Answered step by step

Verified Expert Solution

Question

1 Approved Answer

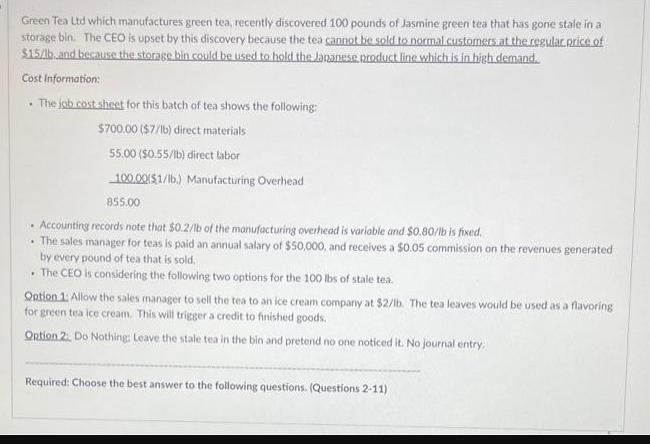

Green Tea Ltd which manufactures green tea, recently discovered 100 pounds of Jasmine green tea that has gone stale in a storage bin. The

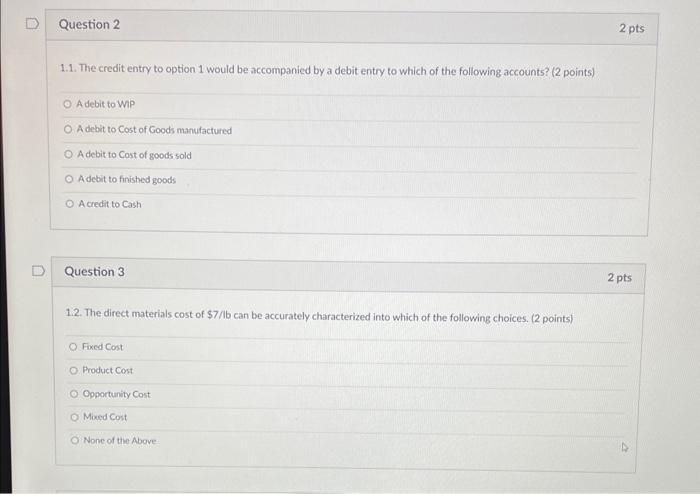

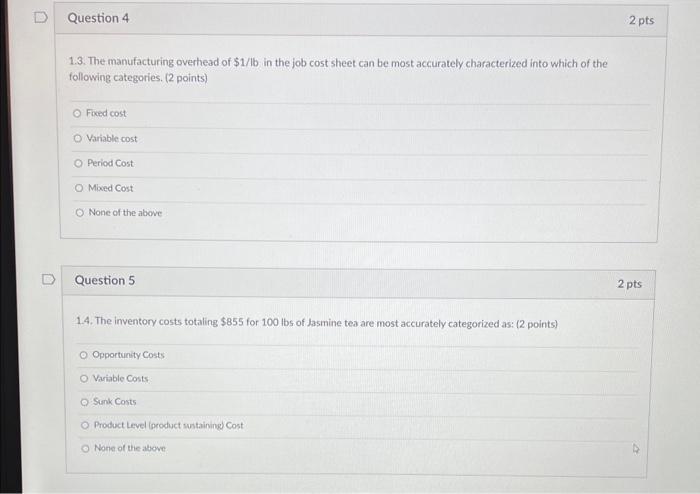

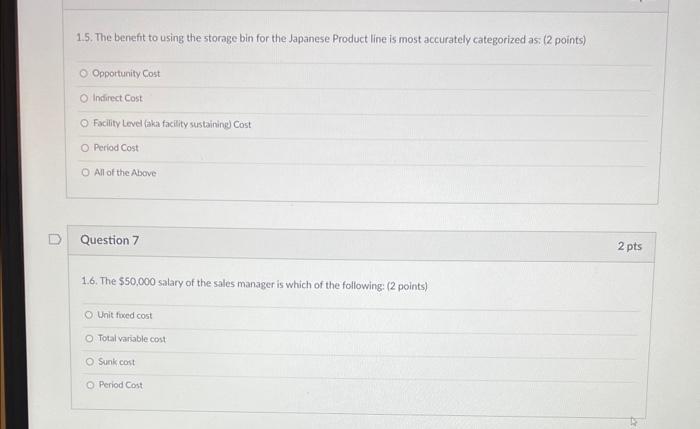

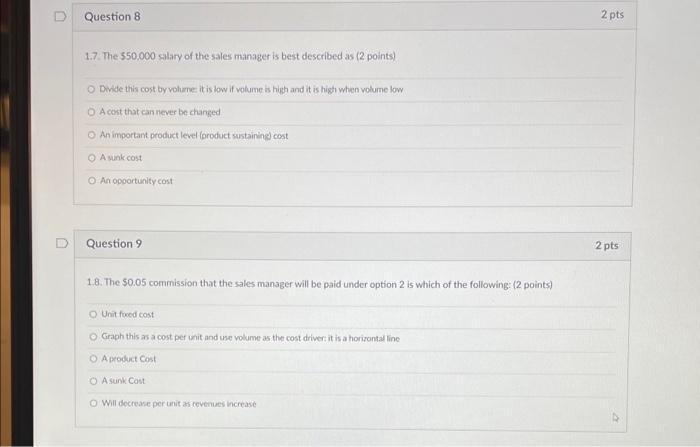

Green Tea Ltd which manufactures green tea, recently discovered 100 pounds of Jasmine green tea that has gone stale in a storage bin. The CEO is upset by this discovery because the tea cannot be sold to normal customers at the regular price of $15/lb. and because the storage bin could be used to hold the Japanese product line which is in high demand. Cost Information: . The job cost sheet for this batch of tea shows the following: $700.00 ($7/1b) direct materials 55.00 ($0.55/lb) direct labor 100.00 $1/lb.) Manufacturing Overhead 855.00 . Accounting records note that $0.2/lb of the manufacturing overhead is variable and $0.80/lb is fixed. The sales manager for teas is paid an annual salary of $50,000, and receives a $0.05 commission on the revenues generated by every pound of tea that is sold. . The CEO is considering the following two options for the 100 lbs of stale tea. Option 1: Allow the sales manager to sell the tea to an ice cream company at $2/lb. The tea leaves would be used as a flavoring for green tea ice cream. This will trigger a credit to finished goods. Option 2: Do Nothing: Leave the stale tea in the bin and pretend no one noticed it. No journal entry. Required: Choose the best answer to the following questions. (Questions 2-11) Question 2 1.1. The credit entry to option 1 would be accompanied by a debit entry to which of the following accounts? (2 points) O A debit to WIP O A debit to Cost of Goods manufactured O A debit to Cost of goods sold O A debit to finished goods O A credit to Cash Question 3 