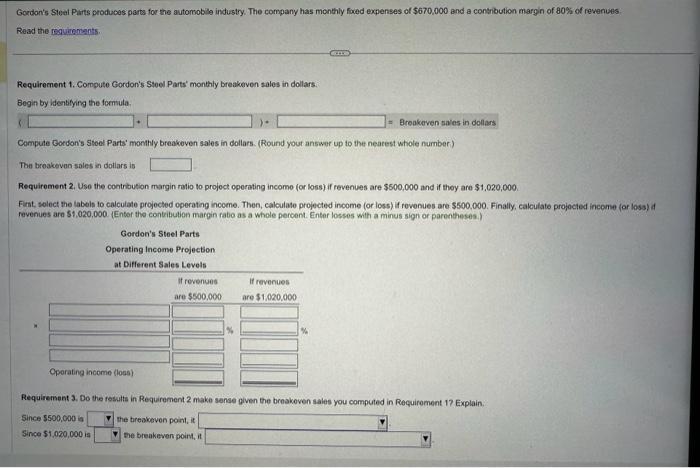

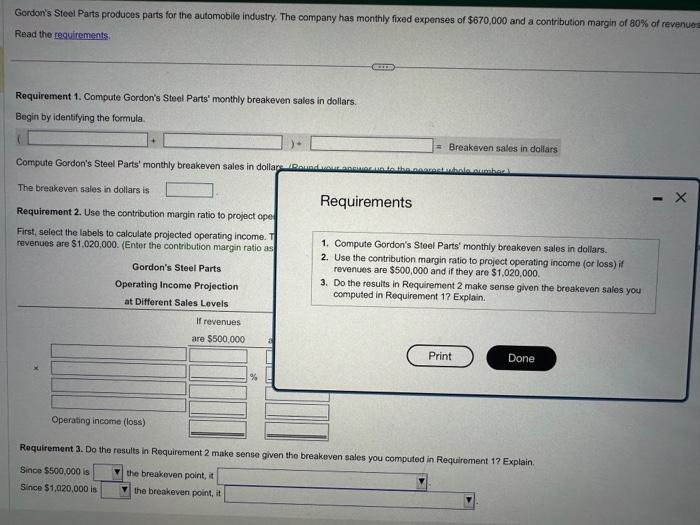

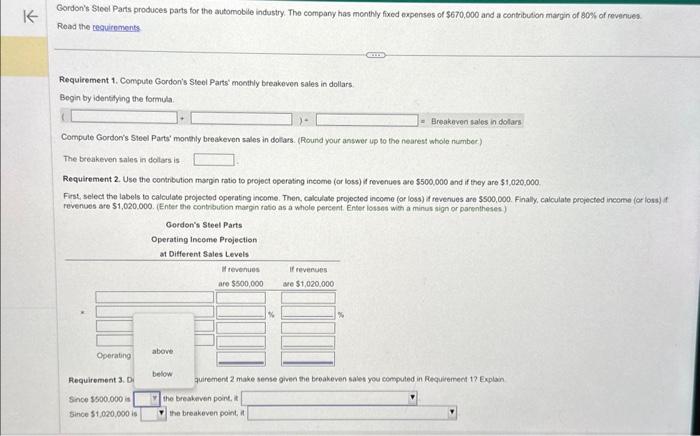

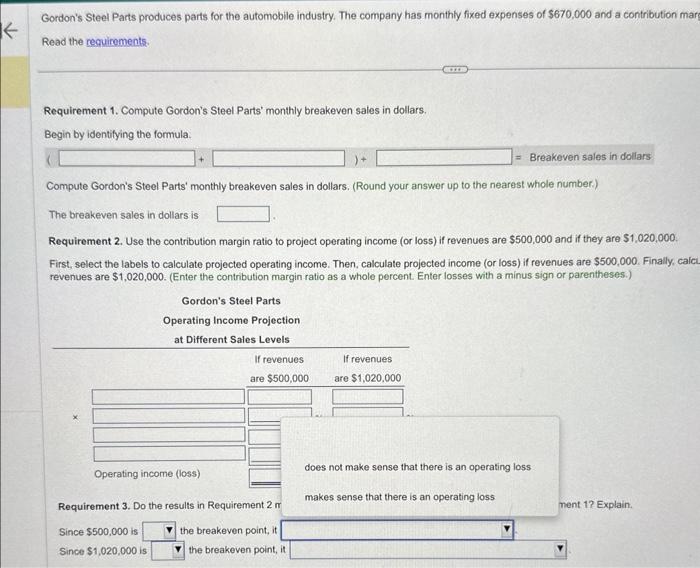

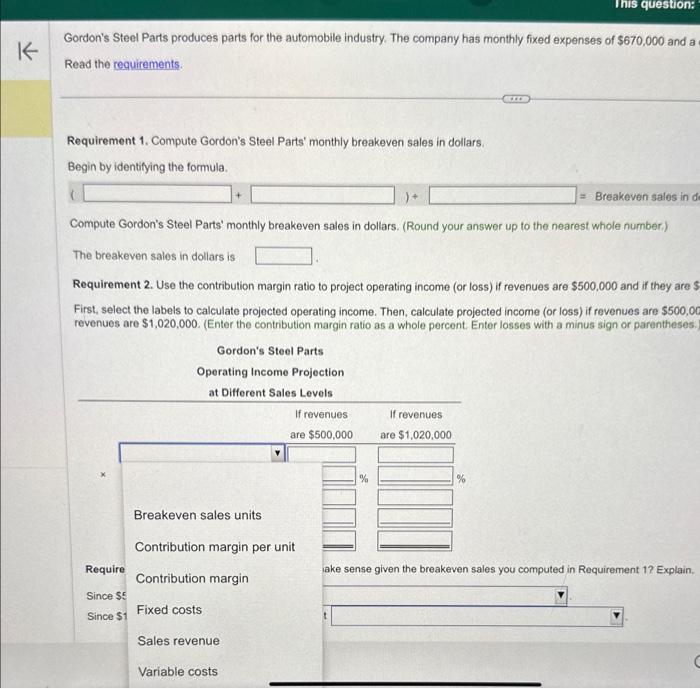

Gordon's Steal Purts produces parts for the automobile industry. The company has monthly foxed expenses of \\( \\$ 670,000 \\) and a contribution margh of \80 of revenues Read the reguirements. Requirement 1. Compute Gordon's Steel Parts' monthly breakeven sales in dollars. Begin by identifying the formula. Compute Gordon's Stoel Parts' momhly breakoven sales in dollars. (Round yout answer up to the nearest whole number) The broakeven sales in dotiars is Requirement 2. Use the contribution margin ratio to projoct operating incomo (or loss) if revenues are \\( \\$ 500,000 \\) and if they are \\( \\$ 1,020,000 \\). Fint, solect the tabels to calculate projected operating income. Then, caloulate projected income (or loss) if revonues are \\( \\$ 500.000 \\). Finally, calculate projocted income (or lass) af revenues are \\( \\$ 1,020,000 \\). Enter the conteribution margin rabo as a whole percent. Enter lossos with a minus sign or parentheses.) Requirement 3. Do the resuits in Requirement 2 make sanse given the breakoven sales you computed in Requiroment 17 Explain. since \\( \\$ 500,000 \\) ia the treakeven point, it Since \\( \\$ 1,020,000 \\) is be breakeven point, Gordon's Steel Parts produces parts for the automobile industry. The company has monthly fixed expenses of \\( \\$ 670,000 \\) and a contribution margin of \80 of revenue Read the requirements. Requirement 1. Compute Gordon's Steel Parts' monthly breakeven sales in dollars. Begin by identifying the formula. The breakeven sales in dollars is Requirement 2 . Use the contribution margin ratio to project ope Requirements First, select the labels to calculate projected operating income. T revenues are \\( \\$ 1,020,000 \\). (Enter the contribution margin ratio as 1. Compute Gordon's Steel Parts' monthly breakeven sales in dollars. 