Answered step by step

Verified Expert Solution

Question

1 Approved Answer

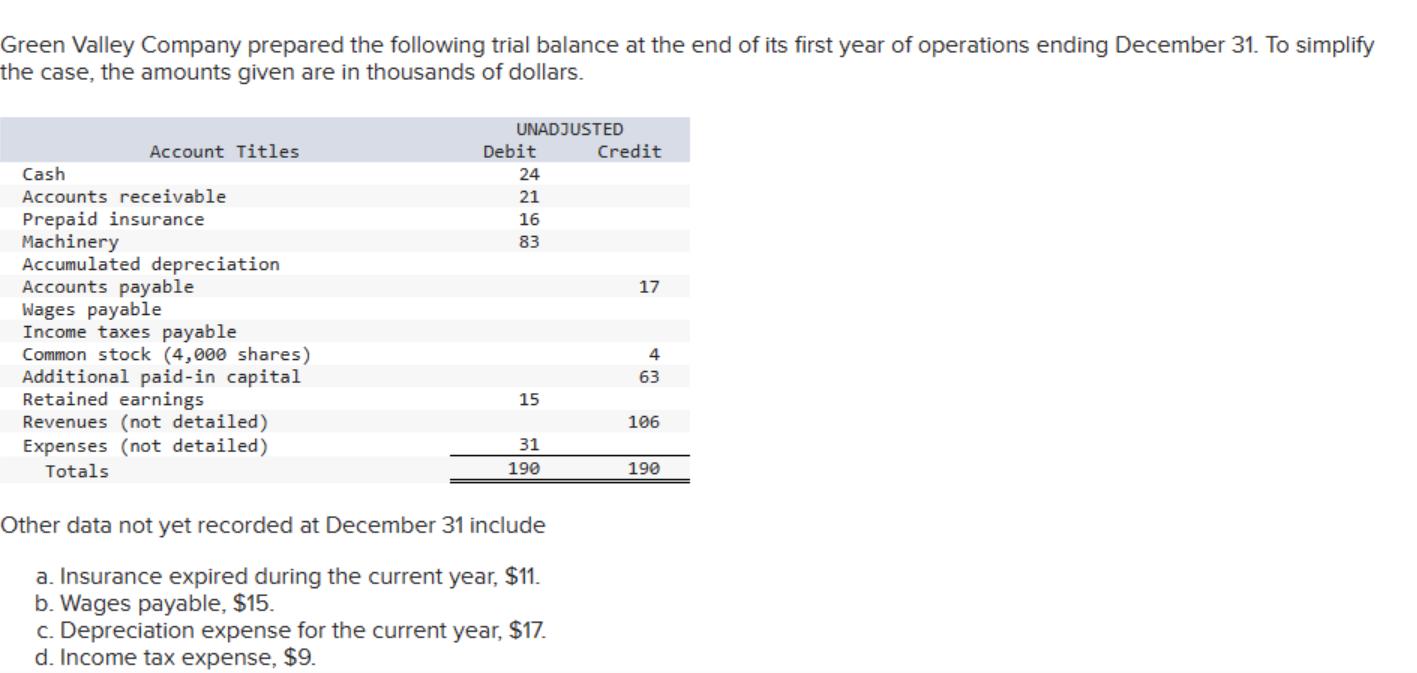

Green Valley Company prepared the following trial balance at the end of its first year of operations ending December 31. To simplify the case,

