Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GPP Company (GPPC) is expanding its research and production capacity to introduce a new line of products. Current plans call for $100 million on

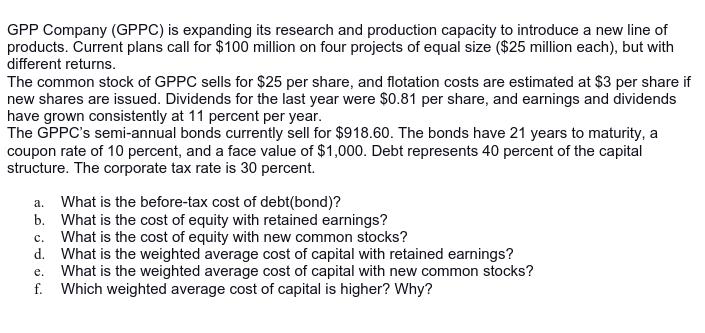

GPP Company (GPPC) is expanding its research and production capacity to introduce a new line of products. Current plans call for $100 million on four projects of equal size ($25 million each), but with different returns. The common stock of GPPC sells for $25 per share, and flotation costs are estimated at $3 per share if new shares are issued. Dividends for the last year were $0.81 per share, and earnings and dividends have grown consistently at 11 percent per year. The GPPC's semi-annual bonds currently sell for $918.60. The bonds have 21 years to maturity, a coupon rate of 10 percent, and a face value of $1,000. Debt represents 40 percent of the capital structure. The corporate tax rate is 30 percent. a. What is the before-tax cost of debt(bond)? b. What is the cost of equity with retained earnings? c. What is the cost of equity with new common stocks? d. What is the weighted average cost of capital with retained earnings? e. What is the weighted average cost of capital with new common stocks? f. Which weighted average cost of capital is higher? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started