Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Green Systems specializes in servers for work group e-commerce and enterprise resource planning (ERP). applications. The company's original job cost system has two direct cost

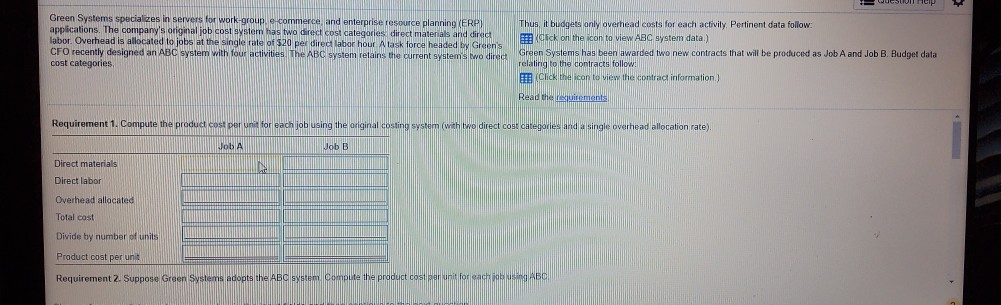

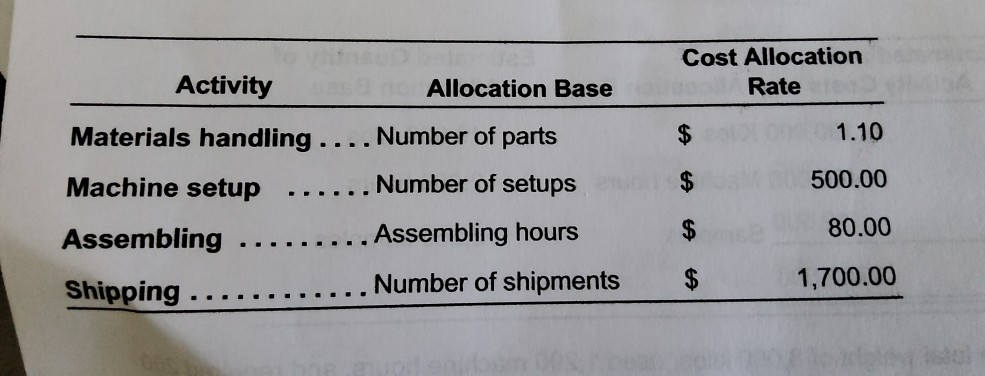

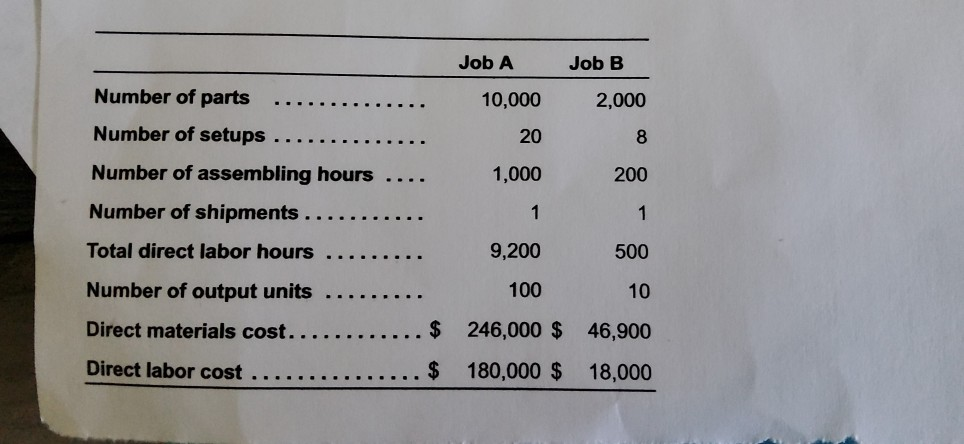

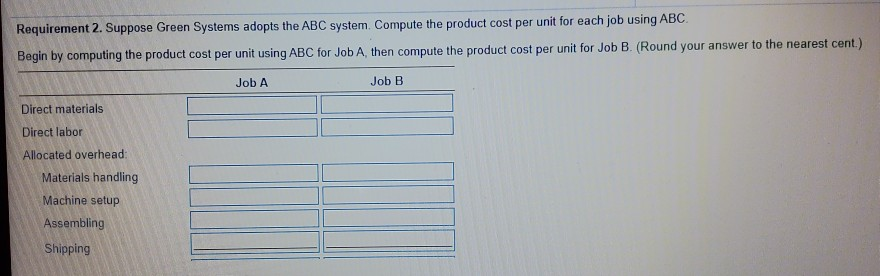

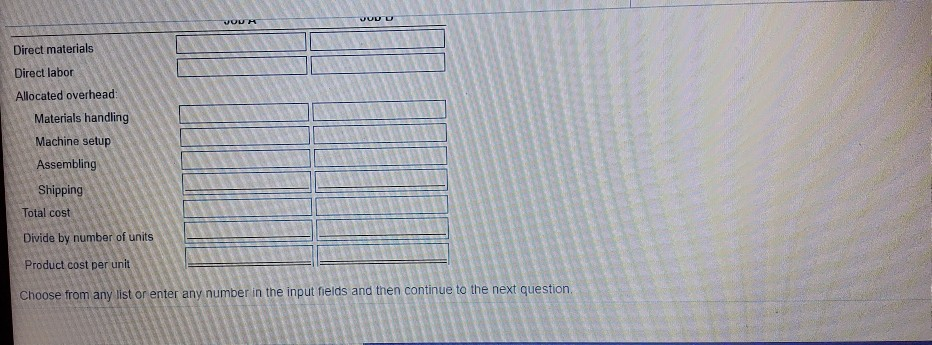

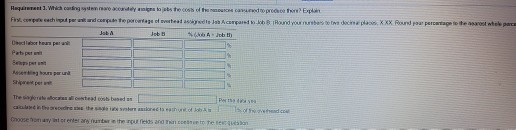

Green Systems specializes in servers for work group e-commerce and enterprise resource planning (ERP). applications. The company's original job cost system has two direct cost categories direct materials and direct labor, Overhead is allocated to jobs at the single rate of $20 per dired labor hour task force headed by Green's CFO recently designed an ABC system with four activities. The ABC system retains the current systems two direct cost categories Thus it budgets only overhead costs for each activity. Pertinent data follow: Click on the icon to view ABC system data) Green Systems been awarded two new contracts that will be produced as Job A and Job B. Budget data relating to the contracts follow! Click the icon to view the contract information) Read the suitements Requirement 1. Compute the product cost per unit for each job using the original costing system (with two direct cost categorien single overhead allocation rate). JobA Job B Direct materials Direct labor Overhead allocated Total cast Divide by number of units Product cost per un Requirement 2. Suppone Green Systems adopts the ABCs Compute the product cost marunt for each Cost Allocation Rate Activity Allocation Base Materials handling .. Number of parts $ 1.10 Machine setup Number of setups $ 500.00 Assembling hours 80.00 Assembling Shipping .. Number of shipments 1,700.00 Job A Job B 10,000 2,000 20 8 Number of parts Number of setups ... Number of assembling hours Number of shipments. 1,000 200 1 1 Total direct labor hours 9,200 500 Number of output units 100 10 Direct materials cost...... $ 246,000 $ 46,900 Direct labor cost $ 180,000 $ 18,000 Requirement 2. Suppose Green Systems adopts the ABC system Compute the product cost per unit for each job using ABC Begin by computing the product cost per unit using ABC for Job A, then compute the product cost per unit for Job B. (Round your answer to the nearest cent.) JobA Job B Direct materials Direct labor Allocated overhead Materials handling Machine setup Assembling Shipping VOUH JUDU Direct materials Direct labor Allocated overhead Materials handling Machine setup Assembling Shipping Total cost Divide by number of units Product cost per unit Choose from any list or enter any number in the input fields and then continue to the next question Hapa Waingewys is the cost of the catre Expo Flatcapite prowage was las compartido depo XXX Randpercentage to the stepen Job Job Sobh Dan par Therested buses