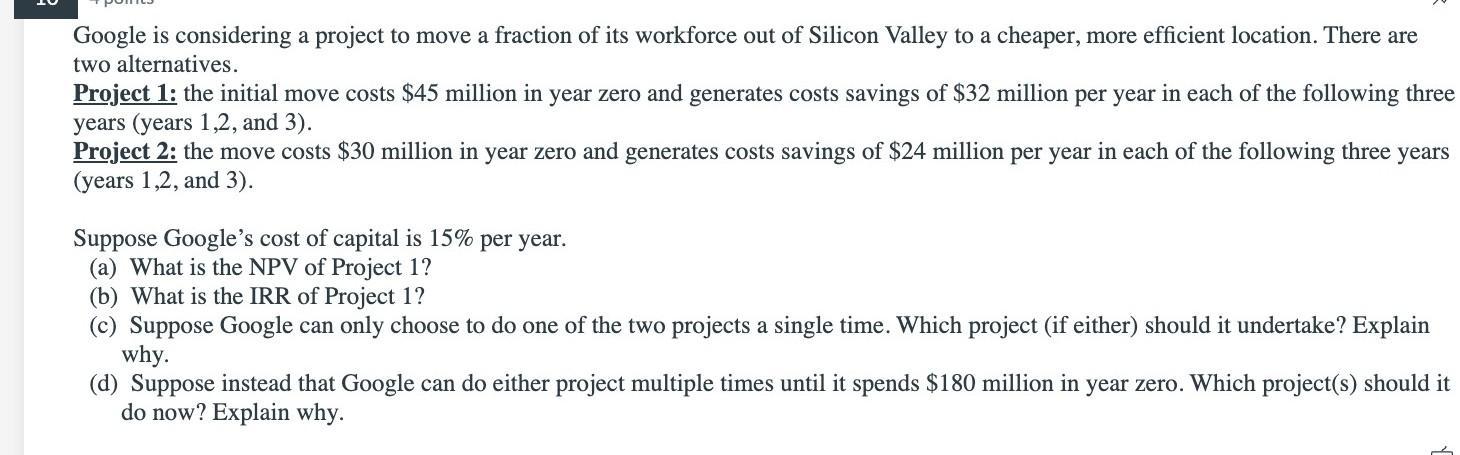

Google is considering a project to move a fraction of its workforce out of Silicon Valley to a cheaper, more efficient location. There are two alternatives. Project 1: the initial move costs $45 million in year zero and generates costs savings of $32 million per year in each of the following three years (years 1,2, and 3). Project 2: the move costs $30 million in year zero and generates costs savings of $24 million per year in each of the following three years (years 1,2, and 3). Suppose Google's cost of capital is 15% per year. (a) What is the NPV of Project 1? (b) What is the IRR of Project 1? (c) Suppose Google can only choose to do one of the two projects a single time. Which project (if either) should it undertake? Explain why. (d) Suppose instead that Google can do either project multiple times until it spends $180 million in year zero. Which project(s) should it do now? Explain why.

Step by Step Solution

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV and Internal Rate of Return IRR we need to discount the cash flows using the cost of capital Lets calculate the NPV and IRR for both projects a NPV of Project 1 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started