Answered step by step

Verified Expert Solution

Question

1 Approved Answer

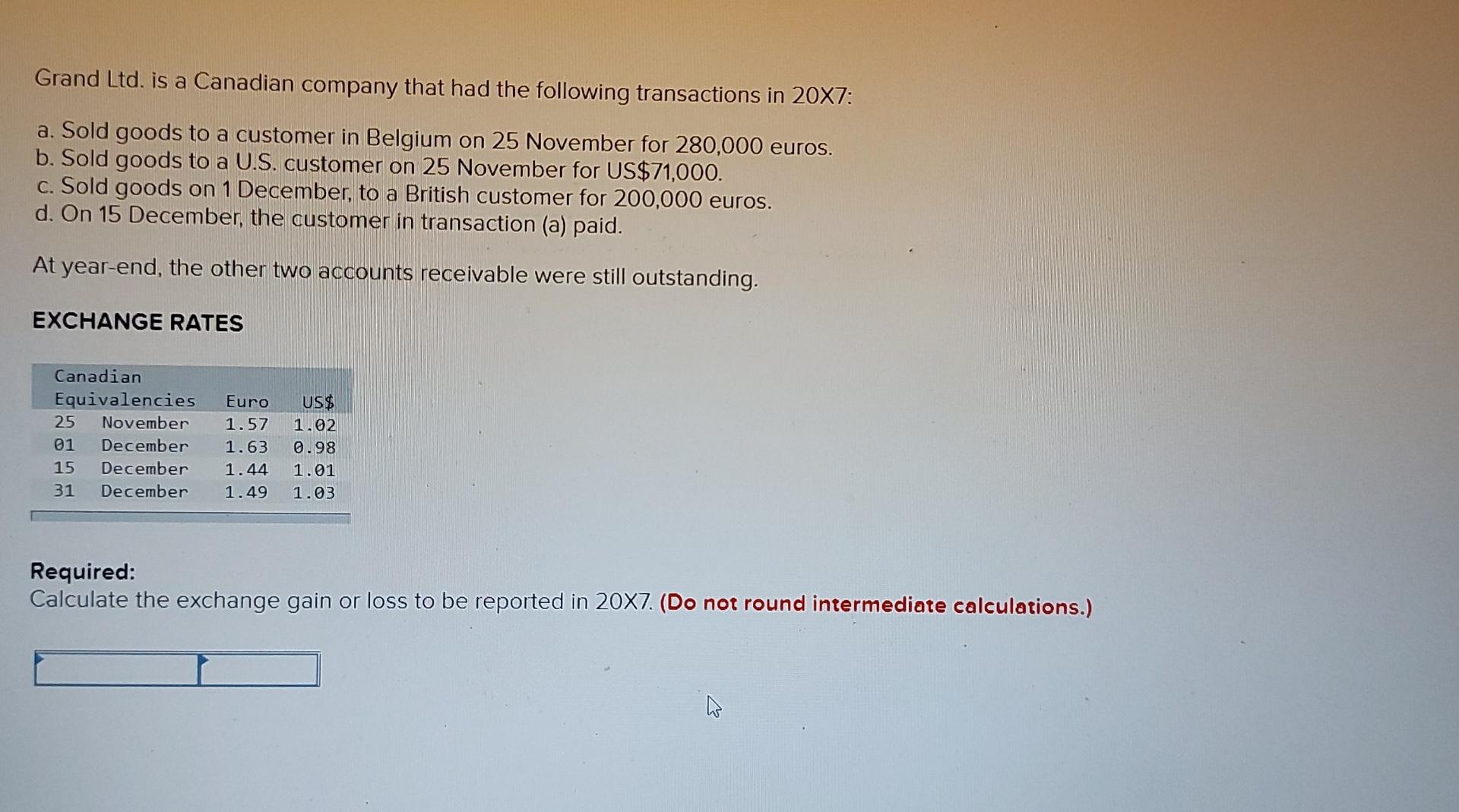

Grand Ltd. is a Canadian company that had the following transactions in 20X7: a. Sold goods to a customer in Belgium on 25 November for

