Question

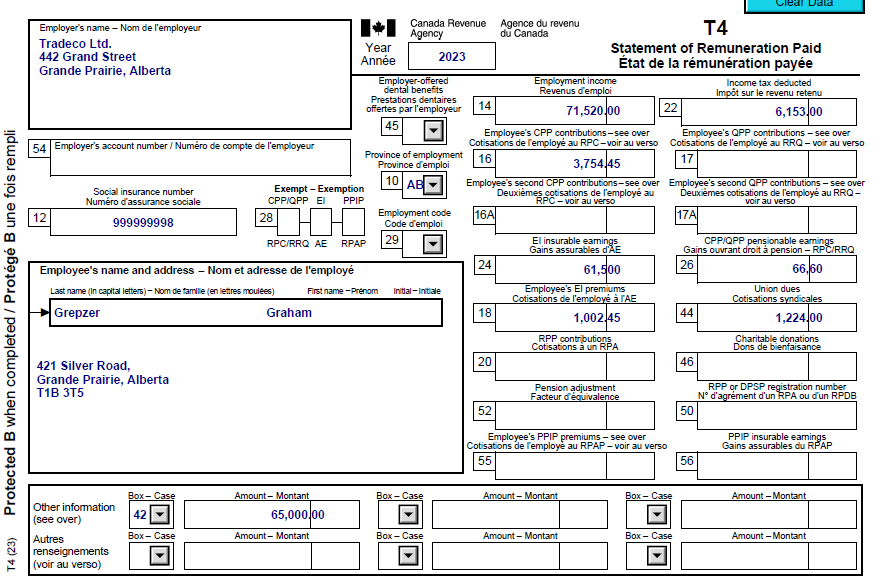

Graham Grepzer is a senior sales manager at Tradeco Ltd. He worked for the same company for a number of years and was using his

Graham Grepzer is a senior sales manager at Tradeco Ltd. He worked for the same company for a number of years and was using his good friend's neighbor to do his taxes but this year he got a reassessment from CRA and may end up paying back a large amount of money. He wasn't too happy with his current situation and asked you to help him with reassessment. He disagrees with the reassessment and asked you to file a Notice of Objection. He did not bring the reassessment notice but assures you that it is wrong. Graham also asked you to prepare his current year taxes as he decided that from now on he would be using a professional to prepare his taxes. Graham provided you with his personal information that you will need to prepare his tax return:

Name: Graham Grepzer SIN: 999 999 998 Marital Status: Married Date of Birth: November 25, 1970 Address: 421 Silver Road, Grande Prairie, Alberta T1B 3T5

Graham's mother, Mary, moved with him after his father passed away. She is dependent on Graham for day-to-day living. She was recently diagnosed with the onset of dementia by her doctor and they are awaiting further results and diagnosis form some recent tests. She receives a modest $12,486 in pensions as her total income. Her date of birth is July 24, 1945 and Graham's sister prepares her tax return (SIN 999 999 899). Graham's spouse, Rose, does not have any income. Her date of birth is January 15, 1973; her SIN is 999 989 999.

Graham gave you the following receipts for the health care expenses he paid in the year, which were quite sizeable: For Graham: Dental - Dr. Gerry Wong on March 26 for $1,300 Dental - Dr. Gerry Wong on April 3 for $1,750 For Graham's mother: Medically prescribed painkillers - $575

Graham has health and dental insurance at work, but these amounts were not covered as the dental insurance has a 50% co-pay provision.

He made donations to the United Way of $100 and the Make a Wish Foundation for $320 which he tries to make a habit of doing every year.

