Answered step by step

Verified Expert Solution

Question

1 Approved Answer

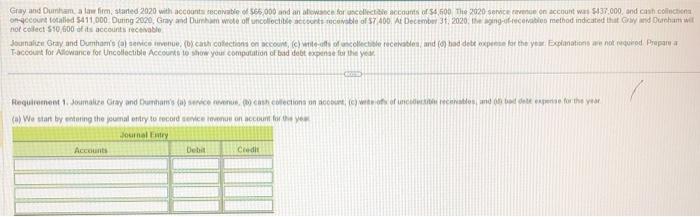

Gray and Durham, a law firm, started 2020 with accounts recevable of $66,000 and an allowance for uncollectible accounts of $4,500 The 2020 service

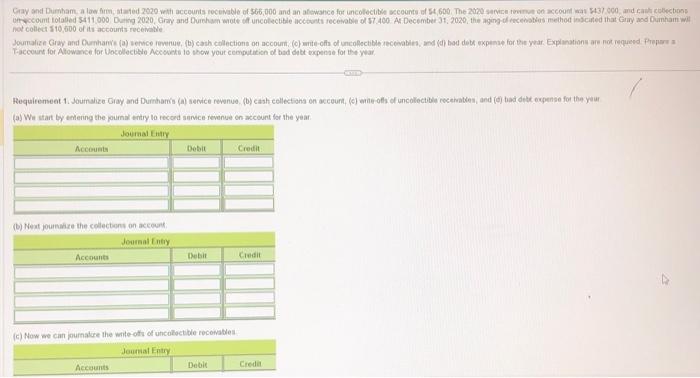

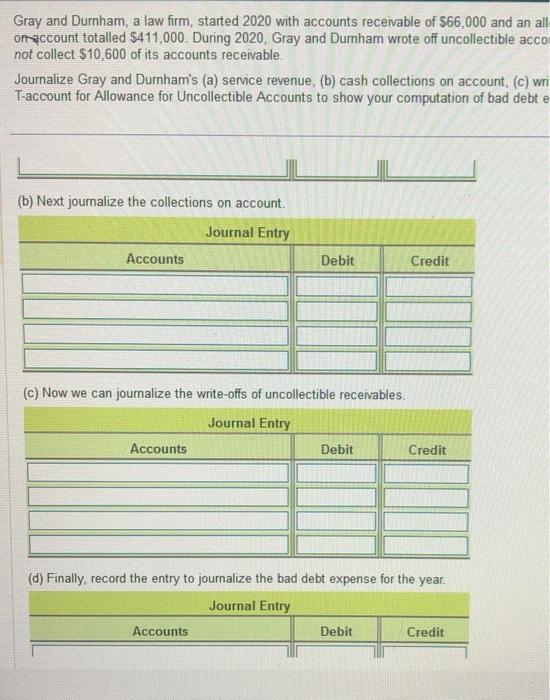

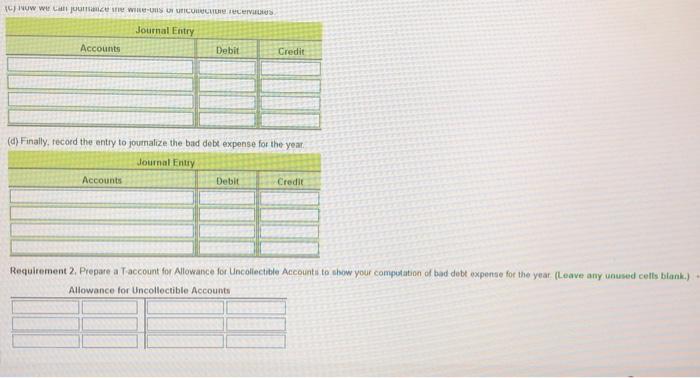

Gray and Durham, a law firm, started 2020 with accounts recevable of $66,000 and an allowance for uncollectible accounts of $4,500 The 2020 service revenue on account was $437,000, and cash.collections on-account totaled $411,000 During 2020, Gray and Durham wrote off uncollectible accounts recevable of $7,400. At December 31, 2020, the aging-of-recevables method indicated that Gray and Dunham wil not collect $10,600 of its accounts receivable Journalize Gray and Dunham's (a) service venue, (b) cash collections on account, (c) write-affs of uncollectible receivables, and (d) had debt expense for the year Explanations are not required. Prepare a T-account for Allowance for Uncollectible Accounts to show your computation of bad debt expense for the year Requirement 1. Joumalize Gray and Dunham's (a) service revenue, (b) cash collections on account, (c) wete-offs of uncodecsit recevables, and of bad dete experise for the year (a) We start by entering the journal entry to record service revenue on account for the year Journal Entry Accounts Debit Credit Gray and Dumham, a law firm, started 2020 with accounts receivable of $66,000 and an afowance for uncollectible accounts of $4,600. The 2020 service revenue on account was $437,000, and cash collections ofccount totalled $411,000 During 2020, Gray and Durnham wrote off uncollectible accounts receivable of $7,400. At December 31, 2020, the aging of recevables method indicated that Gray and Dunham wil not collect $10,600 of its accounts receivable Joumalize Gray and Durhani's (a) senice revenue, (b) cash collections on account, (c) write-offs of uncollectible receivables, and (d) bad debt expense for the year. Explanations are not requeed Prepare T-account for Allowance for Uncollectible Accounts to show your computation of bad debt expense for the year, Requirement 1. Journalize Gray and Dunham's (a) service revenue, (b) cash collections on account, (c) write-offs of uncollectible receivables, and (d) bad debt expense for the your (a) We start by entering the journal entry to record service revenue on account for the year. Journal Entry Accounts Debit Credit (b) Next journalize the collections on account Journal Entry Accounts Debit Credit (c) Now we can journalize the write-offs of uncollectible receivables Journal Entry Accounts Debit Credit Gray and Durnham, a law firm, started 2020 with accounts receivable of $66,000 and an all- on account totalled $411,000. During 2020, Gray and Durnham wrote off uncollectible accom not collect $10,600 of its accounts receivable. Journalize Gray and Durnham's (a) service revenue, (b) cash collections on account, (c) wri T-account for Allowance for Uncollectible Accounts to show your computation of bad debt e (b) Next journalize the collections on account. Journal Entry Accounts Debit Credit (c) Now we can journalize the write-offs of uncollectible receivables. Accounts Journal Entry Debit Credit (d) Finally, record the entry to journalize the bad debt expense for the year. Journal Entry Accounts Debit Credit (C) Now we can journance ine wine-uns un uniculecture recerves Journal Entry Accounts Debit Credit (d) Finally, record the entry to journalize the bad debt expense for the year. Journal Entry Accounts Debit Credit Requirement 2. Prepare a T-account for Allowance for Uncollectible Accounts to show your computation of bad debt expense for the year (Leave any unused cells blank.) - Allowance for Uncollectible Accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started