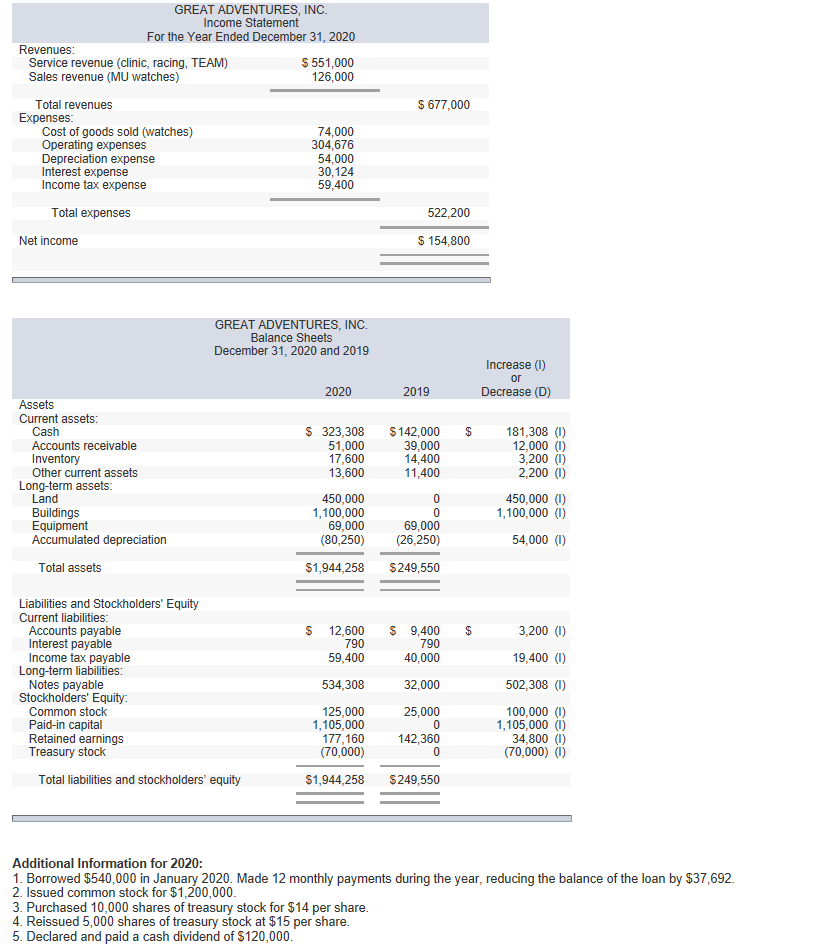

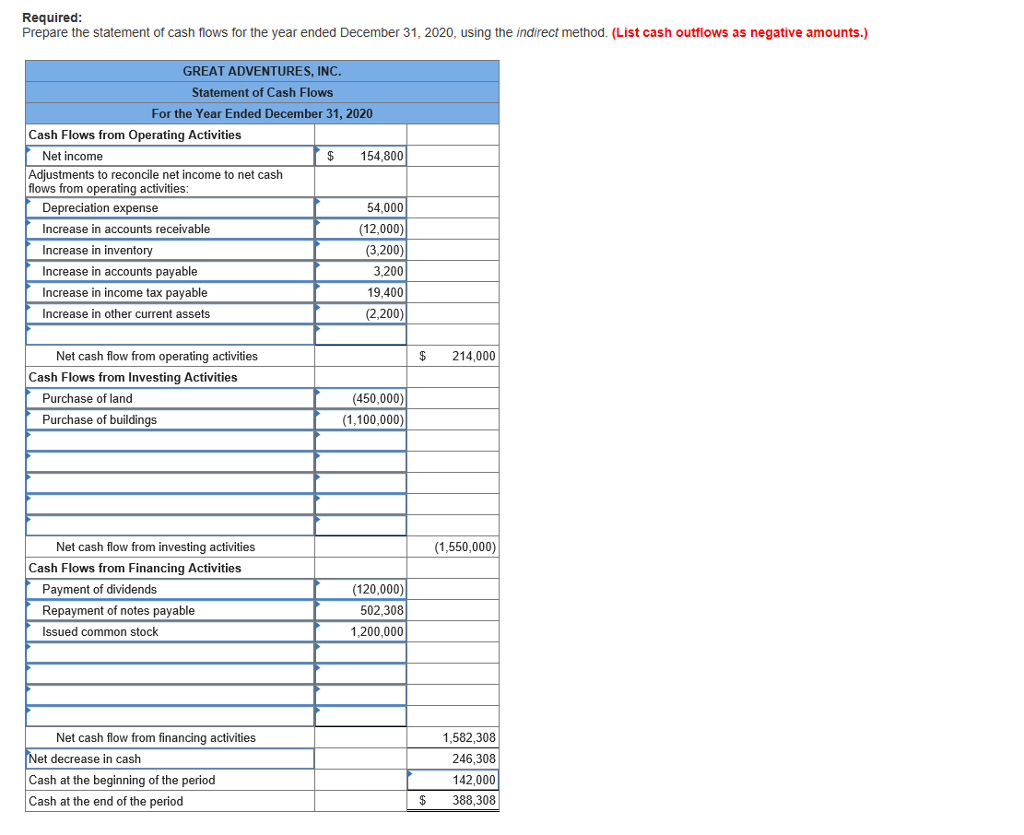

GREAT ADVENTURES, INC Income Statement For the Year Ended December 31, 2020 Revenues Service revenue (clinic, racing, T Sales revenue (MU watches) $ 551,000 126,000 EAM) Total revenues $ 677,000 Cost of goods sold (watches) Operating expenses Depreciation expense Interest expense Income tax expense 74,000 304,676 54,000 30,124 59,400 Total expenses 522,200 Net income $ 154,800 GREAT ADVENTURES, INC Balance Sheets December 31, 2020 and 2019 Increase () or 2020 2019 Decrease (D) Assets Current assets Cash Accounts receivable Inventory Other current assets S 323,308 142,000 $ 39,000 14,400 11,400 51,000 17,600 13,600 181,308 (1) 12,000 (I 3,200 (1) 2,200 () Long-term assets Land Buildings Equipment Accumulated depreciation 450,000 1,100,000 69,000 450,000 (I) 1,100,000 (1) 69,000 (80,250) (26,250) 54,000 (I) Total assets $1,944,258 $249,550 Liabilities and Stockholders' Equity Current liabilities Accounts payable Interest payable Income tax payable S 12,600 S 9,400 S 3,200 (1) 19,400 (I) 502,308 () 790 59,400 790 40,000 32,000 25,000 142,360 Long-term liabilities: Notes payable 534,308 Stockholders' Equity: Common stock Paid-in capital Retained earnings Treasury stock 125,000 1,105,000 177,160 (70,000) 100,000 (1) 1,105,000 () 34,800 (I) (70,000) (1) Total liabilities and stockholders' equity $1,944,258 $249,550 Additional