Question

Govind, age 31, earns a salary of $56,000 and is not an active participant in any other qualified plan. His wife, Olga, reports $600

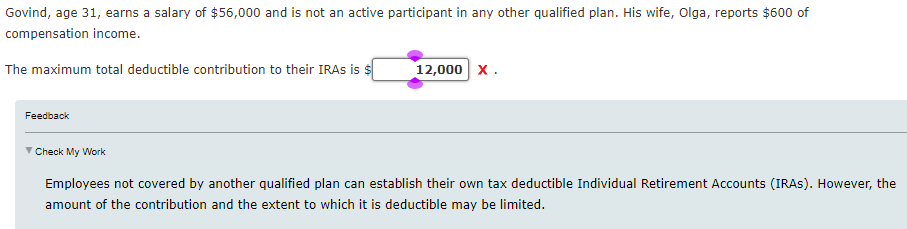

Govind, age 31, earns a salary of $56,000 and is not an active participant in any other qualified plan. His wife, Olga, reports $600 of compensation income. The maximum total deductible contribution to their IRAs is 12,000 X. Feedback Check My Work Employees not covered by another qualified plan can establish their own tax deductible Individual Retirement Accounts (IRAs). However, the amount of the contribution and the extent to which it is deductible may be limited.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER In this case Govind is not an active participant in any other qualified plan and his wife Olg...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South-Western Federal Taxation 2022 Individual Income Taxes

Authors: James C. Young, Annette Nellen, William A. Raabe, Mark Persellin, William H. Hoffman

45th Edition

0357519078, 978-0357519073

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App