Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Green Co. and Blue Co. are equal partners in Turquoise Paint. Turquoise Paint had a net income for tax purposes this year of $300,000,

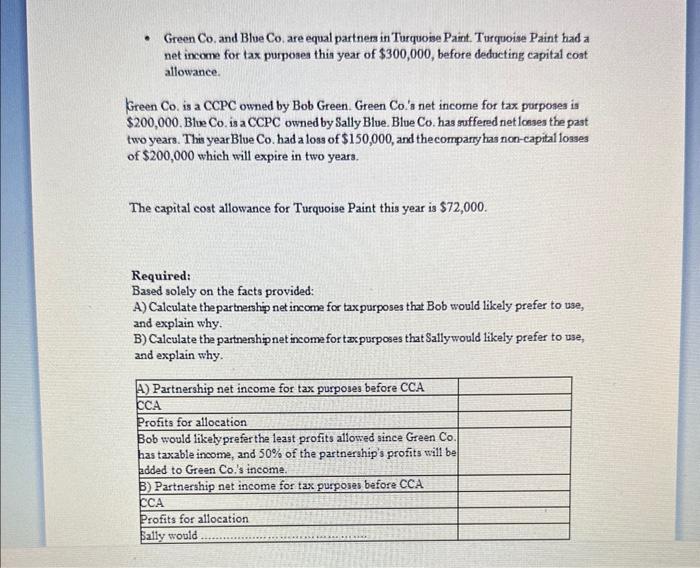

Green Co. and Blue Co. are equal partners in Turquoise Paint. Turquoise Paint had a net income for tax purposes this year of $300,000, before deducting capital cost allowance. Green Co. is a CCPC owned by Bob Green. Green Co.'s net income for tax purposes is $200,000. Blue Co. is a CCPC owned by Sally Blue. Blue Co. has suffered net losses the past two years. This year Blue Co. had a loss of $150,000, and the company has non-capital losses of $200,000 which will expire in two years. The capital cost allowance for Turquoise Paint this year is $72,000. Required: Based solely on the facts provided: A) Calculate the partnership net income for tax purposes that Bob would likely prefer to use, and explain why. B) Calculate the partnership net income for tax purposes that Sallywould likely prefer to use, and explain why. A) Partnership net income for tax purposes before CCA CCA Profits for allocation Bob would likely prefer the least profits allowed since Green Co. has taxable income, and 50% of the partnership's profits will be added to Green Co.'s income. B) Partnership net income for tax purposes before CCA CCA Profits for allocation. Sally would

Step by Step Solution

★★★★★

3.58 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

A Partnership net income for tax purposes that Bob would likely prefer to use Capital Cost Allowance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started