Answered step by step

Verified Expert Solution

Question

1 Approved Answer

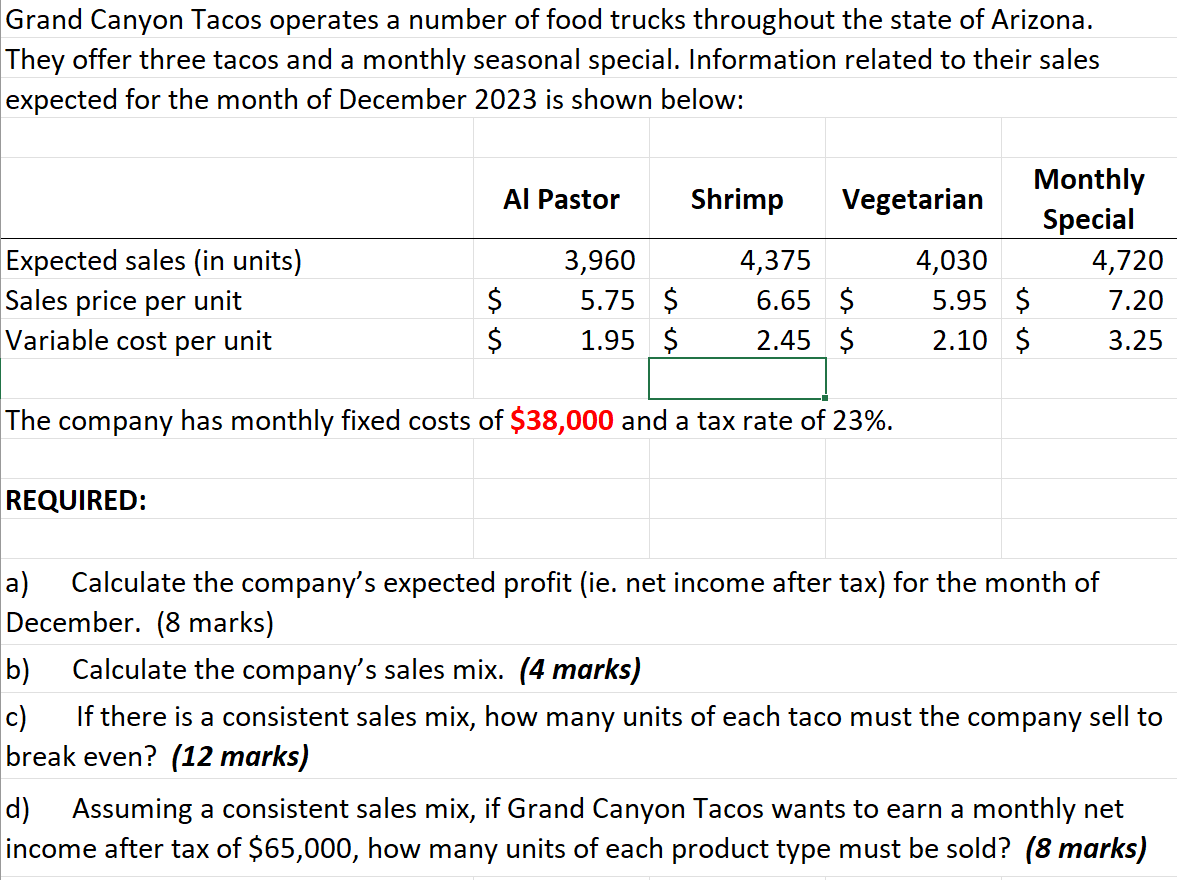

Grand Canyon Tacos operates a number of food trucks throughout the state of Arizona. They offer three tacos and a monthly seasonal special. Information

Grand Canyon Tacos operates a number of food trucks throughout the state of Arizona. They offer three tacos and a monthly seasonal special. Information related to their sales expected for the month of December 2023 is shown below: Monthly Al Pastor Shrimp Vegetarian Special Expected sales (in units) 3,960 4,375 4,030 4,720 Sales price per unit $ 5.75 $ 6.65 $ 5.95 $ 7.20 Variable cost per unit $ 1.95 $ 2.45 $ 2.10 $ 3.25 The company has monthly fixed costs of $38,000 and a tax rate of 23%. REQUIRED: a) Calculate the company's expected profit (ie. net income after tax) for the month of December. (8 marks) b) Calculate the company's sales mix. (4 marks) c) If there is a consistent sales mix, how many units of each taco must the company sell to break even? (12 marks) d) Assuming a consistent sales mix, if Grand Canyon Tacos wants to earn a monthly net income after tax of $65,000, how many units of each product type must be sold? (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started