Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gouhua Zhang has made the following assumptions for a capital budgeting project: Fixed capital investment is 20,000; no investment in net working capital is

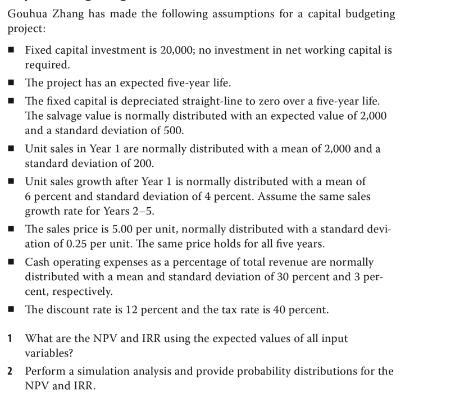

Gouhua Zhang has made the following assumptions for a capital budgeting project: Fixed capital investment is 20,000; no investment in net working capital is required. The project has an expected five-year life. The fixed capital is depreciated straight-line to zero over a five-year life. The salvage value is normally distributed with an expected value of 2,000 and a standard deviation of 500. Unit sales in Year 1 are normally distributed with a mean of 2,000 and a standard deviation of 200. Unit sales growth after Year 1 is normally distributed with a mean of 6 percent and standard deviation of 4 percent. Assume the same sales growth rate for Years 2-5. The sales price is 5.00 per unit, normally distributed with a standard devi- ation of 0.25 per unit. The same price holds for all five years. Cash operating expenses as a percentage of total revenue are normally distributed with a mean and standard deviation of 30 percent and 3 per- cent, respectively. The discount rate is 12 percent and the tax rate is 40 percent. 1 What are the NPV and IRR using the expected values of all input variables? 2 Perform a simulation analysis and provide probability distributions for the NPV and IRR.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Solution to 1 Time Fixed capital Aftertax salvage value Price Output Reven...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started