Answered step by step

Verified Expert Solution

Question

1 Approved Answer

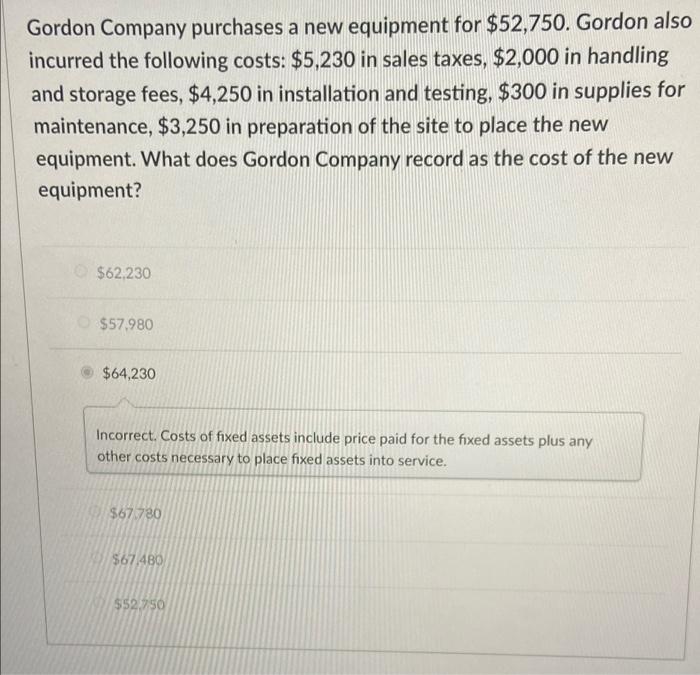

Gordon Company purchases a new equipment for $52,750. Gordon also incurred the following costs: $5,230 in sales taxes, $2,000 in handling and storage fees,

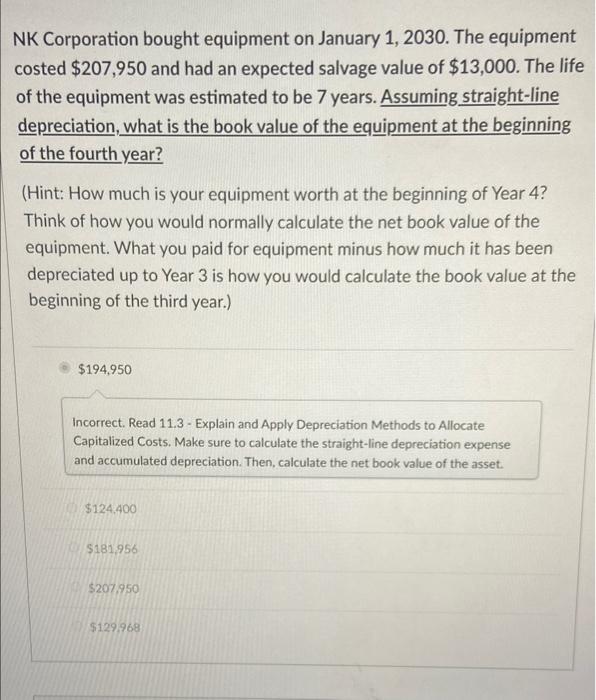

Gordon Company purchases a new equipment for $52,750. Gordon also incurred the following costs: $5,230 in sales taxes, $2,000 in handling and storage fees, $4,250 in installation and testing, $300 in supplies for maintenance, $3,250 in preparation of the site to place the new equipment. What does Gordon Company record as the cost of the new equipment? $62,230 $57,980 $64,230 Incorrect. Costs of fixed assets include price paid for the fixed assets plus any other costs necessary to place fixed assets into service. $67.780 $67.480 $52.750 NK Corporation bought equipment on January 1, 2030. The equipment costed $207,950 and had an expected salvage value of $13,000. The life of the equipment was estimated to be 7 years. Assuming straight-line depreciation, what is the book value of the equipment at the beginning of the fourth year? (Hint: How much is your equipment worth at the beginning of Year 4? Think of how you would normally calculate the net book value of the equipment. What you paid for equipment minus how much it has been depreciated up to Year 3 is how you would calculate the book value at the beginning of the third year.) $194,950 Incorrect. Read 11.3- Explain and Apply Depreciation Methods to Allocate Capitalized Costs. Make sure to calculate the straight-line depreciation expense and accumulated depreciation. Then, calculate the net book value of the asset. $124.400 $181,956 $207,950 $129.968

Step by Step Solution

★★★★★

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

2 Cost of asset When there is purchase of assets by the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started