Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Grannis Corporation purchased land in order to construct a new factory. Expenditures insured by the company were as follows purchase price, $40,000; broker's fees, $7,000;

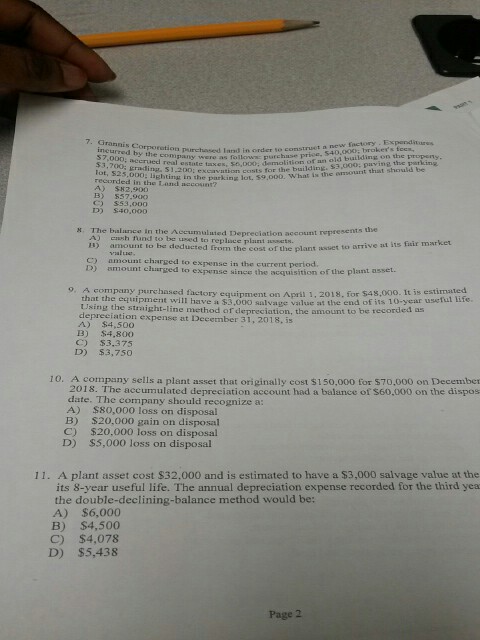

Grannis Corporation purchased land in order to construct a new factory. Expenditures insured by the company were as follows purchase price, $40,000; broker's fees, $7,000; accrued real ecstatic takes, $6,000, demolitions of an old building on the property $3, 700; grading, $1, 200; excavations costs for the building, $3,000; paying parking lot. $25,000; lighting in the parking lot, $9,000. What is the amount that should be recorded in the Land account? A) $82, 900 B) $57, 900 C) $53,000 D) $40,000 The balance in the Accumulated Depreciation account represents the A) Cash fund to be used to replace plant assets C) amount charged to expense in the current period. D) amount charged to expense since the acquisition of the plant asset. A company purchased factory equipment on April 1, 2018, for $48,000. It is estimated that the equipment will have a $3,000 salvage value at the end of its 10-year useful life. Using the straight-line method of depreciation, the amount to be recorded as depreciation expense at December 31 2018, is A) $4, 500 B) $4, 800 C) $3, 375 D) $3, 750 A company sells a plant asset that originally cost $150,000 for $70,000 on December 2018. The accumulated depreciation account had a balance of $60,000 on the dispos date. The company should recognize a: A) $80,000 loss on disposal B) $20,000 gain on disposal C) $20,000 loss on disposal D) $5,000 loss on disposal A plant asset cost $32,000 and is estimated to have a $3,000 salvage value at the its 8-year useful life. The annual depreciation expense recorded for the third yea the double-declining-balance method would be: A) $6,000 B) $4, 500 C) $4, 078 D) $5, 438

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started