Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Graph the value of your portfolio as a function of the relevant stock price. Show ALL your work and use EXCEL for graphs (please display

Graph the value of your portfolio as a function of the relevant stock price. Show ALL your work and use EXCEL for graphs (please display the formulas used once you're done) For each graph, graph for stock prices between 50 and 80 with 50 data points ( Ex 50.5, 51, 51.5, 52 etc). Assume today is the last day for exercising your options.

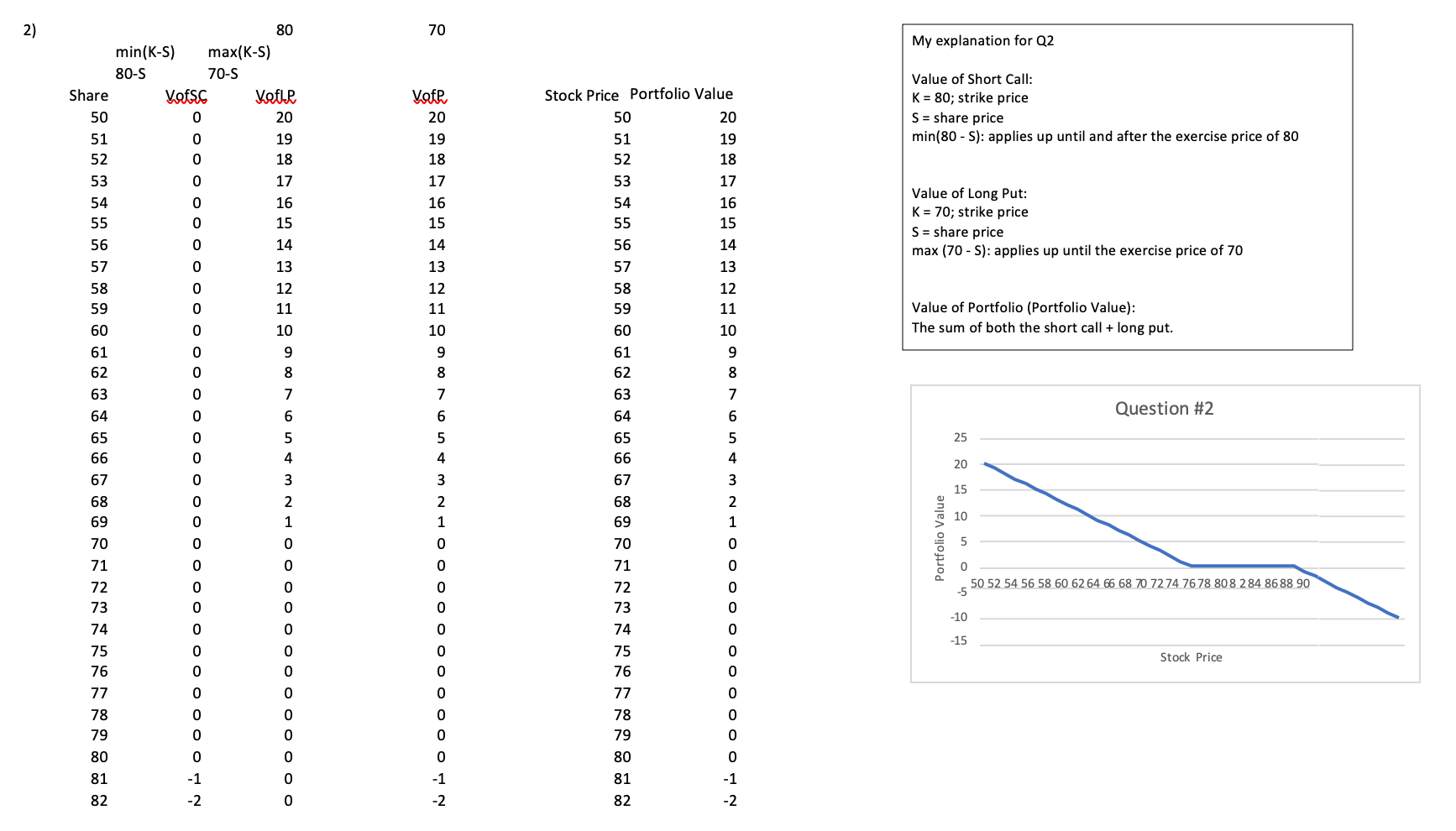

2) You are short a call at 60, and long a put at 75.EXAMPLE ON WHAT IT SHOULD LOOK LIKE WHEN COMPLETED2) You are short a call at 80, and long a put at 70.

2) Share 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 1 2 3 74 75 76 7 78 79 80 81 82 ooooo0012 min(K-S) max(K-S) 80-S 70-S 77 Vafsc 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 -1 -2 80 Kathe 20 19 18 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 0 70 201918716543211098, 50 51 52 53 54 55 56 7 58 59 60 616263646566 68 69 7012345757 78 79 80 81 82 VafR 7 6 5 4 3 2 1 0 0 -2 Stock Price Portfolio Value 57 67 76 DABAGHEER 20 19 18 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 0 0 -1 -2 My explanation for Q2 Value of Short Call: K = 80; strike price S = share price min(80 - S): applies up until and after the exercise price of 80 Value of Long Put: K = 70; strike price S = share price max (70-S): applies up until the exercise price of 70 Value of Portfolio (Portfolio Value): The sum of both the short call + long put. Portfolio Value 25 20 15 10 Question #2 0 -5 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 808 284 86 88 90 -10 -15 Stock Price

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Call exercise price 70 Put exercise price 65 If the stoc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started