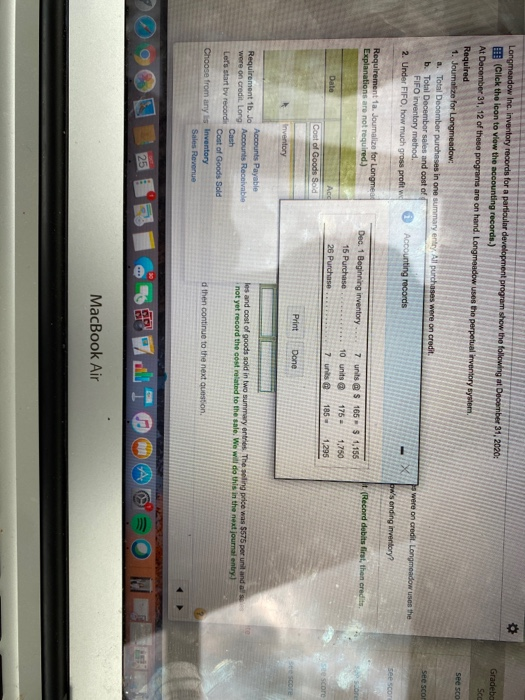

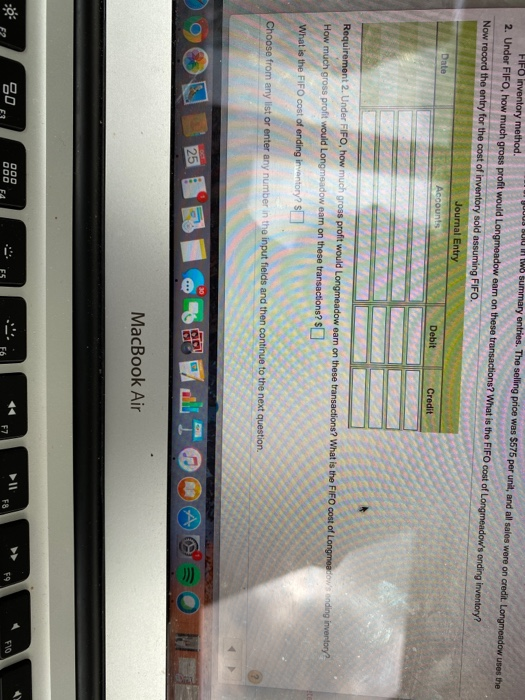

* Gradebo Sca Longmeadow Inc. Inventory records for a particular development program show the following at December 31, 2020: (Click the lean to view the accounting records.) At December 31, 12 of these programs are on hand. Longmeadow uses the perpetual ventory system, Required 1. Joumalize for Longmeadow a. Total December purchases in one summary entry. All purchases were on credit b. Total December sales and cost of FIFO inventory method Accounting records 2. Under FIFO, how much gross profit w See sco See scor were on credit. Longmeadow uses the bws ending inventory? esco Requirement ta. Journalize for Longmea Explanations are not required.) (Record debits first, then credits Dec 1 Beginning inventory 15 Purchase 26 Purchase 7 units@ $ 165 $ 1,156 10 units 175 - 1.750 7 unis 185 1,295 Date Aco Cost of Goods Sold escore Print Done Se score Inventory les and cost of goods sold in two summary entries. The selling price was $575 per unit and all not yet record the cost related to the sale. We will do this in the next journal entry) Accounts Payable Requirement 1b. Jo wore on credit. Long Accounts Receivable Cash Let's start by recordi Cost of Goods Sold Choose from any is Inventory Sales Revenue d then continue to the next question MacBook Air BUIU A WO summary entries. The selling price was $575 per unit, and all sales were on credit. Longmeadow uses the FIFO Inventory method 2. Under FIFO, how much gross profit would Longmeadow earn on these transactions? What is the FIFO cost of Longmeadow's ending inventory? Now record the entry for the cost of inventory sold assuming FIFO. Journal Entry Accounts Debit Credit Date Requirement 2. Under FIFO, how much gross profit would Longmeadow eam on these transactions? What is the FIFO cost of Longmeadow's ending invertory How much gross profit would Longmeadow earn on these transactions? $ What is the Fifo cost of ending inventory? ] Choose from any list or enter any number in the input fields and then continue to the next question MacBook Air 80 000 000 ES F7 F8 F9 FVO