Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Green Leaf Limited is an IT company operating in Ghana. The main business of Green Leaf is assembling of personal computer from components that

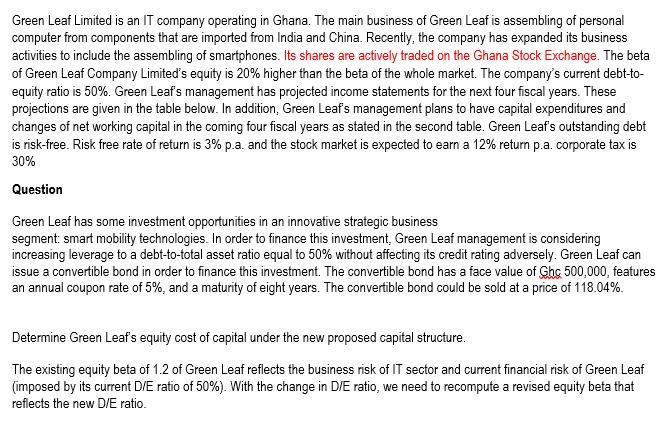

Green Leaf Limited is an IT company operating in Ghana. The main business of Green Leaf is assembling of personal computer from components that are imported from India and China. Recently, the company has expanded its business activities to include the assembling of smartphones. Its shares are actively traded on the Ghana Stock Exchange. The beta of Green Leaf Company Limited's equity is 20% higher than the beta of the whole market. The company's current debt-to- equity ratio is 50%. Green Leaf's management has projected income statements for the next four fiscal years. These projections are given in the table below. In addition, Green Leaf's management plans to have capital expenditures and changes of net working capital in the coming four fiscal years as stated in the second table. Green Leaf's outstanding debt is risk-free. Risk free rate of return is 3% p.a. and the stock market is expected to earn a 12% return p.a. corporate tax is 30% Question Green Leaf has some investment opportunities in an innovative strategic business segment: smart mobility technologies. In order to finance this investment, Green Leaf management is considering increasing leverage to a debt-to-total asset ratio equal to 50% without affecting its credit rating adversely. Green Leaf can issue a convertible bond in order to finance this investment. The convertible bond has a face value of Ghc 500,000, features an annual coupon rate of 5%, and a maturity of eight years. The convertible bond could be sold at a price of 118.04%. Determine Green Leaf's equity cost of capital under the new proposed capital structure. The existing equity beta of 1.2 of Green Leaf reflects the business risk of IT sector and current financial risk of Green Leaf (imposed by its current D/E ratio of 50%). With the change in D/E ratio, we need to recompute a revised equity beta that reflects the new D/E ratio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The new equity beta can be computed using the follo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started