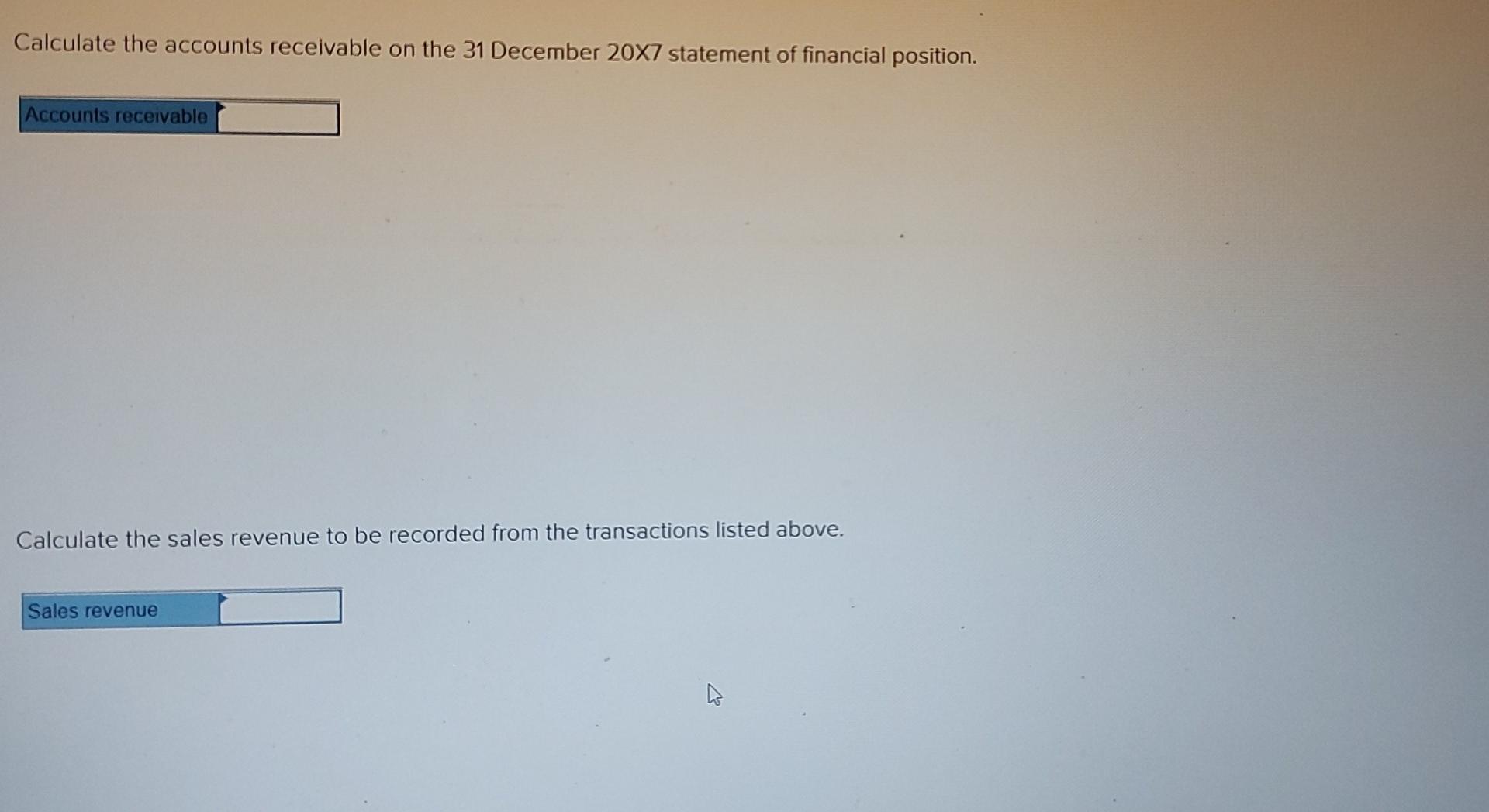

Grand Ltd. is a Canadian company that had the following transactions in 20X7: a. Sold goods to a customer in Belgium on 25 November for 280,000 euros. b. Sold goods to a U.S. customer on 25 November for US$71,000. C. Sold goods on 1 December, to a British customer for 200,000 euros. d. On 15 December, the customer in transaction (a) paid. At year-end, the other two accounts receivable were still outstanding. EXCHANGE RATES Canadian Equivalencies 25 November 01 December 15 December 31 December Euro 1.57 1.63 1.44 1.49 US$ 1.02 0.98 1.01 1.03 Required: Calculate the exchange gain or loss to be reported in 20X7. (Do not round intermediate calculations.) w Calculate the accounts receivable on the 31 December 20X7 statement of financial position. Accounts receivable Calculate the sales revenue to be recorded from the transactions listed above. Sales revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started