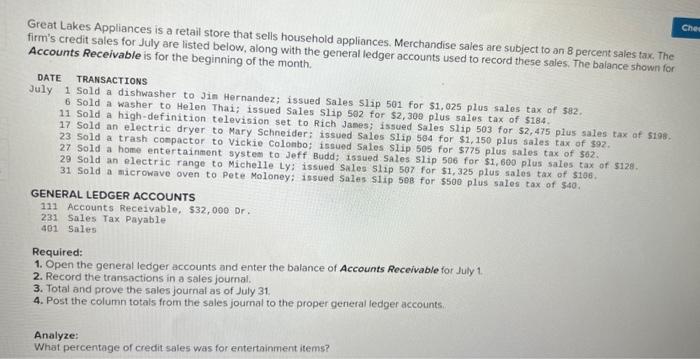

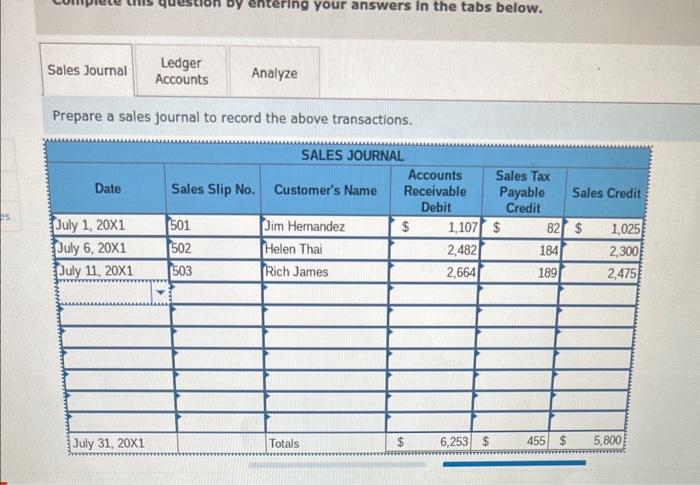

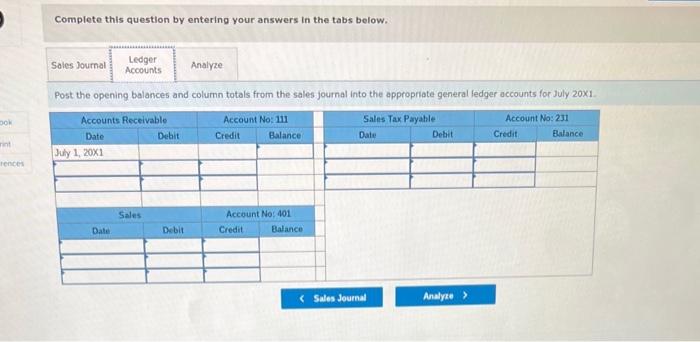

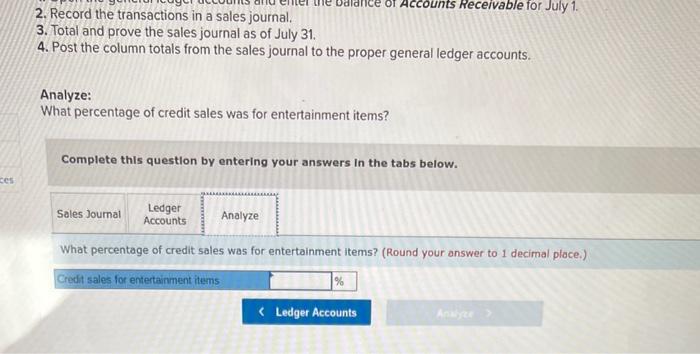

Great Lakes Appliances is a retail store that sells household appliances. Merchandise sales are subject to an 8 percent sales tax. The firm's credit sales for July are listed below, along with the general ledger accounts used to record these sales. The balance shown for Accounts Receivable is for the beginning of the month. DATE TRANSACTIONS July 1 Sold a dishwasher to Jin Hernandez; issued Sales slip 501 for $1,025 plus sales tax of 592 . 6 Sold a washer to Helen Thai; issued Sales Slip 502 for $2, 300 plus sales tax of 5184 . 11 Sold a high-definition television set to Rich James; issued Sales Slip 503 for 52,475 plus sales tax of 5198 . 17 Sold an electric dryer to Mary Schneider; issued 5ales Siip 504 for \$1, 150 plus sales tax of 392 , 23 Sold a trash compactor to Vickie Colombo; issued 5ales slip 505 for $775 plus sales tax of 302 . 27 Sold a home entertainment system to Jeff Budd; 15sued Sales slip 506 for \$1, 600 plus sales tax of $128. 29 Sold an electrc range to Michelle Ly; issued Sales Slip 507 for $1,325 plus sales tax of $106. 31 Sold a microwave oven to Pete Moloney; issued Sales s1ip 508 for $500 plus sales tax of $40. GENERAL LEDGER ACCOUNTS 111 Accounts Receivab1e, 532,000 Dr. 231 Sales Tax Payable 401 Sales Required: 1. Open the general ledger accounts and enter the balance of Accounts Receivable for July 1. 2. Record the transactions in a sales journal. 3. Total and prove the sales journal as of July 31 . 4. Post the column totals from the sales journal to the proper general ledger accounts. Analyze: What percentage of credit sales was for entertainment items? Prepare a sales journal to record the above transactions. Complete this question by entering your answers in the tabs below. Post the opening balances and column totals from the sales journal into the appropriate general fedger accounts for July 201 2. Record the transactions in a sales journal. 3. Total and prove the sales journal as of July 31. 4. Post the column totals from the sales journal to the proper general ledger accounts. Analyze: What percentage of credit sales was for entertainment items? Complete this question by entering your answers In the tabs below. What percentage of credit sales was for entertainment items? (Round your answer to 1 decimal place.)