Answered step by step

Verified Expert Solution

Question

1 Approved Answer

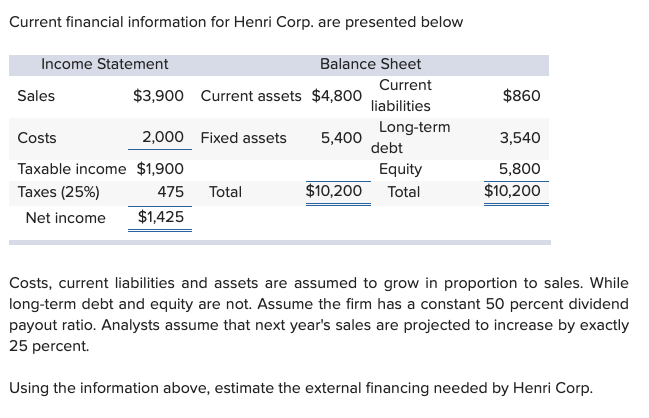

gracias! Current financial information for Henri Corp. are presented below $860 Income Statement Balance Sheet Current Sales $3,900 Current assets $4,800 liabilities Costs Long-term 2,000

gracias!

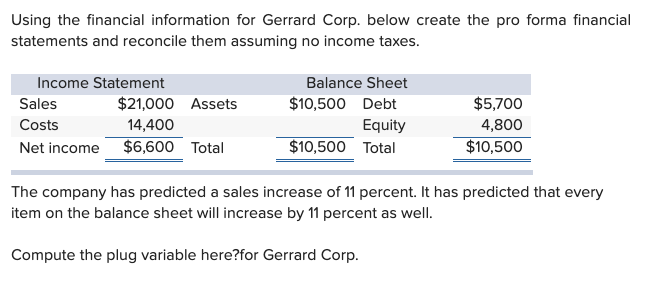

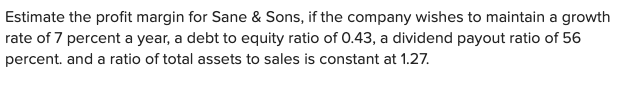

Current financial information for Henri Corp. are presented below $860 Income Statement Balance Sheet Current Sales $3,900 Current assets $4,800 liabilities Costs Long-term 2,000 Fixed assets 5,400 debt Taxable income $1,900 Equity Taxes (25%) 475 Total $10,200 Total Net income $1,425 3,540 5,800 $10,200 Costs, current liabilities and assets are assumed to grow in proportion to sales. While long-term debt and equity are not. Assume the firm has a constant 50 percent dividend payout ratio. Analysts assume that next year's sales are projected to increase by exactly 25 percent Using the information above, estimate the external financing needed by Henri Corp. Using the financial information for Gerrard Corp. below create the pro forma financial statements and reconcile them assuming no income taxes. Income Statement Sales $21,000 Assets Costs 14,400 Net income $6,600 Total Balance Sheet $10,500 Debt Equity $10,500 Total $5,700 4,800 $10,500 The company has predicted a sales increase of 11 percent. It has predicted that every item on the balance sheet will increase by 11 percent as well. Compute the plug variable here?for Gerrard CorpStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started