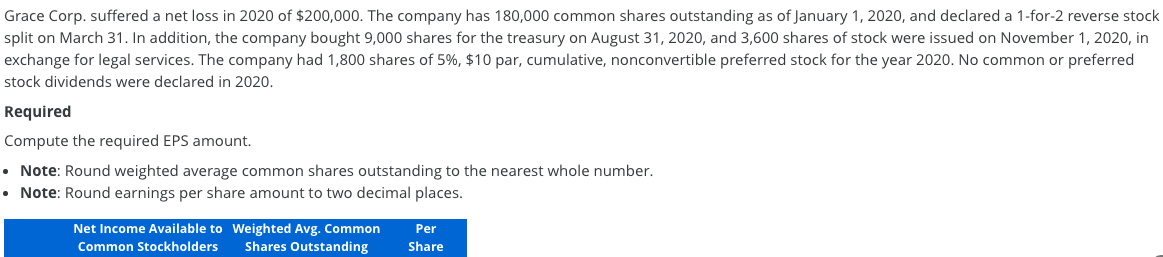

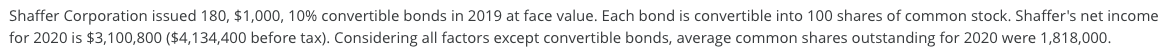

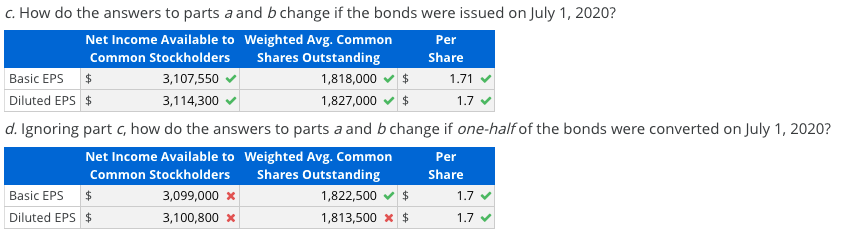

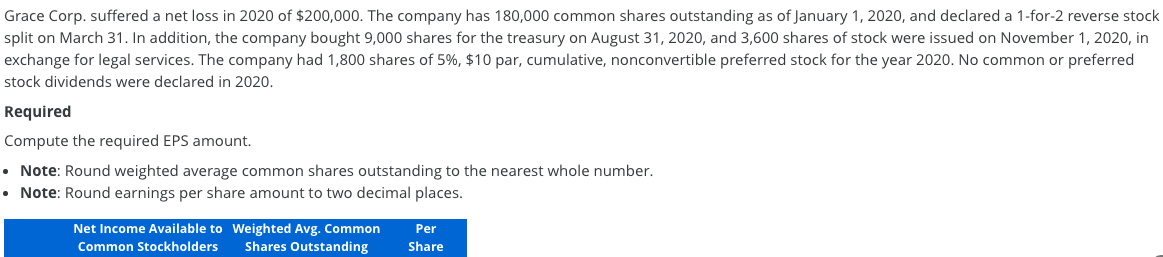

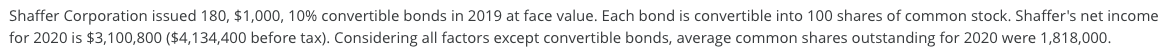

Grace Corp. suffered a net loss in 2020 of $200,000. The company has 180,000 common shares outstanding as of January 1, 2020, and declared a 1-for-2 reverse stock split on March 31. In addition, the company bought 9,000 shares for the treasury on August 31, 2020, and 3,600 shares of stock were issued on November 1, 2020, in exchange for legal services. The company had 1,800 shares of 5%, $10 par, cumulative, nonconvertible preferred stock for the year 2020. No common or preferred stock dividends were declared in 2020. Required Compute the required EPS amount. Note: Round weighted average common shares outstanding to the nearest whole number. Note: Round earnings per share amount to two decimal places. Net Income Available to Weighted Avg. Common Common Stockholders Shares Outstanding Per Share Shaffer Corporation issued 180, $1,000, 10% convertible bonds in 2019 at face value. Each bond is convertible into 100 shares of common stock. Shaffer's net income for 2020 is $3,100,800 ($4,134,400 before tax). Considering all factors except convertible bonds, average common shares outstanding for 2020 were 1,818,000. c. How do the answers to parts a and b change if the bonds were issued on July 1, 2020? Net Income Available to Weighted Avg. Common Per Common Stockholders Shares Outstanding Share Basic EPS $ 3,107,550 1,818,000 $ 1.71 Diluted EPS $ 3,114,300 1,827,000 $ 1.7 d. Ignoring part c, how do the answers to parts a and b change if one-half of the bonds were converted on July 1, 2020? Net Income Available to Weighted Avg. Common Common Stockholders Shares Outstanding Basic EPS $ 3,099,000 x 1,822,500 $ Diluted EPS $ 3,100,800 x 1,813,500 * $ Per Share 1.7 1.7 Grace Corp. suffered a net loss in 2020 of $200,000. The company has 180,000 common shares outstanding as of January 1, 2020, and declared a 1-for-2 reverse stock split on March 31. In addition, the company bought 9,000 shares for the treasury on August 31, 2020, and 3,600 shares of stock were issued on November 1, 2020, in exchange for legal services. The company had 1,800 shares of 5%, $10 par, cumulative, nonconvertible preferred stock for the year 2020. No common or preferred stock dividends were declared in 2020. Required Compute the required EPS amount. Note: Round weighted average common shares outstanding to the nearest whole number. Note: Round earnings per share amount to two decimal places. Net Income Available to Weighted Avg. Common Common Stockholders Shares Outstanding Per Share Shaffer Corporation issued 180, $1,000, 10% convertible bonds in 2019 at face value. Each bond is convertible into 100 shares of common stock. Shaffer's net income for 2020 is $3,100,800 ($4,134,400 before tax). Considering all factors except convertible bonds, average common shares outstanding for 2020 were 1,818,000. c. How do the answers to parts a and b change if the bonds were issued on July 1, 2020? Net Income Available to Weighted Avg. Common Per Common Stockholders Shares Outstanding Share Basic EPS $ 3,107,550 1,818,000 $ 1.71 Diluted EPS $ 3,114,300 1,827,000 $ 1.7 d. Ignoring part c, how do the answers to parts a and b change if one-half of the bonds were converted on July 1, 2020? Net Income Available to Weighted Avg. Common Common Stockholders Shares Outstanding Basic EPS $ 3,099,000 x 1,822,500 $ Diluted EPS $ 3,100,800 x 1,813,500 * $ Per Share 1.7 1.7