Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Great White (Pty) Ltd has one employee who is paid on a monthly basis. The employees name is Steven Shade. Steven is paid a

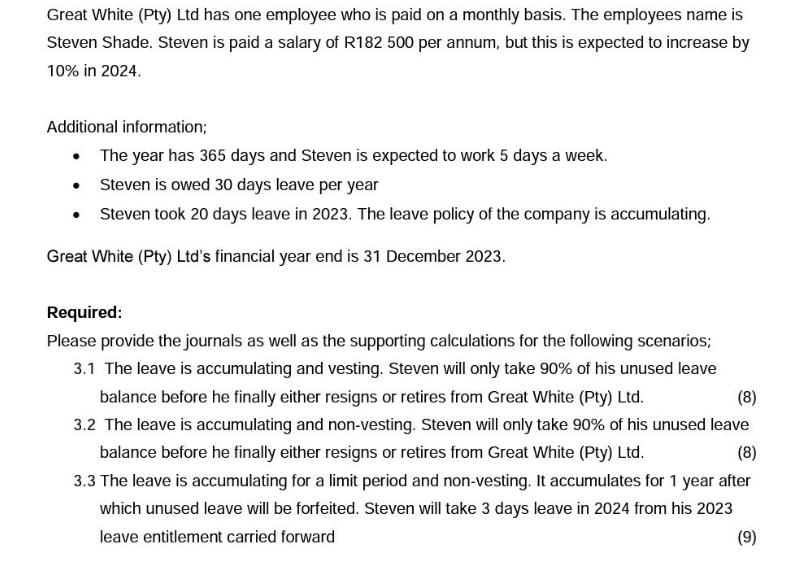

Great White (Pty) Ltd has one employee who is paid on a monthly basis. The employees name is Steven Shade. Steven is paid a salary of R182 500 per annum, but this is expected to increase by 10% in 2024. Additional information; The year has 365 days and Steven is expected to work 5 days a week. Steven is owed 30 days leave per year Steven took 20 days leave in 2023. The leave policy of the company is accumulating. Great White (Pty) Ltd's financial year end is 31 December 2023. Required: Please provide the journals as well as the supporting calculations for the following scenarios; 3.1 The leave is accumulating and vesting. Steven will only take 90% of his unused leave balance before he finally either resigns or retires from Great White (Pty) Ltd. (8) 3.2 The leave is accumulating and non-vesting. Steven will only take 90% of his unused leave balance before he finally either resigns or retires from Great White (Pty) Ltd. (8) 3.3 The leave is accumulating for a limit period and non-vesting. It accumulates for 1 year after which unused leave will be forfeited. Steven will take 3 days leave in 2024 from his 2023 leave entitlement carried forward (9)

Step by Step Solution

★★★★★

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entry 31 Leave is Accumulating and Vesting Debit Employee Benefits Payable Credit Leave Entitlement Steven Shade Amount 20 days R182500 365 da...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started