Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gordon & Groton, CPAs, were the auditors of Bank & Company, a brokerage firm and member of a national stock exchange. Gordon & Groton audited

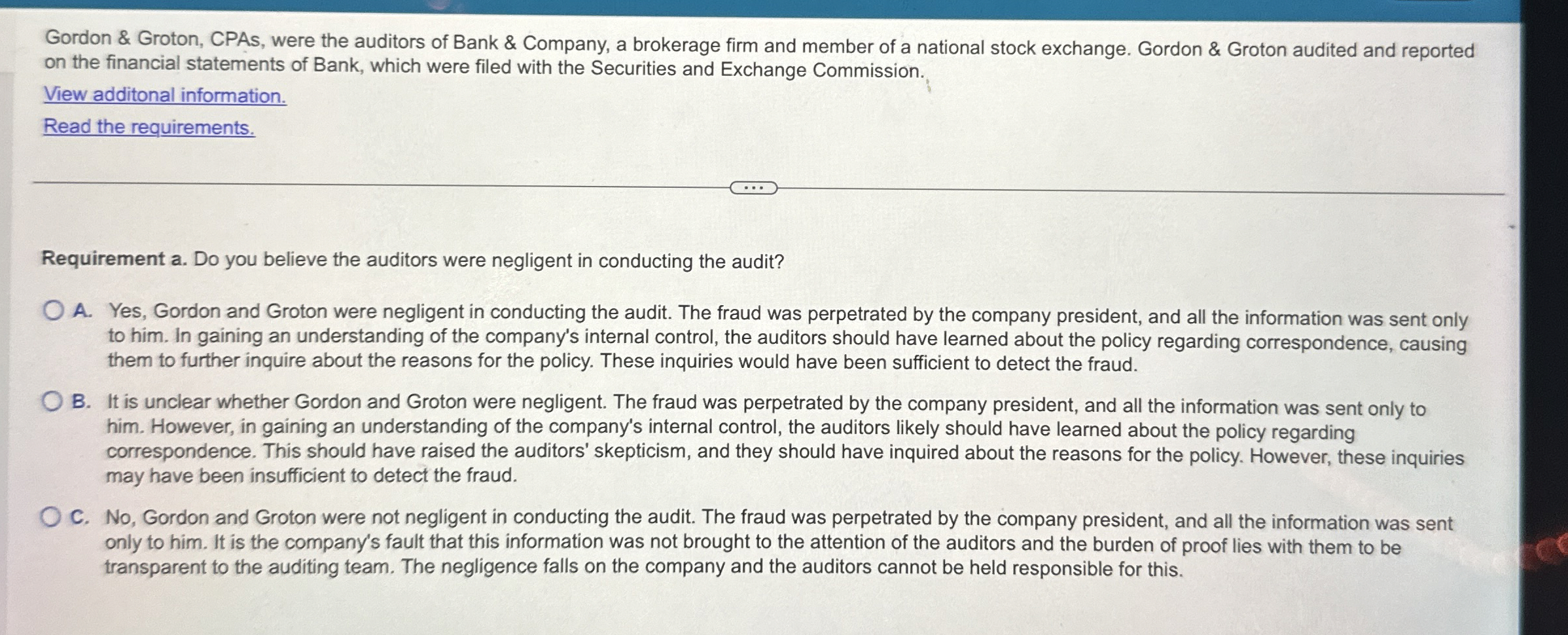

Gordon & Groton, CPAs, were the auditors of Bank & Company, a brokerage firm and member of a national stock exchange. Gordon & Groton audited and reported

on the financial statements of Bank, which were filed with the Securities and Exchange Commission.

View additonal information.

Read the requirements.

Requirement a Do you believe the auditors were negligent in conducting the audit?

A Yes, Gordon and Groton were negligent in conducting the audit. The fraud was perpetrated by the company president, and all the information was sent only

to him. In gaining an understanding of the company's internal control, the auditors should have learned about the policy regarding correspondence, causing

them to further inquire about the reasons for the policy. These inquiries would have been sufficient to detect the fraud.

B It is unclear whether Gordon and Groton were negligent. The fraud was perpetrated by the company president, and all the information was sent only to

him. However, in gaining an understanding of the company's internal control, the auditors likely should have learned about the policy regarding

correspondence. This should have raised the auditors' skepticism, and they should have inquired about the reasons for the policy. However, these inquiries

may have been insufficient to detect the fraud.

C No Gordon and Groton were not negligent in conducting the audit. The fraud was perpetrated by the company president, and all the information was sent

only to him. It is the company's fault that this information was not brought to the attention of the auditors and the burden of proof lies with them to be

transparent to the auditing team. The negligence falls on the company and the auditors cannot be held responsible for this.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started