Answered step by step

Verified Expert Solution

Question

1 Approved Answer

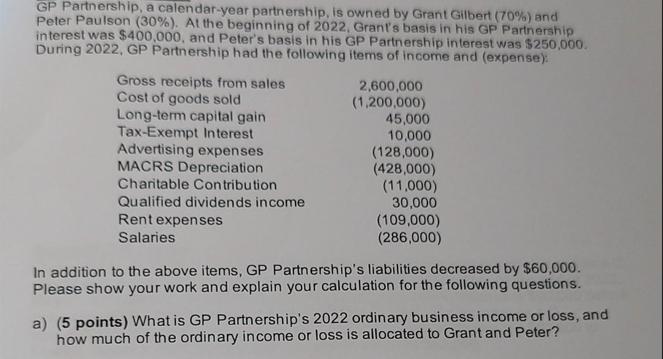

GP Partnership, a calendar-year partnership, is owned by Grant Gilbert (70%) and Peter Paulson (30%). At the beginning of 2022, Grant's basis in his

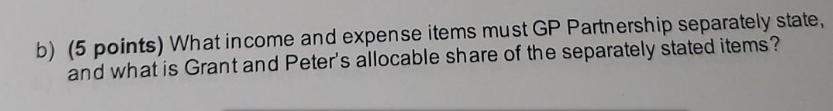

GP Partnership, a calendar-year partnership, is owned by Grant Gilbert (70%) and Peter Paulson (30%). At the beginning of 2022, Grant's basis in his GP Partnership interest was $400,000, and Peter's basis in his GP Partnership interest was $250,000. During 2022, GP Partnership had the following items of income and (expense): Gross receipts from sales Cost of goods sold Long-term capital gain Tax-Exempt Interest Advertising expenses MACRS Depreciation Charitable Contribution Qualified dividends income Rent expenses Salaries 2,600,000 (1,200,000) 45,000 10,000 (128,000) (428,000) (11,000) 30,000 (109,000) (286,000) In addition to the above items, GP Partnership's liabilities decreased by $60,000. Please show your work and explain your calculation for the following questions. a) (5 points) What is GP Partnership's 2022 ordinary business income or loss, and how much of the ordinary income or loss is allocated to Grant and Peter? b) (5 points) What income and expense items must GP Partnership separately state, and what is Grant and Peter's allocable share of the separately stated items?

Step by Step Solution

★★★★★

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate GP Partnerships 2022 ordinary business income or loss we need to sum up the income an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started