Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Green Co. is a decentralized company consisting of several strategic business units (divisions). The Yellow Division (YD) makes one product, the YT-100, which it

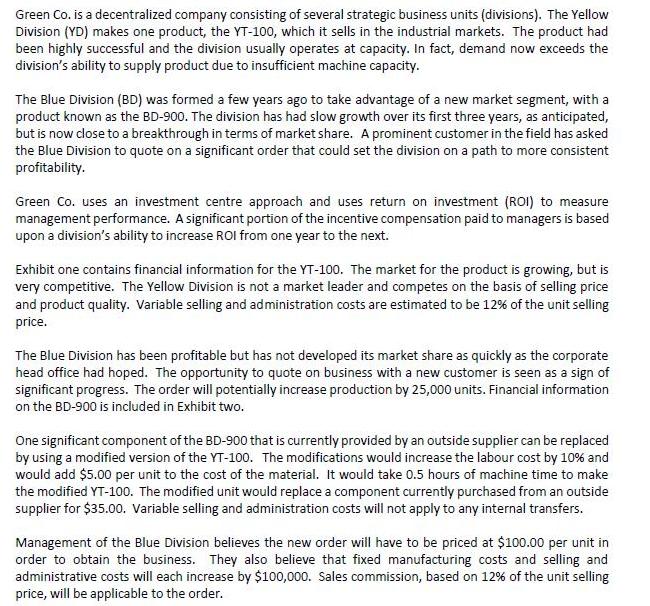

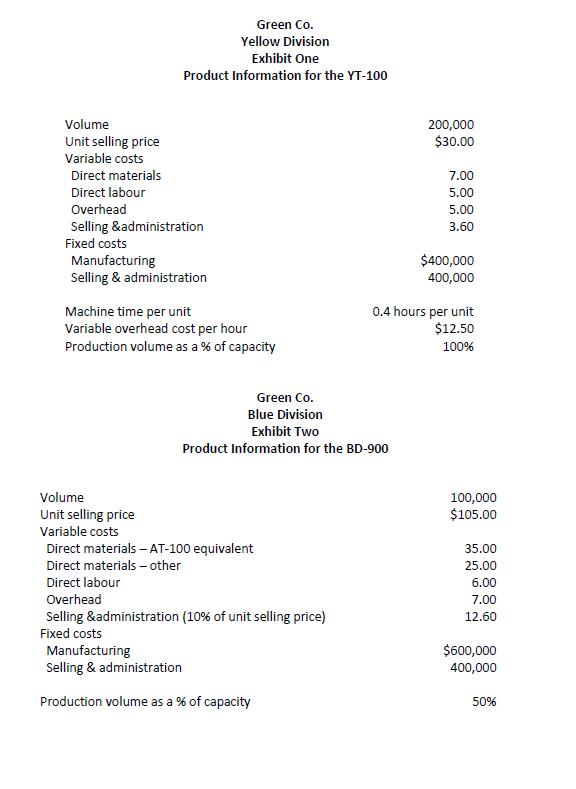

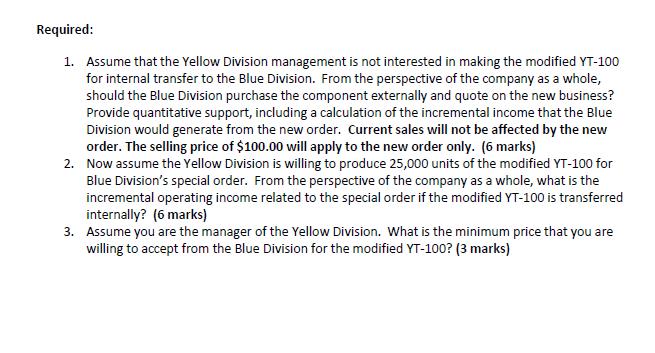

Green Co. is a decentralized company consisting of several strategic business units (divisions). The Yellow Division (YD) makes one product, the YT-100, which it sells in the industrial markets. The product had been highly successful and the division usually operates at capacity. In fact, demand now exceeds the division's ability to supply product due to insufficient machine capacity. The Blue Division (BD) was formed a few years ago to take advantage of a new market segment, with a product known as the BD-900. The division has had slow growth over its first three years, as anticipated, but is now close to a breakthrough in terms of market share. A prominent customer in the field has asked the Blue Division to quote on a significant order that could set the division on a path to more consistent profitability. Green Co. uses an investment centre approach and uses return on investment (ROI) to measure management performance. A significant portion of the incentive compensation paid to managers is based upon a division's ability to increase ROI from one year to the next. Exhibit one contains financial information for the YT-100. The market for the product is growing, but is very competitive. The Yellow Division is not a market leader and competes on the basis of selling price and product quality. Variable selling and administration costs are estimated to be 12% of the unit selling price. The Blue Division has been profitable but has not developed its market share as quickly as the corporate head office had hoped. The opportunity to quote on business with a new customer is seen as a sign of significant progress. The order will potentially increase production by 25,000 units. Financial information on the BD-900 is included in Exhibit two. One significant component of the BD-900 that is currently provided by an outside supplier can be replaced by using a modified version of the YT-100. The modifications would increase the labour cost by 10% and would add $5.00 per unit to the cost of the material. It would take 0.5 hours of machine time to make the modified YT-100. The modified unit would replace a component currently purchased from an outside supplier for $35.00. Variable selling and administration costs will not apply to any internal transfers. Management of the Blue Division believes the new order will have to be priced at $100.00 per unit in order to obtain the business. They also believe that fixed manufacturing costs and selling and administrative costs will each increase by $100,000. Sales commission, based on 12% of the unit selling price, will be applicable to the order.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Should the Blue Division purchase the component externally and quote on the new business To determine whether the Blue Division should purchase the component externally or make it internally using t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started