2. Use the contribution margin ratio to project operating income (or loss) if revenues are \\( \\$ 500,000 \\) and if they are \\( \\$ 1,020,000 \\). 3. Do the results in Requirement 2 make sense given the breakeven sales you computed in Requirement 1 ? Explain. Requirement 3. Do the results in Requirement 2 make sense given the breakeven sales you computed in Requiroment 1 ? Explain. Since \\( \\$ 500,000 \\) is Since \\( \\$ 1,020,000 \\) is the breakoven point, it the breakeven point, Gordon's Steel Parts produces parts for the automobile industry. The company has monthly fixed expenses of \\( \\$ 670,000 \\) and a Read the requirements. Requirement 1. Compute Gordon's Steel Parts' monthly breakeven sales in dollars. Begin by identifying the formula. Compute Gordon's Steel Parts' monthly breakeven sales in dollars. (Round your answer up to the nearest whole number.) The breakeven sales in dollars is Requirement 2. Use the contribution margin ratio to project operating income (or loss) if revenues are \\( \\$ 500,000 \\) and if they are First, select the labels to calculate projected operating income. Then, calculate projected income (or loss) if revenues are \\( \\$ 500,00 \\) revenues are \\( \\$ 1,020,000 \\). (Enter the contribution margin ratio as a whole percent. Enter losses with a minus sign or parentheses. les you computed in Requirement 1 ? Explain. Gordon's Steel Parts produces parts for the automobile industry. The company has monthly fixed expenses of \\( \\$ 670,000 \\) and a contribution margin of \80 of revenue Read the requirements. Requirement 1. Compute Gordon's Steel Parts' monthly breakeven sales in dollars. Begin by identifying the formula. The breakeven sales in dollars is