Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Green Tech Limited will be issuing bonds for the purpose of financing a new environmentally friendly waste management system on 1st June 2019. The

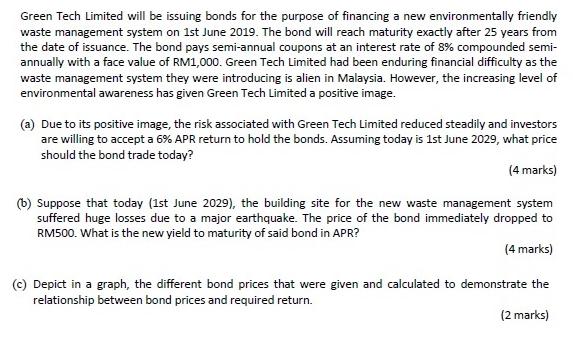

Green Tech Limited will be issuing bonds for the purpose of financing a new environmentally friendly waste management system on 1st June 2019. The bond will reach maturity exactly after 25 years from the date of issuance. The bond pays semi-annual coupons at an interest rate of 8% compounded semi- annually with a face value of RM1,000. Green Tech Limited had been enduring financial difficulty as the waste management system they were introducing is alien in Malaysia. However, the increasing level of environmental awareness has given Green Tech Limited a positive image. (a) Due to its positive image, the risk associated with Green Tech Limited reduced steadily and investors are willing to accept a 6% APR return to hold the bonds. Assuming today is 1st June 2029, what price should the bond trade today? (4 marks) (b) Suppose that today (1st June 2029), the building site for the new waste management system suffered huge losses due to a major earthquake. The price of the bond immediately dropped to RM500. What is the new yield to maturity of said bond in APR? (4 marks) (c) Depict in a graph, the different bond prices that were given and calculated to demonstrate the relationship between bond prices and required return. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a To calculate the price of the bond we need to find the present value of the future cash flows coupons and face value discounted at the requir...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started