Answered step by step

Verified Expert Solution

Question

1 Approved Answer

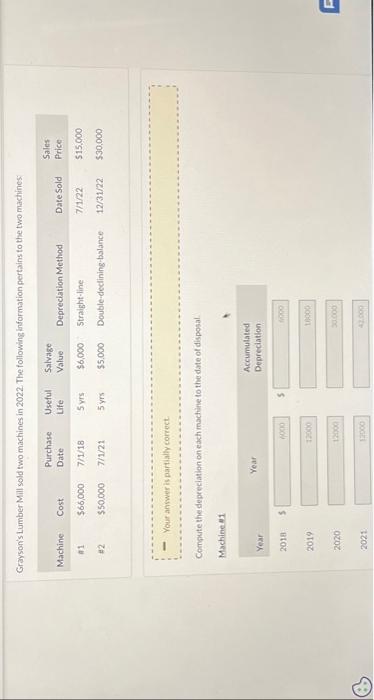

Grayson's Lumber Mill sold two machines in 2022. The following information pertains to the two machines Purchase Machine Cost Date Useful Life Salvage Value

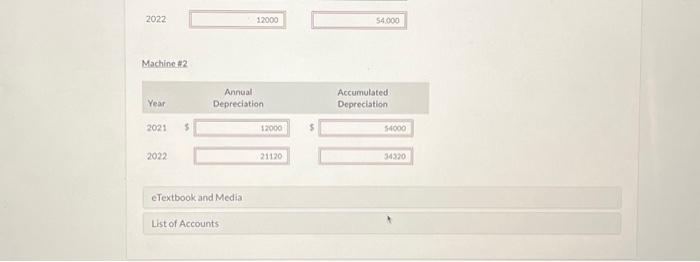

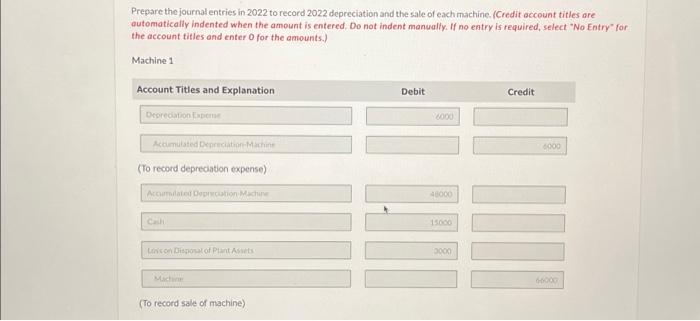

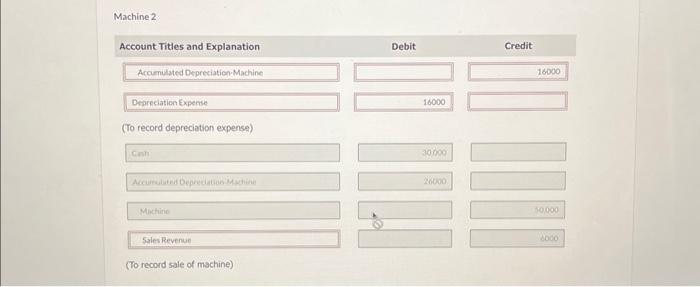

Grayson's Lumber Mill sold two machines in 2022. The following information pertains to the two machines Purchase Machine Cost Date Useful Life Salvage Value Sales Depreciation Method Date Sold Price: #1 $66,000 7/1/18 5 yrs $6,000 Straight-line 7/1/22 $15,000 #2 $50,000 7/1/21 5 yrs $5.000 Double-declining-balance 12/31/22 $30,000 - Your answer is partially correct Compute the depreciation on each machine to the date of disposal. Machine #1 Accumulated Year Year 2018 Depreciation 1000 $ 2019 12000 2020 12000 2021 12000 42.000 10000 30.000 F 2022 Machine #2 Year 2021 $ 2022 12000 54.000 Annual Depreciation eTextbook and Medial List of Accounts 12000 21120 Accumulated Depreciation 54000 34320 Prepare the journal entries in 2022 to record 2022 depreciation and the sale of each machine. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Machine 1 Account Titles and Explanation Depreciation Accumulated Depreciation Machine (To record depreciation expense) Debit 6000 Credit 6000 Accumulated Depreciation Machine 48000 Cash 15000 Loss on Disposal of Plant Assets Machine (To record sale of machine) 0000 66000 Machine 2 Account Titles and Explanation Accumulated Depreciation-Machine Depreciation Expense (To record depreciation expense) Debit Credit 16000 Cash 30,000 Accumulated Depreciation Machine 26000 Machine Sales Revenue (To record sale of machine) 16000 50,000 60001

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started