Requirement 2 . Use the contribution margin ratio to project ope Requirements First, select the labels to calculate projected operating income. T revenues are \\( \\$ 1,020,000 \\). (Enter the contribution margin ratio as 1. Compute Gordon's Steel Parts' monthly breakeven sales in dollars. 2. Use the contribution margin ratio to project operating income (or loss) if revenues are \\( \\$ 500,000 \\) and if they are \\( \\$ 1,020,000 \\). 3. Do the results in Requirement 2 make sense given the breakeven sales you computed in Requirement 1 ? Explain. Requirement 3. Do the results in Requirement 2 make sense given the breakeven sales you computed in Requiroment 1 ? Explain. Since \\( \\$ 500,000 \\) is Since \\( \\$ 1,020,000 \\) is the breakoven point, it the breakeven point, Gordon's Sieal Parts produces parts for the automoble industry. The company has monthly fixed expenses of \\( \\$ 670,000 \\) and a contribution margin of \80 of revenues. Road the reguirements Requirement 1. Compute Gordon's Steel Parts' moothly breakeven sales in dollars. Begin by identitying the formula: Compute Gordoris Steel Parts' monthly breakeven sales in doltars. (Round yout answer up to the nearest whole number.) The breakeven sales in dolars is Requirement 2. Use the comtribution margin ratio to project operating income (or loss) if revenues are \\( \\$ 500,000 \\) and if they are \\( \\$ 1,020,000 \\). Ferst, select the labels to calculate projected operating income. Then, calculate projocted income (or loss) if revenues are \\( \\$ 500,000 \\). Finally, calculate projected income (or loss) if revenues are \\$1,020,000. (Enter the contribution matpin ratio as a whole pereent. Enter losses with a minus sign or parentheses) Hes you computed in Requiremeet 1? Explain Since \\( \\$ 500.000 \\) is the breakeven point, af since \\( 5+, 020,000 \\) is the breakeven point