Center the corect the Choose a trente ao the pure and te 15 of Books he Thaigalalaalai Parade I can wyth Theatre wadah bered wych Who wa the Westerse They hech www powo Boy Widow Down we can help 2 Choose the end Green Systems specializes in servers for work group e-commerce and enterprise resource planning (ERP). applications. The company's original job cost system has two direct cost categories direct materials and direct labor, Overhead is allocated to jobs at the single rate of $20 per dired labor hour task force headed by Green's CFO recently designed an ABC system with four activities. The ABC system retains the current systems two direct cost categories Thus it budgets only overhead costs for each activity. Pertinent data follow: Click on the icon to view ABC system data) Green Systems been awarded two new contracts that will be produced as Job A and Job B. Budget data relating to the contracts follow! Click the icon to view the contract information) Read the suitements Requirement 1. Compute the product cost per unit for each job using the original costing system (with two direct cost categorien single overhead allocation rate). JobA Job B Direct materials Direct labor Overhead allocated Total cast Divide by number of units Product cost per un Requirement 2. Suppone Green Systems adopts the ABCs Compute the product cost marunt for each Cost Allocation Rate Activity Allocation Base Materials handling .. Number of parts $ 1.10 Machine setup Number of setups $ 500.00 Assembling hours 80.00 Assembling Shipping .. Number of shipments 1,700.00 Job A Job B 10,000 2,000 20 8 Number of parts Number of setups ... Number of assembling hours Number of shipments. 1,000 200 1 1 Total direct labor hours 9,200 500 Number of output units 100 10 Direct materials cost...... $ 246,000 $ 46,900 Direct labor cost $ 180,000 $ 18,000 Requirement 2. Suppose Green Systems adopts the ABC system Compute the product cost per unit for each job using ABC Begin by computing the product cost per unit using ABC for Job A, then compute the product cost per unit for Job B. (Round your answer to the nearest cent.) JobA Job B Direct materials Direct labor Allocated overhead Materials handling Machine setup Assembling Shipping VOUH JUDU Direct materials Direct labor Allocated overhead Materials handling Machine setup Assembling Shipping Total cost Divide by number of units Product cost per unit Choose from any list or enter any number in the input fields and then continue to the next question Hapa Waingewys is the cost of the catre Expo Flatcapite prowage was las compartido depo XXX Randpercentage to the stepen Job Job Sobh Dan par Therested buses Center the corect the Choose a trente ao the pure and te 15 of Books he Thaigalalaalai Parade I can wyth Theatre wadah bered wych Who wa the Westerse They hech www powo Boy Widow Down we can help 2 Choose the end

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started