Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gorham Manufacturing's sales slumped badly in 2020. For the first time in its history, it operated at a loss. The company's income statement showed the

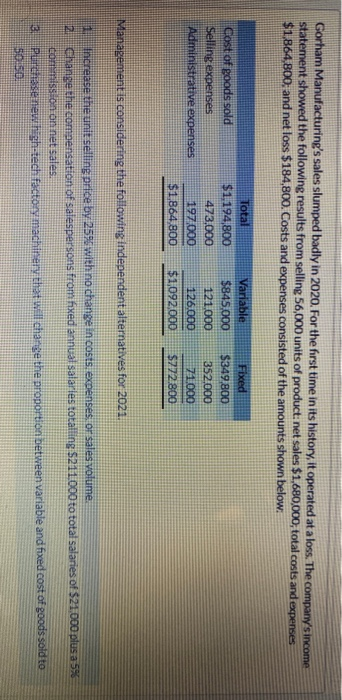

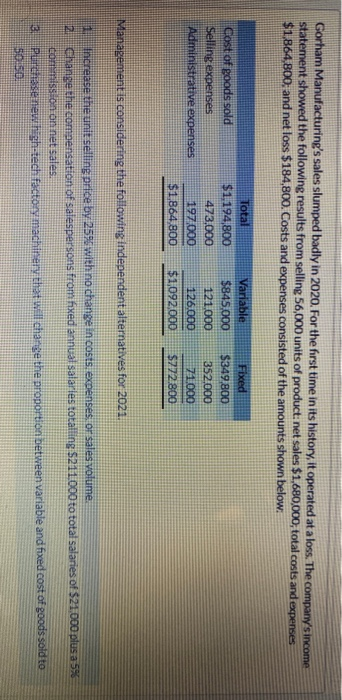

Gorham Manufacturing's sales slumped badly in 2020. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 56,000 units of product: net sales $1,680,000, total costs and expenses $1,864,800, and net loss $184,800. Costs and expenses consisted of the amounts shown below: Cost of goods sold Selling expenses Administrative expenses Total $1,194,800 473.000 197.000 $1.864.800 Variable $845.000 121.000 126.000 $1,092,000 Fixed $349,800 352.000 71.000 $272.800 Management is considering the following independent alternatives for 2021. Increase the unit selling price by 2596 with no change in costs, expenses or sales volume. 2. Change the compensation of salespersons from fixed annual salarles totalling $211000to total salaries of $21,000 plus a 5% cons on annet sales Purchase new.high-tech factory machinery that will change the proportion between variable and fixed cost of goods sold to 50 SO 3 Gorham Manufacturing's sales slumped badly in 2020. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 56,000 units of product: net sales $1,680,000, total costs and expenses $1,864,800, and net loss $184,800. Costs and expenses consisted of the amounts shown below: Cost of goods sold Selling expenses Administrative expenses Total $1,194,800 473.000 197.000 $1.864.800 Variable $845.000 121.000 126.000 $1,092,000 Fixed $349,800 352.000 71.000 $272.800 Management is considering the following independent alternatives for 2021. Increase the unit selling price by 2596 with no change in costs, expenses or sales volume. 2. Change the compensation of salespersons from fixed annual salarles totalling $211000to total salaries of $21,000 plus a 5% cons on annet sales Purchase new.high-tech factory machinery that will change the proportion between variable and fixed cost of goods sold to 50 SO 3

Gorham Manufacturing's sales slumped badly in 2020. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 56,000 units of product: net sales $1,680,000, total costs and expenses $1,864,800, and net loss $184,800. Costs and expenses consisted of the amounts shown below: Cost of goods sold Selling expenses Administrative expenses Total $1,194,800 473.000 197.000 $1.864.800 Variable $845.000 121.000 126.000 $1,092,000 Fixed $349,800 352.000 71.000 $272.800 Management is considering the following independent alternatives for 2021. Increase the unit selling price by 2596 with no change in costs, expenses or sales volume. 2. Change the compensation of salespersons from fixed annual salarles totalling $211000to total salaries of $21,000 plus a 5% cons on annet sales Purchase new.high-tech factory machinery that will change the proportion between variable and fixed cost of goods sold to 50 SO 3 Gorham Manufacturing's sales slumped badly in 2020. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 56,000 units of product: net sales $1,680,000, total costs and expenses $1,864,800, and net loss $184,800. Costs and expenses consisted of the amounts shown below: Cost of goods sold Selling expenses Administrative expenses Total $1,194,800 473.000 197.000 $1.864.800 Variable $845.000 121.000 126.000 $1,092,000 Fixed $349,800 352.000 71.000 $272.800 Management is considering the following independent alternatives for 2021. Increase the unit selling price by 2596 with no change in costs, expenses or sales volume. 2. Change the compensation of salespersons from fixed annual salarles totalling $211000to total salaries of $21,000 plus a 5% cons on annet sales Purchase new.high-tech factory machinery that will change the proportion between variable and fixed cost of goods sold to 50 SO 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started