Answered step by step

Verified Expert Solution

Question

1 Approved Answer

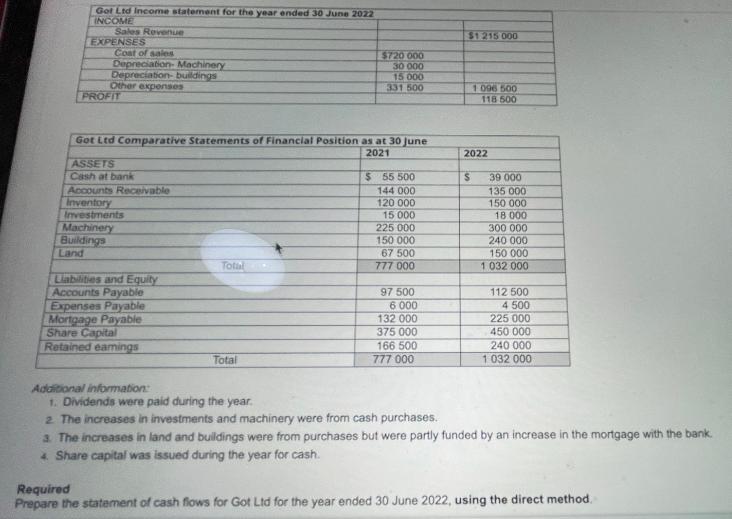

Got Ltd Income statement for the year ended 30 June 2022 INCOME Sales Revenue EXPENSES Coat of sales Depreciation Machinery Depreciation-buildings Other expenses PROFIT

Got Ltd Income statement for the year ended 30 June 2022 INCOME Sales Revenue EXPENSES Coat of sales Depreciation Machinery Depreciation-buildings Other expenses PROFIT Got Ltd Comparative Statements of Financial Position as at 30 June 2021 ASSETS Cash at bank Accounts Receivable Inventory Investments Machinery Buildings Land Liabilities and Equity Accounts Payable Expenses Payable Mortgage Payable Share Capital Retained earnings Total $720 000 30 000 15 000 331 500 Total $ 55 500 144 000 120 000 15 000 225 000 150 000 67 500 777 000 97 500 6.000 132 000 375 000 166 500 777 000 Additional information: 1. Dividends were paid during the year. 2. The increases in investments and machinery were from cash purchases. $1215 000 1 096 500 118 500 2022 S 39 000 135 000 150 000 18.000 300 000 240 000 150 000 1 032 000 112 500 4 500 225 000 450 000 240 000 1 032 000 3. The increases in land and buildings were from purchases but were partly funded by an increase in the mortgage with the bank. 4. Share capital was issued during the year for cash. Required Prepare the statement of cash flows for Got Ltd for the year ended 30 June 2022, using the direct method.

Step by Step Solution

★★★★★

3.31 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the statement of cash flows for Got Ltd for the year ended 30 June 2022 using the direct method we need to analyze the changes in cash flows from operating investing and financing activitie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started