Answered step by step

Verified Expert Solution

Question

1 Approved Answer

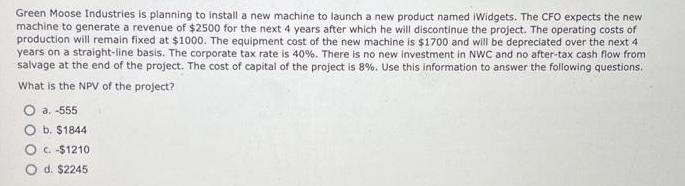

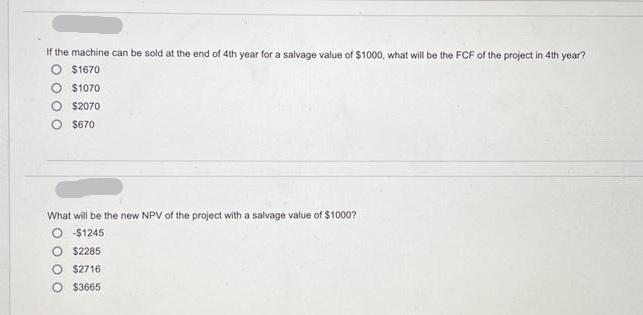

Green Moose Industries is planning to install a new machine to launch a new product named Widgets. The CFO expects the new machine to

Green Moose Industries is planning to install a new machine to launch a new product named Widgets. The CFO expects the new machine to generate a revenue of $2500 for the next 4 years after which he will discontinue the project. The operating costs of production will remain fixed at $1000. The equipment cost of the new machine is $1700 and will be depreciated over the next 4 years on a straight-line basis. The corporate tax rate is 40%. There is no new investment in NWC and no after-tax cash flow from salvage at the end of the project. The cost of capital of the project is 8%. Use this information to answer the following questions. What is the NPV of the project? O a. -555 O b. $1844 OC-$1210 d. $2245 If the machine can be sold at the end of 4th year for a salvage value of $1000, what will be the FCF of the project in 4th year? $1670 $1070 $2070 $670 What will be the new NPV of the project with a salvage value of $1000? O-$1245 O $2285 O $2716 $3665 Green Moose Industries is planning to install a new machine to launch a new product named Widgets. The CFO expects the new machine to generate a revenue of $2500 for the next 4 years after which he will discontinue the project. The operating costs of production will remain fixed at $1000. The equipment cost of the new machine is $1700 and will be depreciated over the next 4 years on a straight-line basis. The corporate tax rate is 40%. There is no new investment in NWC and no after-tax cash flow from salvage at the end of the project. The cost of capital of the project is 8%. Use this information to answer the following questions. What is the NPV of the project? O a. -555 O b. $1844 OC-$1210 d. $2245 If the machine can be sold at the end of 4th year for a salvage value of $1000, what will be the FCF of the project in 4th year? $1670 $1070 $2070 $670 What will be the new NPV of the project with a salvage value of $1000? O-$1245 O $2285 O $2716 $3665 Green Moose Industries is planning to install a new machine to launch a new product named Widgets. The CFO expects the new machine to generate a revenue of $2500 for the next 4 years after which he will discontinue the project. The operating costs of production will remain fixed at $1000. The equipment cost of the new machine is $1700 and will be depreciated over the next 4 years on a straight-line basis. The corporate tax rate is 40%. There is no new investment in NWC and no after-tax cash flow from salvage at the end of the project. The cost of capital of the project is 8%. Use this information to answer the following questions. What is the NPV of the project? O a. -555 O b. $1844 OC-$1210 d. $2245 If the machine can be sold at the end of 4th year for a salvage value of $1000, what will be the FCF of the project in 4th year? $1670 $1070 $2070 $670 What will be the new NPV of the project with a salvage value of $1000? O-$1245 O $2285 O $2716 $3665

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To calculate the Net Present Value NPV of the project we can follow these steps Step 1 Ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started