Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Great Southern Furniture Company (GSFC) produces dining tables in a three-stage process: cutting, assembly and staining. Direct materials (lumber) are added at the beginning

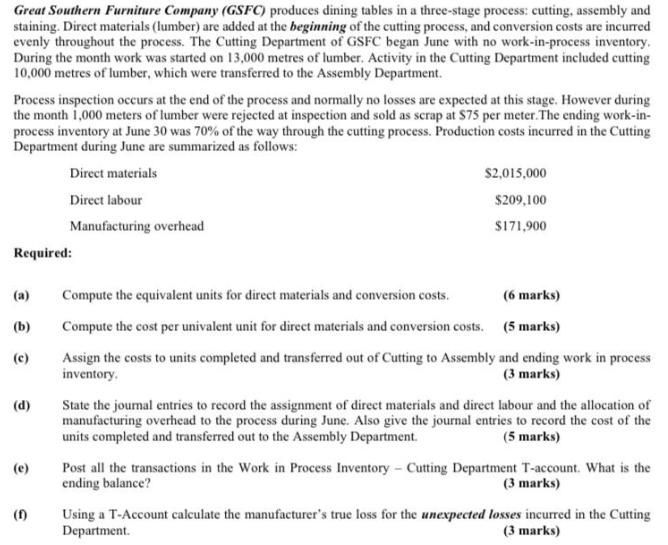

Great Southern Furniture Company (GSFC) produces dining tables in a three-stage process: cutting, assembly and staining. Direct materials (lumber) are added at the beginning of the cutting process, and conversion costs are incurred evenly throughout the process. The Cutting Department of GSFC began June with no work-in-process inventory. During the month work was started on 13,000 metres of lumber. Activity in the Cutting Department included cutting 10,000 metres of lumber, which were transferred to the Assembly Department. Process inspection occurs at the end of the process and normally no losses are expected at this stage. However during the month 1,000 meters of lumber were rejected at inspection and sold as scrap at $75 per meter.The ending work-in- process inventory at June 30 was 70% of the way through the cutting process. Production costs incurred in the Cutting Department during June are summarized as follows: Direct materials $2,015,000 Direct labour $209,100 Manufacturing overhead S171,900 Required: (a) Compute the equivalent units for direct materials and conversion costs. (6 marks) (b) Compute the cost per univalent unit for direct materials and conversion costs. (5 marks) Assign the costs to units completed and transferred out of Cutting to Assembly and ending work in process inventory. (c) (3 marks) (d) State the journal entries to record the assignment of direct materials and direct labour and the allocation of manufacturing overhead to the process during June. Also give the journal entries to record the cost of the units completed and transferred out to the Assembly Department. (5 marks) Post all the transactions in the Work in Process Inventory - Cutting Department T-account. What is the ending balance? (e) (3 marks) (1) Using a T-Account calculate the manufacturer's true loss for the unexpected losses incurred in the Cutting Department. (3 marks)

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Journal entries for the assignment of various costs to the cutting process Date Account Dr Cr Direct ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started