Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Grand Chocolate Inc. is a producer of premium chocolate based in Palo Alto. i) (Click the icon to view additional information.) More info -

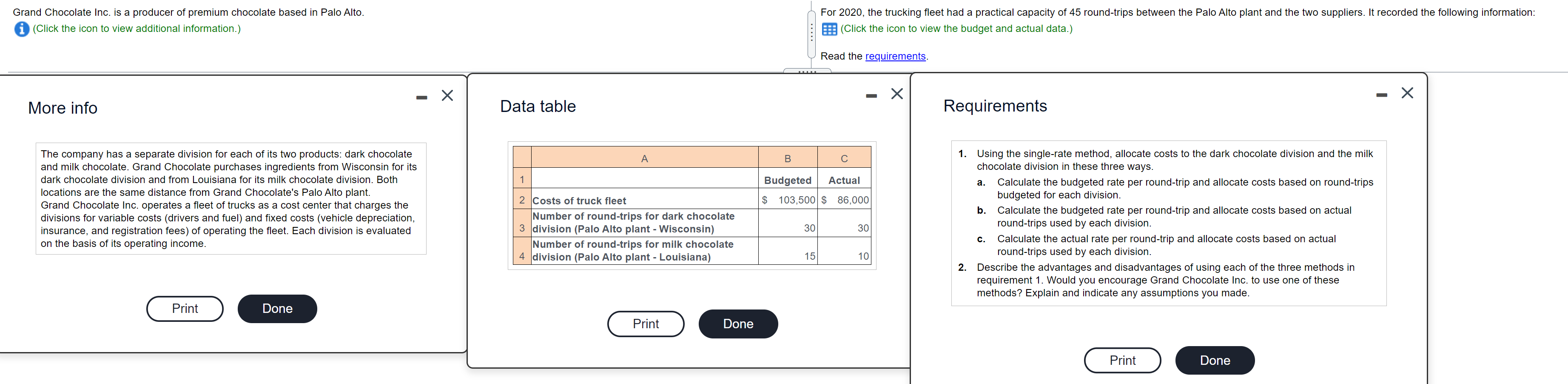

Grand Chocolate Inc. is a producer of premium chocolate based in Palo Alto. i) (Click the icon to view additional information.) More info - Data table The company has a separate division for each of its two products: dark chocolate and milk chocolate. Grand Chocolate purchases ingredients from Wisconsin for its dark chocolate division and from Louisiana for its milk chocolate division. Both locations are the same distance from Grand Chocolate's Palo Alto plant. Grand Chocolate Inc. operates a fleet of trucks as a cost center that charges the divisions for variable costs (drivers and fuel) and fixed costs (vehicle depreciation, insurance, and registration fees) of operating the fleet. Each division is evaluated on the basis of its operating income. 1 2 Costs of truck fleet A Number of round-trips for dark chocolate 3 division (Palo Alto plant - Wisconsin) Number of round-trips for milk chocolate 4 division (Palo Alto plant - Louisiana) Print Done Print Done B For 2020, the trucking fleet had a practical capacity of 45 round-trips between the Palo Alto plant and the two suppliers. It recorded the following information: (Click the icon to view the budget and actual data.) Read the requirements. Budgeted Actual $ 103,500 $ 86,000 Requirements 1. Using the single-rate method, allocate costs to the dark chocolate division and the milk chocolate division in these three ways. a. Calculate the budgeted rate per round-trip and allocate costs based on round-trips budgeted for each division. b. 30 30 Calculate the budgeted rate per round-trip and allocate costs based on actual round-trips used by each division. 15 10 2. C. Calculate the actual rate per round-trip and allocate costs based on actual round-trips used by each division. Describe the advantages and disadvantages of using each of the three methods in requirement 1. Would you encourage Grand Chocolate Inc. to use one of these methods? Explain and indicate any assumptions you made. Print Done - Requirement 1. Using the single-rate method, allocate costs to the dark chocolate division and the milk chocolate division in these three ways. a. Calculate the budgeted rate per round-trip and allocate costs based on round-trips budgeted for each division. The budgeted rate per round-trip is This translates to indirect costs allocated to the dark chocolate division for and milk chocolate division for b. Calculate the budgeted rate per round-trip and allocate costs based on actual round-trips used by each division. The budgeted rate per round-trip is This translates to indirect costs allocated to the dark chocolate division for and milk chocolate division for c. Calculate the actual rate per round-trip and allocate costs based on actual round-trips used by each division. The actual rate per round-trip is and milk chocolate division for This translates to indirect costs allocated to the dark chocolate division for Requirement 2. Describe the advantages and disadvantages of using each of the three methods in requirement 1. When budgeted rates/budgeted quantities are used, the dark chocolate and milk chocolate divisions know at the start of 2020 that they will be charged a total of for transportation of dark chocolate and of milk chocolate. In effect, the fleet resource becomes a the managers to over-use the trucking fleet. for transportation fixed cost for each division. This type of cost may motivate When budgeted rates/actual quantities are used, the dark chocolate and milk chocolate divisions know at the start of 2020 that they will be charged a rate per round trip This enables them to make operating decisions knowing the rate they will have to pay for transportation. Each division can still control its total transportation costs by minimizing the number of round trips it uses. Assuming that the budgeted rate was based on honest estimates of their annual usage, this method will also provide an estimate of the excess trucking capacity (the portion of fleet costs not charged to either division) The use of actual costs/actual quantities makes the costs allocated to one division a function of the actual demand of other users. In 2020, the actual usage was below the 85 trips budgeted. The dark chocolate division used all the trips budgeted trips, the dark chocolate division bears a proportionately higher share of the fixed costs. it had budgeted. Because the milk chocolate division's actual trips were less than the Would you encourage Indulgence Inc. to use one of these methods? Explain and indicate any assumptions you made. Of the three single-rate methods suggested in this problem, the budgeted rate and actual quantity effort to drive down the budgeted rate). may be the best one to use. (The management of Indulgence, Inc. would have to ensure that the managers of the dark chocolate and milk chocolate divisions do not systematically overestimate their budgeted use of the fleet division in an

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Requirement 1 a Budgeted Rate per RoundTrip Based on Budgeted Data Total Budgeted Cost 103500 Total ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started