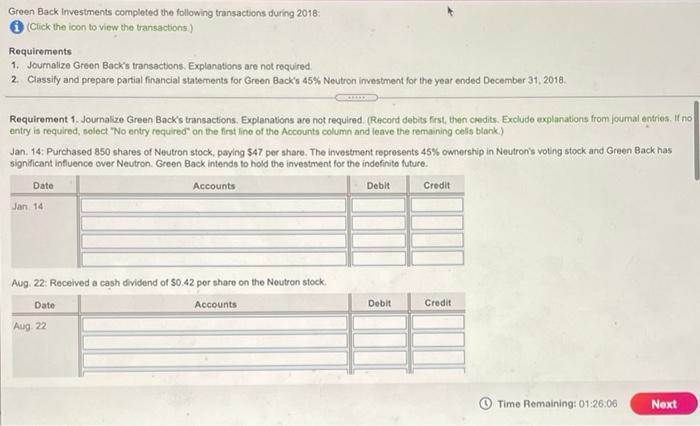

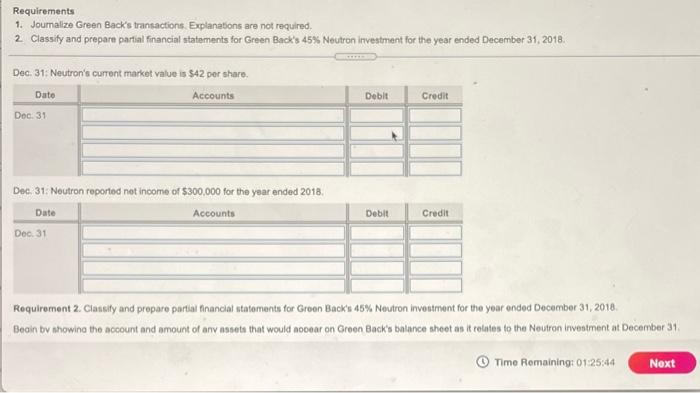

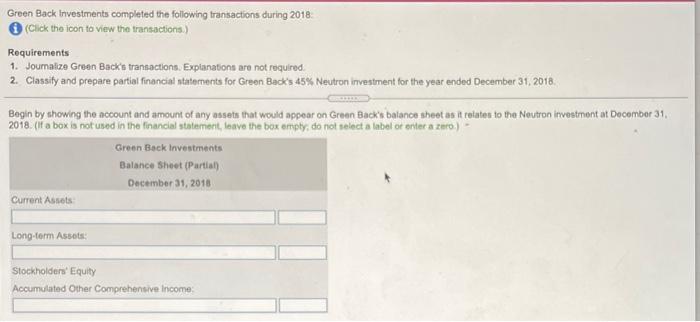

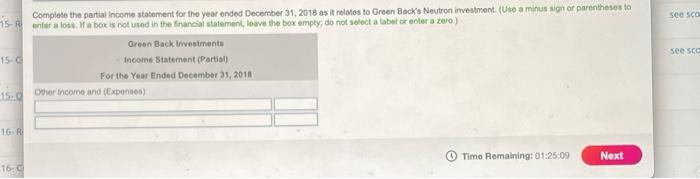

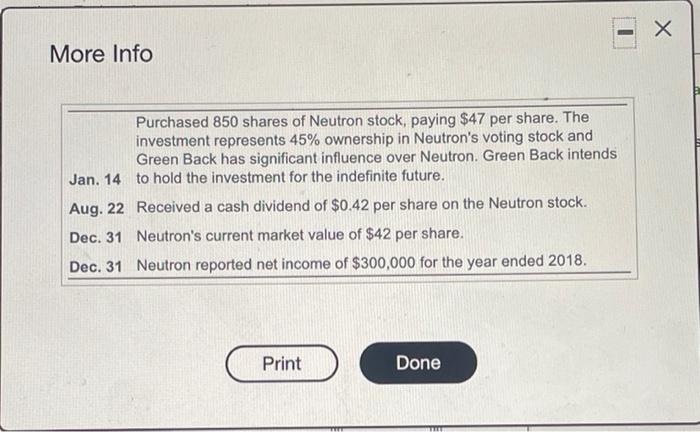

Green Back Investments completed the following transactions during 2018: (Click the icon to view the transactions) Requirements 1. Journalize Green Back's transactions. Explanations are not required, 2 Classily and prepare partial financial statements for Green Back's 45% Neutron investment for the year ended December 31, 2018 Requirement 1. Journalize Green Back's transactions. Explanations are not required. (Record debits first, the credits. Excluto explanations from oumal entries. It no entry in required, nolect "No entry required on the first line of the Accounts column and leave the remaining colis blank.) Jan 14: Purchased 850 shares of Neutron stock, paying 547 per share. The investment represents 45% ownership in Neutron's voting stock and Green Back has significant Influence over Neutron Green Back intends to hold the investment for the indefinita future. Accounts Debit Date Credit Jan 14 Aug 22: Received a cash dividend of $0.42 por share on the Neutron stock Date Accounts Dobit Credit Aug 22 Time Remaining: 01:26:06 Next Requirements 1. Journalize Green Back's transactions. Explanations are not required. 2. Classify and prepara partial financial statements for Green Back's 45% Neutron investment for the year ended December 31, 2018 Dec. 31: Neutron's current market value 5 $42 per share, Date Accounts Debit Credit Dec 31 Dec. 31. Noutron reported net income of $300,000 for the year ended 2018, Date Accounts Debit Credit Dec 31 Requirement 2. Classify and prepare partial financial statements for Green Back's 45%. Neutron investment for the year ended December 31, 2018 Beain by showing the account and amount of any assets that would noosar on Green Back's balance sheet an it relates to the Neutron investment at December 31 Time Romaining:01:25:44 Next Green Back Investments completed the following transactions during 2018 Click the icon to view the transactions.) Requirements 1. Joumalize Green Back's transactions. Explanations are not required. 2. Classify and prepare partial financial statements for Green Back's 45% Neutron investment for the year ended December 31, 2018 Begin by showing the account and amount of any assets that would appear on Green Back's balance sheet as it relates to the Neutron investment at December 31, 2018. (if a box is not used in the financial statement, leave the box empty, do not select a label or enter a zero) Green Back Investments Balance Sheet (Partian December 31, 2018 Current Assets Long-term Assets Stockholders' Equity Accumulated Other Comprehensive Income seesco Complete the partial income statement for the year ended December 31, 2018 as it relates to Green Back's Neutron investment (Use a minus sign of parentheses to 5- punteratos a box is not used in the financial statement, leave the box empty, do not select a label or enter a zero.) Green Back Investments 15 Income Statement (Partial) For the Year Ended December 31, 2011 150 Other Income and (Expenses) see sco 16- Timo Romaining: 01:25:09 Next 16-9 More Info Purchased 850 shares of Neutron stock, paying $47 per share. The investment represents 45% ownership in Neutron's voting stock and Green Back has significant influence over Neutron. Green Back intends Jan. 14 to hold the investment for the indefinite future. Aug. 22 Received a cash dividend of $0.42 per share on the Neutron stock. Dec. 31 Neutron's current market value of $42 per share. Dec. 31 Neutron reported net income of $300,000 for the year ended 2018. Print Done