Information for 2020: 1. Borrowed $540,000 in January 2020. Made 12 monthly payments during the year, reducing the balance of the loan by $37,692 2. Issued common stock for $1,200,000 3. Purchased 10,000 shares of treasury stock for $14 per share 4. Reissued 5,000 shares of treasury stock at $15 per share 5. Declared and paid a cash dividend of $120,000 Required Prepare the statement of cash flows for the year ended December 31, 2020, using the indirect method. (List cash outflows as negative amounts.) GREAT ADVENTURES, INC. Statement of Cash Flows For the Year Ended December 31, 2020 Cash Flows from Operating Activities Net income $154,800 Adjustments to reconcile net income to net cash flows from operating activities Depreciation expense Increase in accounts receivable Increase in inventory Increase in accounts payable Increase in income tax payable Increase in other current assets 54,000 (12,000) (3,200) 3,200 19,400 (2,200) Net cash flow from operating activities $ 214,000 Cash Flows from Investing Activities Purchase of land (450,000) 1.100,000) Purchase of buildings Net cash flow from investing activities (1,550,000) Cash Flows from Financing Activities Payment of dividends Repayment of notes payable Issued common stock (120,000) 502,308 1,200,000 1,582,308 246,308 142,000 $388,308 Net cash flow from financing activities et decrease in cash Cash at the beginning of the period Cash at the end of the period