Answered step by step

Verified Expert Solution

Question

1 Approved Answer

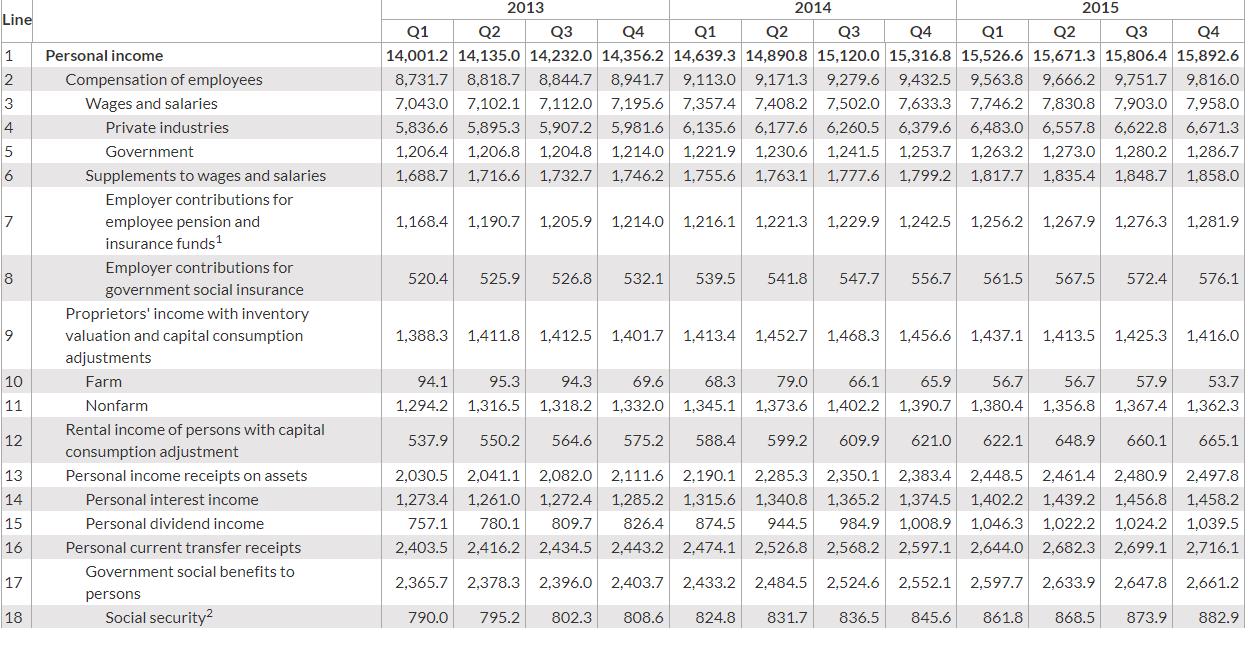

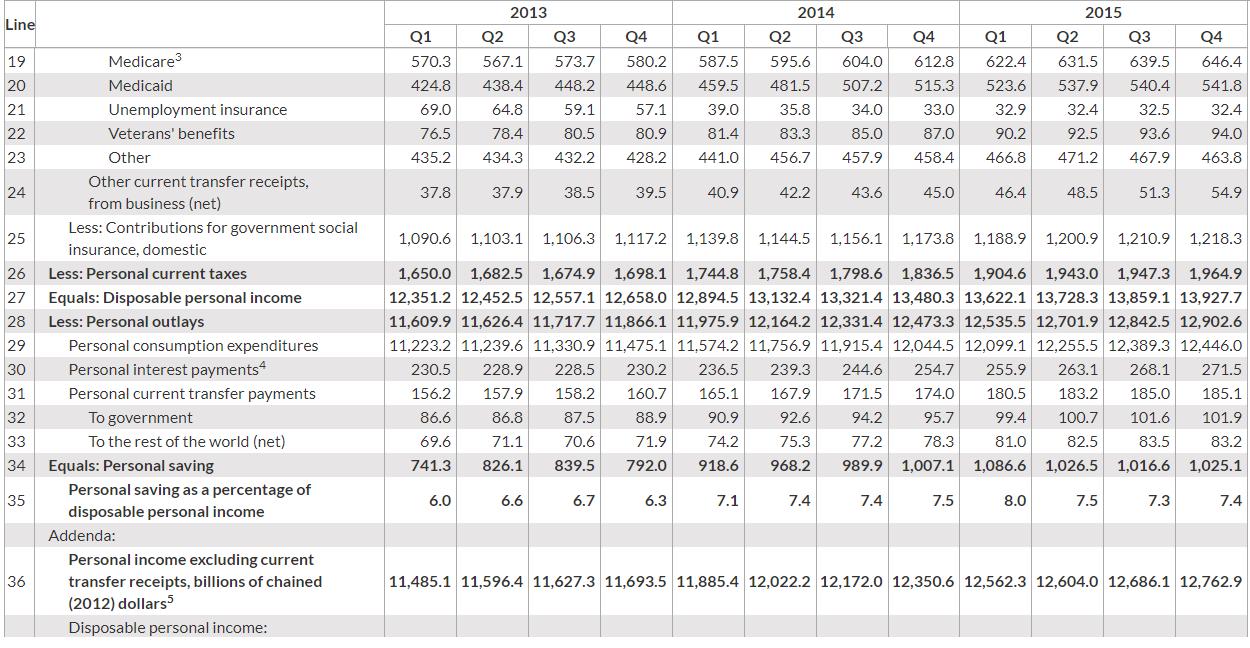

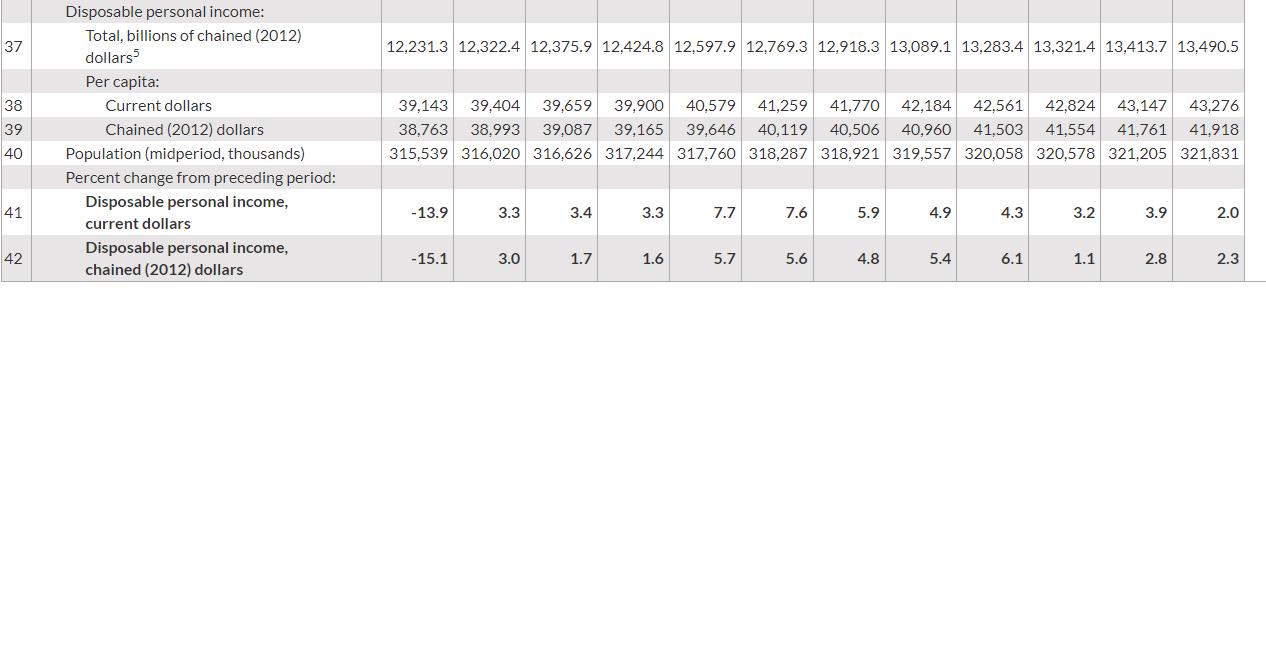

What was Disposable Personal Income (DPI) for the fourth quarter of 2014 What percentage of Real GDP is Disposable Personal Income? Is the economy operating

What was Disposable Personal Income (DPI) for the fourth quarter of 2014

What percentage of Real GDP is Disposable Personal Income?

