Answered step by step

Verified Expert Solution

Question

1 Approved Answer

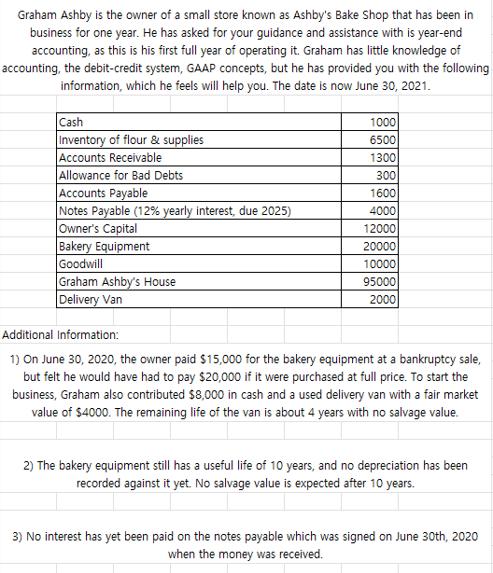

Graham Ashby is the owner of a small store known as Ashby's Bake Shop that has been in business for one year. He has

Graham Ashby is the owner of a small store known as Ashby's Bake Shop that has been in business for one year. He has asked for your guidance and assistance with is year-end accounting, as this is his first full year of operating it. Graham has little knowledge of accounting, the debit-credit system, GAAP concepts, but he has provided you with the following information, which he feels will help you. The date is now June 30, 2021. Cash Inventory of flour & supplies Accounts Receivable Allowance for Bad Debts Accounts Payable Notes Payable (12% yearly interest, due 2025) Owner's Capital Bakery Equipment Goodwill Graham Ashby's House Delivery Van 1000 6500 1300 300 1600 4000 12000 20000 10000 95000 2000 Additional Information: 1) On June 30, 2020, the owner paid $15,000 for the bakery equipment at a bankruptcy sale, but felt he would have had to pay $20,000 if it were purchased at full price. To start the business, Graham also contributed $8,000 in cash and a used delivery van with a fair market value of $4000. The remaining life of the van is about 4 years with no salvage value. 2) The bakery equipment still has a useful life of 10 years, and no depreciation has been recorded against it yet. No salvage value is expected after 10 years. 3) No interest has yet been paid on the notes payable which was signed on June 30th, 2020 when the money was received. 3) No interest has yet been paid on the notes payable which was signed on June 30th, 2020 when the money was received. 4) Goodwill was established by the owner: due to what he considered the excellent location of his rented shop in the mall. 5) The bakery was given a 12-month deferral (rent payments delayed for 12 months) on its monthly rent of $1000. No record of this fact had been made. 6) Graham has been taking $100 per week in wages but has not kept any records of this. 7) He thinks the business earned $11,000 last year. Required: Prepare a report to Mr. Ashby explaining any 5 GAAPS he has broken and how he broke them and what he should be doing to conform to the GAAP's

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided there are several GAAP Generally Accepted Accounting Principles that Mr Ashby may have broken Below are the top five ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started