Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Grace Richardson is a 22-year-old who recently graduated from Boston College. She graduated with a degree in Elementary Education. Grace is excited to start teaching

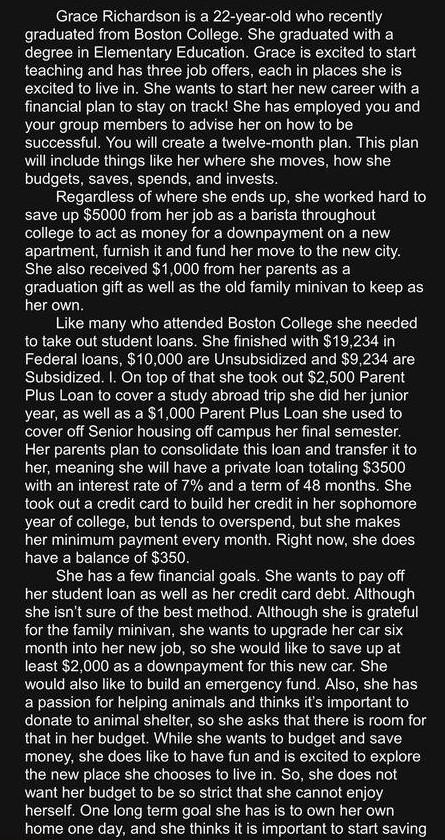

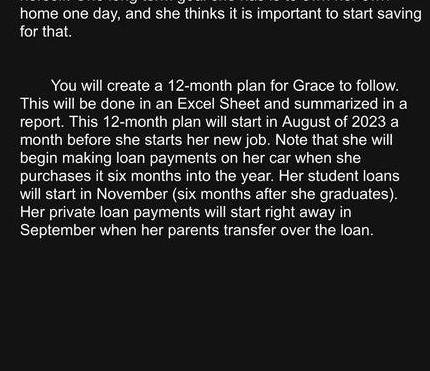

Grace Richardson is a 22-year-old who recently graduated from Boston College. She graduated with a degree in Elementary Education. Grace is excited to start teaching and has three job offers, each in places she is excited to live in. She wants to start her new career with a financial plan to stay on track! She has employed you and your group members to advise her on how to be successful. You will create a twelve-month plan. This plan will include things like her where she moves, how she budgets, saves, spends, and invests. Regardless of where she ends up, she worked hard to save up $5000 from her job as a barista throughout college to act as money for a downpayment on a new apartment, furnish it and fund her move to the new city. She also received $1,000 from her parents as a graduation gift as well as the old family minivan to keep as her own. Like many who attended Boston College she needed to take out student loans. She finished with $19,234 in Federal loans, $10,000 are Unsubsidized and $9,234 are Subsidized. I. On top of that she took out $2,500 Parent Plus Loan to cover a study abroad trip she did her junior year, as well as a $1,000 Parent Plus Loan she used to cover off Senior housing off campus her final semester. Her parents plan to consolidate this loan and transfer it to her, meaning she will have a private loan totaling $3500 with an interest rate of 7% and a term of 48 months. She took out a credit card to build her credit in her sophomore year of college, but tends to overspend, but she makes her minimum payment every month. Right now, she does have a balance of $350. She has a few financial goals. She wants to pay off her student loan as well as her credit card debt. Although she isn't sure of the best method. Although she is grateful for the family minivan, she wants to upgrade her car six month into her new job, so she would like to save up at least $2,000 as a downpayment for this new car. She would also like to build an emergency fund. Also, she has a passion for helping animals and thinks it's important to donate to animal shelter, so she asks that there is room for that in her budget. While she wants to budget and save money, she does like to have fun and is excited to explore the new place she chooses to live in. So, she does not want her budget to be so strict that she cannot enjoy herself. One long term goal she has is to own her own home one day, and she thinks it is important to start saving home one day, and she thinks it is important to start saving for that. You will create a 12-month plan for Grace to follow. This will be done in an Excel Sheet and summarized in a report. This 12-month plan will start in August of 2023 a month before she starts her new job. Note that she will begin making loan payments on her car when she purchases it six months into the year. Her student loans will start in November (six months after she graduates). Her private loan payments will start right away in September when her parents transfer over the loan. Offer 1: Elementary School Teacher James Madison Charter Academy Colorado Springs, CO Job information - We offer a competitive compensation package which includes comprehensive health bencfits - Payi $31,000.00 per year . 401(k) - Dental insurance - Flexible spending account - Health insurance - Life insurance -Paid time of - Professional development assistance -Retirement plan - Vision insurance Offer 2 : Elementary School Teachers: Grades 3-5 True North Classical Academy Miami, FL Information: -Salary starting at $47,500, commensurate on experience - Health Insurance -Dental lnsurance - Vision Insurance .401K -A positive and nurturing work environment focused on the wellbeing of our educators and students - A strong culture of professional development and growth centered around classical education - We offer an opportunity to obtain your Professional Educator's Certification through our FLDOE approved teacher certification program Ofter 3: Elementary Classroom Teacher - Grades 3 Maine School Administrative District H75 Topsham, ME Information: - Pay: $39,500 per year - 401(k) - Dental insurance - Health insurance -Life insurance -Paid time off - Professional development assistance -Retirement plan - Vision insurance Grace Richardson is a 22-year-old who recently graduated from Boston College. She graduated with a degree in Elementary Education. Grace is excited to start teaching and has three job offers, each in places she is excited to live in. She wants to start her new career with a financial plan to stay on track! She has employed you and your group members to advise her on how to be successful. You will create a twelve-month plan. This plan will include things like her where she moves, how she budgets, saves, spends, and invests. Regardless of where she ends up, she worked hard to save up $5000 from her job as a barista throughout college to act as money for a downpayment on a new apartment, furnish it and fund her move to the new city. She also received $1,000 from her parents as a graduation gift as well as the old family minivan to keep as her own. Like many who attended Boston College she needed to take out student loans. She finished with $19,234 in Federal loans, $10,000 are Unsubsidized and $9,234 are Subsidized. I. On top of that she took out $2,500 Parent Plus Loan to cover a study abroad trip she did her junior year, as well as a $1,000 Parent Plus Loan she used to cover off Senior housing off campus her final semester. Her parents plan to consolidate this loan and transfer it to her, meaning she will have a private loan totaling $3500 with an interest rate of 7% and a term of 48 months. She took out a credit card to build her credit in her sophomore year of college, but tends to overspend, but she makes her minimum payment every month. Right now, she does have a balance of $350. She has a few financial goals. She wants to pay off her student loan as well as her credit card debt. Although she isn't sure of the best method. Although she is grateful for the family minivan, she wants to upgrade her car six month into her new job, so she would like to save up at least $2,000 as a downpayment for this new car. She would also like to build an emergency fund. Also, she has a passion for helping animals and thinks it's important to donate to animal shelter, so she asks that there is room for that in her budget. While she wants to budget and save money, she does like to have fun and is excited to explore the new place she chooses to live in. So, she does not want her budget to be so strict that she cannot enjoy herself. One long term goal she has is to own her own home one day, and she thinks it is important to start saving home one day, and she thinks it is important to start saving for that. You will create a 12-month plan for Grace to follow. This will be done in an Excel Sheet and summarized in a report. This 12-month plan will start in August of 2023 a month before she starts her new job. Note that she will begin making loan payments on her car when she purchases it six months into the year. Her student loans will start in November (six months after she graduates). Her private loan payments will start right away in September when her parents transfer over the loan. Offer 1: Elementary School Teacher James Madison Charter Academy Colorado Springs, CO Job information - We offer a competitive compensation package which includes comprehensive health bencfits - Payi $31,000.00 per year . 401(k) - Dental insurance - Flexible spending account - Health insurance - Life insurance -Paid time of - Professional development assistance -Retirement plan - Vision insurance Offer 2 : Elementary School Teachers: Grades 3-5 True North Classical Academy Miami, FL Information: -Salary starting at $47,500, commensurate on experience - Health Insurance -Dental lnsurance - Vision Insurance .401K -A positive and nurturing work environment focused on the wellbeing of our educators and students - A strong culture of professional development and growth centered around classical education - We offer an opportunity to obtain your Professional Educator's Certification through our FLDOE approved teacher certification program Ofter 3: Elementary Classroom Teacher - Grades 3 Maine School Administrative District H75 Topsham, ME Information: - Pay: $39,500 per year - 401(k) - Dental insurance - Health insurance -Life insurance -Paid time off - Professional development assistance -Retirement plan - Vision insurance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started