Is the economy operating above or below equilibrium? (i.e., are Aggregate Expenditures above or below Aggregate Output?)

What conclusion can you draw from this information

2013 2014 2015 Line Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 1 Personal income 14,001.2 14,135.0 14,232.0 14,356.2 14,639.3 14,890.8 15,120.0 15,316.8 15,526.6 15,671.3 15,806.4 15,892.6 Compensation of employees 8,731.7 8,818.7 8,844.7 8,941.7 9,113.0 9,171.3 9,279.6 9,432.5 9,563.8 9.666.2 9,751.7 9,816.0 3 7,043.0 7,102.1 7,112.0 7,633.3 7,903.0 7,958.0 6,557.8 6,622.8 6,671.3 1,280.2 1.286.7 Wages and salaries 7,195.6 7,357.4 7,408.2 7,502.0 7,746.2 7,830.8 4 Private industries 5,836.6 5,895.3 5,907.2 5,981.6 6,135.6 6,177.6 6,260.5 6,379.6 6,483.0 5 1,263.2 1,273.0 1,777.6 1,799.2 1,817.7 1,835.4 Government 1,206.4 1,206.8 1,204.8 1,214.0 1,221.9 1,230.6 1,241.5 1,253.7 Supplements to wages and salaries 1,688.7 1,716.6 1,732.7 1.746.2 1,755.6 1,763.1 1,848.7 1,858.0 Employer contributions for employee pension and insurance funds! 7 1,168.4 1,190.7 1,205.9 1.214.0 1,216.1 1,221.3 1,229.9 1,242.5 1,256.2 1,267.9 1.276.3 1.281.9 Employer contributions for 8 520.4 525.9 526.8 532.1 539.5 541.8 547.7 556.7 561.5 567.5 572.4 576.1 government social insurance Proprietors' income with inventory valuation and capital consumption 1,388.3 1,411.8 1,412.5 1,401.7 1,413.4 1,452.7 1,468.3 1,456.6 1,437.1 1,413.5 1,425.3 1,416.0 adjustments 10 Farm 94.1 95.3 94.3 69.6 68.3 79.0 66.1 65.9 56.7 56.7 57.9 53.7 11 Nonfarm 1,294.2 1,316.5 1,318.2 1,332.0 1,345.1 1,373.6 1,402.2 1,390.7 1,380.4 1,356.8 1,367.4 1,362.3 Rental income of persons with capital 12 537.9 550.2 564.6 575.2 588.4 599.2 609.9 621.0 622.1 648.9 660.1 665.1 consumption adjustment 2,285.3 2,350.1 2,383.4 2,448.5 2,461.4 2,480.9 2,497.8 1,340.8 1,365.2 13 Personal income receipts on assets 2,030.5 2,041.1 2,082.0 2,111.6 2,190.1 14 Personal interest income 1,273.4 1,261.0 1,272.4 1,285.2 1,315.6 1,374.5 1,402.2 1,439.2 1,456.8 1,458.2 15 Personal dividend income 757.1 780.1 809.7 826.4 874.5 944.5 984.9 1,008.9 1,046.3 1,022.2 1,024.2 1,039.5 16 Personal current transfer receipts 2,403.5 2,416.2 2,434.5 2,443.2 2,474.1 2,526.8 2,568.2 2,597.1 2,644.0 2,682.3 2,699.1 2,716.1 Government social benefits to 17 2,365.7 2,378.3 2,396.0 2,403.7 2,433.2 2,484.5 2,524.6 2,552.1 2,597.7 2,633.9 2,647.8 2,661.2 persons 18 Social security? 790.0 795.2 802.3 808.6 824.8 831.7 836.5 845.6 861.8 868.5 873.9 882.9

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Dissble Inme is the mney tht is vilble frm n individuls slry fter heshe ys ll stte nd federl txes It ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started