1.2. The direct materials cost of $7/lb can be accurately characterized into which of the following choices. (2 points) O Fixed Cost O Product Cost O Opportunity Cost O Mixed Cost None of the Above 2 pts 2 pts Question 4 1.3. The manufacturing overhead of $1/lb in the job cost sheet can be most accurately characterized into which of the following categories. (2 points) O Fixed cost O Variable cost O Period Cost O Mixed Cost O None of the above Question 5 1.4. The inventory costs totaling $855 for 100 lbs of Jasmine tea are most accurately categorized as: (2 points) O Opportunity Costs O Variable Costs O Sunk Costs O Product Level (product sustaining) Cost O None of the above 2 pts 2 pts 1.5. The benefit to using the storage bin for the Japanese Product line is most accurately categorized as: (2 points) O Opportunity Cost O Indirect Cost O Facility Level (aka facility sustaining) Cost O Period Cost O All of the Above Question 7 1.6. The $50,000 salary of the sales manager is which of the following: (2 points) O Unit fixed cost O Total variable cost O Sunk cost O Period Cost 2 pts Question 81 1.7. The $50,000 salary of the sales manager is best described as (2 points) O Divide this cost by volume it is low if volume is high and it is high when volume low O A cost that can never be changed O An important product level (product sustaining) cost Asunk cost O An opportunity cost Question 9 1.8. The $0.05 commission that the sales manager will be paid under option 2 is which of the following: (2 points) O Unit foxed cost O Graph this as a cost per unit and use volume as the cost driver: it is a horizontal line O A product Cost OA sunk Cost O Will decrease per unit as revenues increase 2 pts 2 pts

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Question 2 The credit entry to Option 1 would be accompanied by a debit entry to the Finished Goods account This is because the stale tea w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started