Answered step by step

Verified Expert Solution

Question

1 Approved Answer

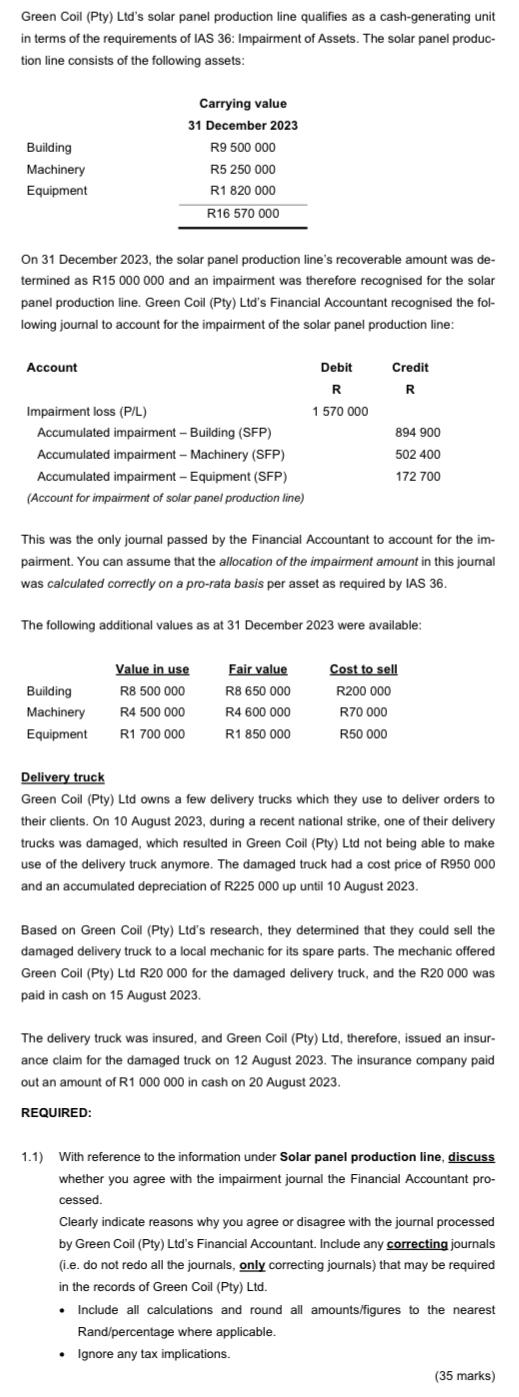

Green Coil (Pty) Ltd's solar panel production line qualifies as a cash-generating unit in terms of the requirements of IAS 36: Impairment of Assets.

Green Coil (Pty) Ltd's solar panel production line qualifies as a cash-generating unit in terms of the requirements of IAS 36: Impairment of Assets. The solar panel produc- tion line consists of the following assets: Carrying value 31 December 2023 Building Machinery Equipment R9 500 000 R5 250 000 R1 820 000 R16 570 000 On 31 December 2023, the solar panel production line's recoverable amount was de- termined as R15 000 000 and an impairment was therefore recognised for the solar panel production line. Green Coil (Pty) Ltd's Financial Accountant recognised the fol- lowing journal to account for the impairment of the solar panel production line: Account Impairment loss (P/L) Accumulated impairment - Building (SFP) Accumulated impairment - Machinery (SFP) Accumulated impairment - Equipment (SFP) (Account for impairment of solar panel production line) Debit R Credit R 1 570 000 894 900 502 400 172 700 This was the only journal passed by the Financial Accountant to account for the im- pairment. You can assume that the allocation of the impairment amount in this journal was calculated correctly on a pro-rata basis per asset as required by IAS 36. The following additional values as at 31 December 2023 were available: Building Machinery Value in use R8 500 000 Fair value Cost to sell R8 650 000 R200 000 R4 500 000 R4 600 000 R70 000 Equipment R1 700 000 R1 850 000 R50 000 Delivery truck Green Coil (Pty) Ltd owns a few delivery trucks which they use to deliver orders to their clients. On 10 August 2023, during a recent national strike, one of their delivery trucks was damaged, which resulted in Green Coil (Pty) Ltd not being able to make use of the delivery truck anymore. The damaged truck had a cost price of R950 000 and an accumulated depreciation of R225 000 up until 10 August 2023. Based on Green Coil (Pty) Ltd's research, they determined that they could sell the damaged delivery truck to a local mechanic for its spare parts. The mechanic offered Green Coil (Pty) Ltd R20 000 for the damaged delivery truck, and the R20 000 was paid in cash on 15 August 2023. The delivery truck was insured, and Green Coil (Pty) Ltd, therefore, issued an insur- ance claim for the damaged truck on 12 August 2023. The insurance company paid out an amount of R1 000 000 in cash on 20 August 2023. REQUIRED: 1.1) With reference to the information under Solar panel production line, discuss whether you agree with the impairment journal the Financial Accountant pro- cessed. Clearly indicate reasons why you agree or disagree with the journal processed by Green Coil (Pty) Ltd's Financial Accountant. Include any correcting journals (i.e. do not redo all the journals, only correcting journals) that may be required in the records of Green Coil (Pty) Ltd. Include all calculations and round all amounts/figures to the nearest Rand/percentage where applicable. Ignore any tax implications. (35 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

I agree with the impairment journal processed by Green Coil Pty Ltds Financial Accountant for the so...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started