Question

Grass Security, which began operations in 2017, invests in long-term available-for-sale securities. Following is a series of transactions and events determining its long-term investment activity.

Grass Security, which began operations in 2017, invests in long-term available-for-sale securities. Following is a series of transactions and events determining its long-term investment activity. 2017

| Jan. | 20 | Purchased 1,400 shares of Johnson & Johnson at $20.90 per share plus a $280 commission. | ||

| Feb. | 9 | Purchased 1,600 shares of Sony at $46.60 per share plus a $265 commission. | ||

| June | 12 | Purchased 1,900 shares of Mattel at $27.40 per share plus a $235 commission. | ||

| Dec. | 31 | Per share fair values for stocks in the portfolio are Johnson & Johnson, $21.90; Mattel, $31.30; and Sony, $38.40. |

2018

| Apr. | 15 | Sold 1,400 shares of Johnson & Johnson at $23.90 per share less a $565 commission. | ||

| July | 5 | Sold 1,900 shares of Mattel at $24.30 per share less a $275 commission. | ||

| July | 22 | Purchased 1,000 shares of Sara Lee at $22.90 per share plus a $520 commission. | ||

| Aug. | 19 | Purchased 1,300 shares of Eastman Kodak at $17.40 per share plus a $238 commission. | ||

| Dec. | 31 | Per share fair values for stocks in the portfolio are: Kodak, $19.65; Sara Lee, $20.40; and Sony, $35.40. |

2019

| Feb. | 27 | Purchased 2,800 shares of Microsoft at $67.40 per share plus a $565 commission. | ||

| June | 21 | Sold 1,600 shares of Sony at $48.40 per share less a(n) $920 commission. | ||

| June | 30 | Purchased 1,800 shares of Black & Decker at $36.40 per share plus a $475 commission. | ||

| Aug. | 3 | Sold 1,000 shares of Sara Lee at $16.65 per share less a $475 commission. | ||

| Nov. | 1 | Sold 1,300 shares of Eastman Kodak at $23.15 per share less a(n) $665 commission. | ||

| Dec. | 31 | Per share fair values for stocks in the portfolio are: Black & Decker, $39.40; and Microsoft, $69.40. |

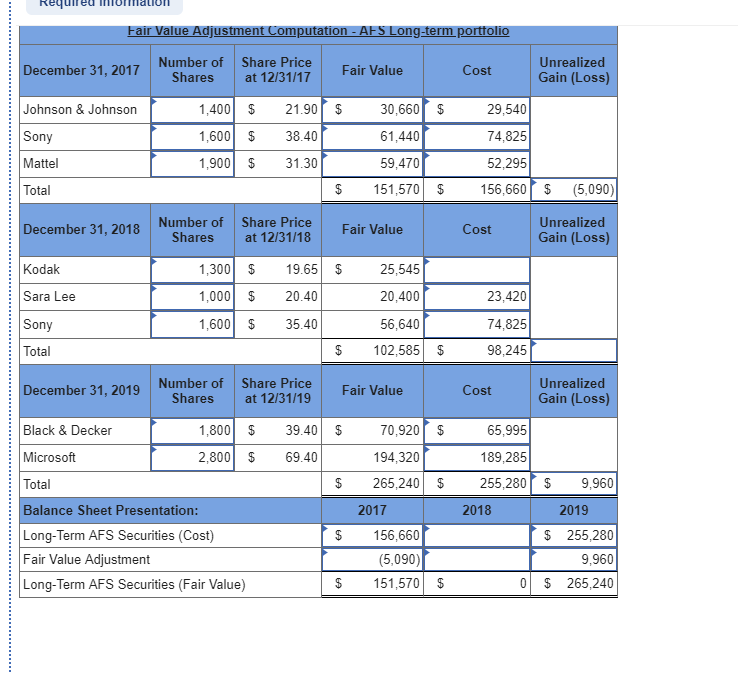

Complete the following table that summarizes the (a) total cost, (b) total fair value adjustment, and (c) total fair value of the portfolio of long-term available-for-sale securities at each year-end. (Do not round your intermediate calculations. Loss amounts should be indicated with a minus sign.)

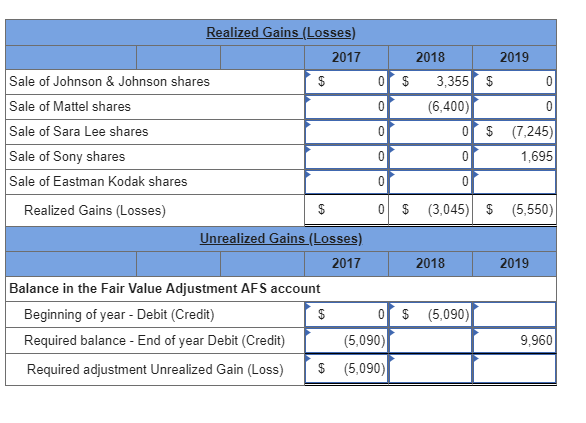

Complete the following table that summarizes (a) the realized gains and losses and (b) the unrealized gains or losses for the portfolio of long-term available-for-sale securities at each year-end. (Do not round your intermediate calculations. Losses should be indicated by a minus sign. )

Please help, I can't figure out the blanks. ty

air Value Adjustment Computation-AFS Long-term porttoli Unrealized Gain (Loss) Number of Share P December 31, 2017 Johnson & Johnson Sony Mattel Total Cost Shares at 12/31/17 1.4001$ 21.90$ 1,600$ 38.40 1,900$ 31.30 30,660S 61,440 59,470 29,540 74,825 52,295 $151,570 $ 156,660 (5,090) Unrealized Gain (Loss) Number of Share Price December 31, 2018 Kodak Sara Lee Sony Total Cost hares at 12/31/18 Fair Value 1,300$ 19.65 $ 1,000$ 20.40 1,600$ 35.40 25,545 20,400 56,640 23,420 74,825 98,245 $ 102,585 S Unrealized Gain (Loss) Number of Share Price December 31, 2019 Cost ares at 12/31/19 Fair Value 70,920 65,995 Black & Decker Microsoft Total Balance Sheet Presentation: Long-Term AFS Securities (Cost) Fair Value Adjustment Long-Term AFS Securities (Fair Value) 1,800 $ 39.40 S 2,800 $ 69.40 194,320 189,285 $ 265,240$ 255,280$ 9,960 2017 2018 2019 $ 156,660 $ 255,280 9,960 0 265,240 (5,090) $151,570 $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started