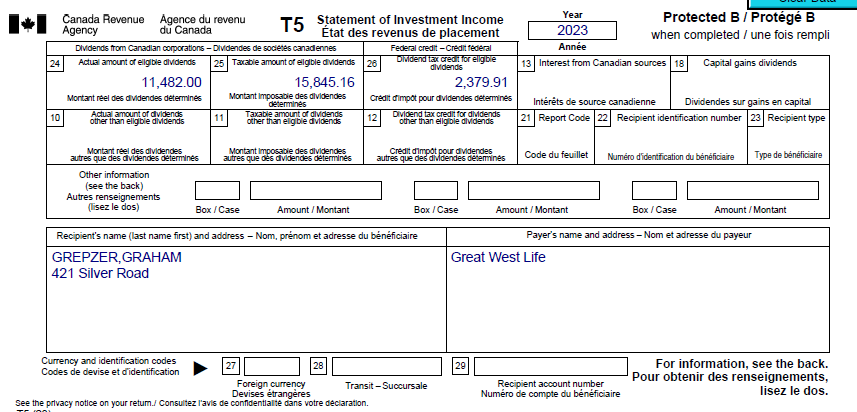

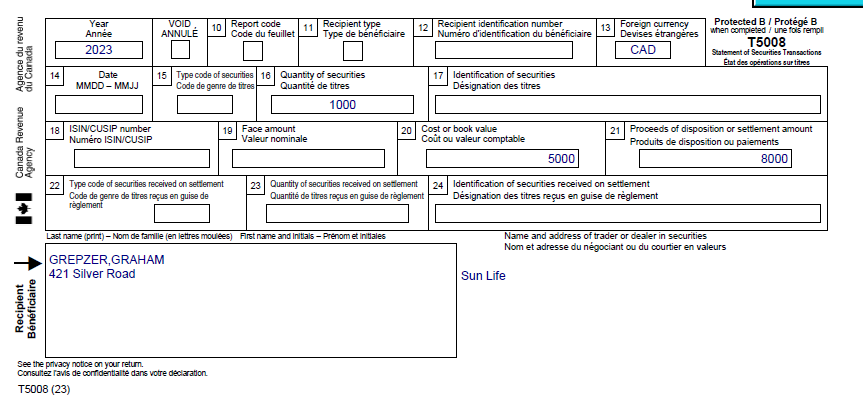

Graham paid Canadian Professional Sales Association dues $1,300 and made $3,500 in RRSP contributions. His Notice of Assessment shows his RRSP contribution limit to be $31,300. Attached are the copies of Graham's tax slips: T4 - Tradeco Ltd.

24 Actual amount of eligible dividends 25 Taxable amount of eligible dividends 26 11,482.00 15,845.16 Montant rel des dividendes determines Montant Imposable des dividendes determines 10 Actual amount of dividends other than eligible dividends 11 Taxable amount of dividends other than eligible dividends 12 Credit d'impt pour dividendes determines Dividend tax credit for dividends other than eligible dividends Canada Revenue Agency Agence du revenu du Canada T5 Statement of Investment Income tat des revenus de placement Dividends from Canadian corporations - Dividendes de societes canadiennes Federal credit-Credit federal Dividend tax credit for eligible dividends Year 2023 Anne Protected B/Protg B when completed / une fois rempli 13 Interest from Canadian sources 18 Intrts de source canadienne Capital gains dividends Dividendes sur gains en capital 2,379.91 21 Report Code 22 Recipient identification number 23 Recipient type Montant rel des dividendes autres que des dividendes determines Montant Imposable des dividendes autres que des dividendes determines Credit d'impt pour dividendes autres que des dividendes determines Code du feuillet Numro d'identification du bnficiaire Type de bnficiaire Other information (see the back) Autres renseignements (lisez le dos) Box/Case Amount / Montant Box/Case Amount / Montant Box / Case Amount /Montant Recipient's name (last name first) and address - Nom, prnom et adresse du bnficiaire GREPZER, GRAHAM 421 Silver Road Currency and identification codes Codes de devise et d'identification 28 Foreign currency Devises trangres See the privacy notice on your return./ Consultez l'avis de confidentialite dans votre declaration. TC 1001 Payer's name and address-Nom et adresse du payeur Great West Life Transit-Succursale Recipient account number Numro de compte du bnficiaire For information, see the back. Pour obtenir des renseignements, lisez le dos.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare Graham Grepzers tax return we need to include the following information 1 Personal Inform...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started