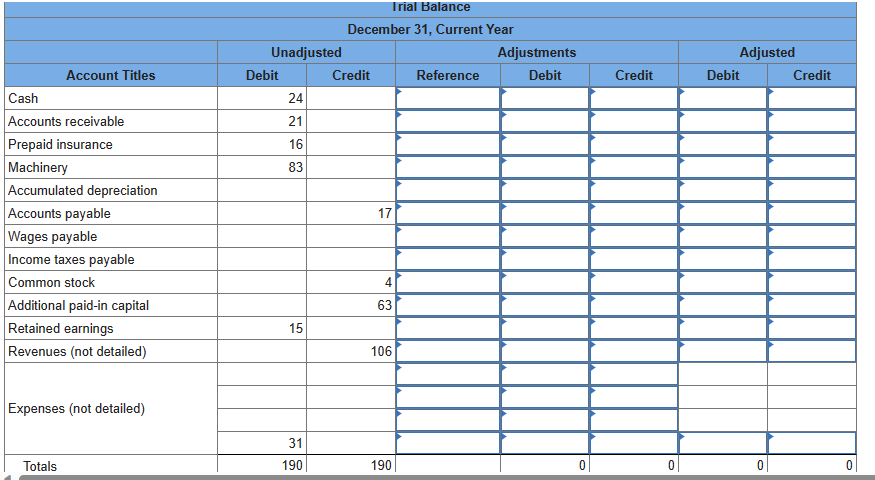

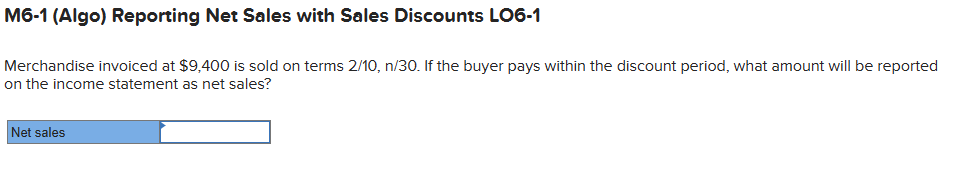

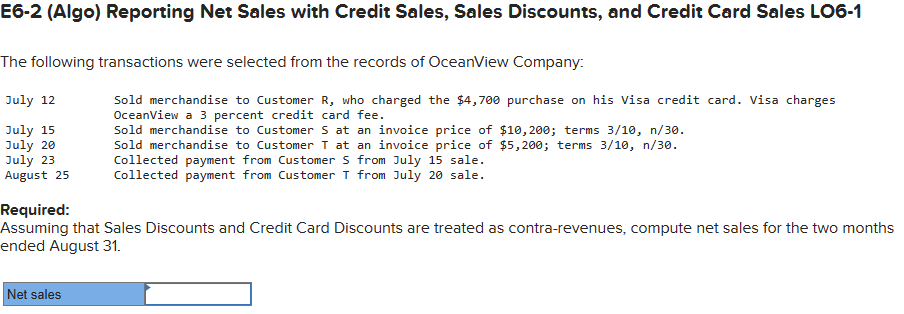

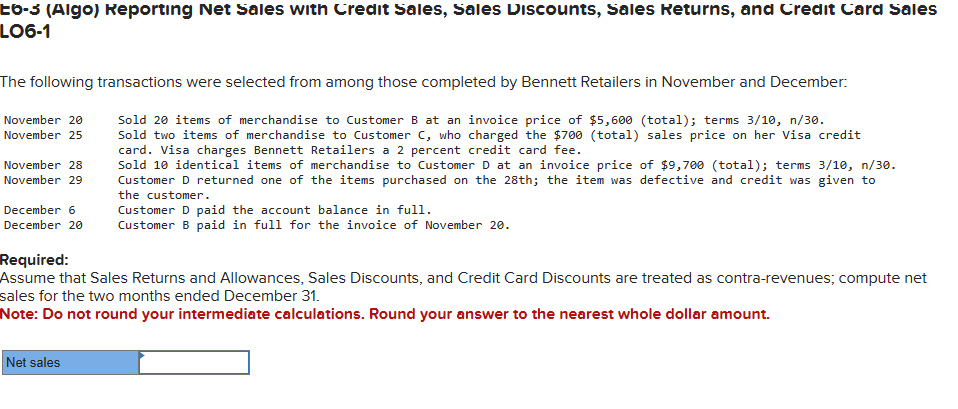

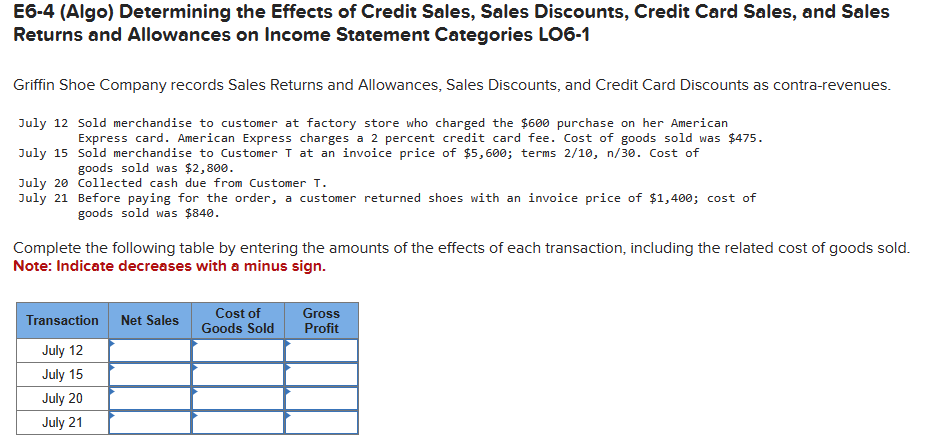

Green Valley Company prepared the following trial balance at the end of its first year of operations ending December 31. To simplify the case, the amounts given are in thousands of dollars. Cash Account Titles Accounts receivable Prepaid insurance Machinery Accumulated depreciation Accounts payable Wages payable Income taxes payable Common stock (4,000 shares) Additional paid-in capital Retained earnings Revenues (not detailed) Expenses (not detailed) Totals UNADJUSTED Debit Credit 24 21 16 83 17 4 63 15 106 31 190 190 Other data not yet recorded at December 31 include a. Insurance expired during the current year, $11. b. Wages payable, $15. c. Depreciation expense for the current year, $17. d. Income tax expense, $9. Trial Balance December 31, Current Year Unadjusted Account Titles Debit Credit Reference Cash 24 Accounts receivable 21 Prepaid insurance 16 Machinery 83 Accumulated depreciation Accounts payable 17 Wages payable Income taxes payable Common stock 4 Additional paid-in capital 63 Retained earnings 15 Revenues (not detailed) 106 Expenses (not detailed) Totals Adjustments Adjusted Debit Credit Debit Credit 31 190 190 0 0 HW 06A - Required i M6-1 (Algo) Reporting Net Sales with Sales Discounts LO6-1 Merchandise invoiced at $9,400 is sold on terms 2/10, n/30. If the buyer pays within the discount period, what amount will be reported on the income statement as net sales? Net sales E6-2 (Algo) Reporting Net Sales with Credit Sales, Sales Discounts, and Credit Card Sales LO6-1 The following transactions were selected from the records of OceanView Company: July 12 Sold merchandise to Customer R, who charged the $4,700 purchase on his Visa credit card. Visa charges OceanView a 3 percent credit card fee. July 15 July 20 July 23 August 25 Required: Sold merchandise to Customer S at an invoice price of $10,200; terms 3/10, n/30. Sold merchandise to Customer T at an invoice price of $5,200; terms 3/10, n/30. Collected payment from Customer S from July 15 sale. Collected payment from Customer T from July 20 sale. Assuming that Sales Discounts and Credit Card Discounts are treated as contra-revenues, compute net sales for the two months ended August 31. Net sales Eb-3 (Algo) Reporting Net Sales with Credit Sales, Sales Discounts, Sales Returns, and Credit Card Sales LO6-1 The following transactions were selected from among those completed by Bennett Retailers in November and December: November 20 November 25 November 28 November 29 December 6 December 20 Required: Sold 20 items of merchandise to Customer B at an invoice price of $5,600 (total); terms 3/10, n/30. Sold two items of merchandise to Customer C, who charged the $700 (total) sales price on her Visa credit card. Visa charges Bennett Retailers a 2 percent credit card fee. Sold 10 identical items of merchandise to Customer D at an invoice price of $9,700 (total); terms 3/10, n/30. Customer D returned one of the items purchased on the 28th; the item was defective and credit was given to the customer. Customer D paid the account balance in full. Customer B paid in full for the invoice of November 20. Assume that Sales Returns and Allowances, Sales Discounts, and Credit Card Discounts are treated as contra-revenues; compute net sales for the two months ended December 31. Note: Do not round your intermediate calculations. Round your answer to the nearest whole dollar amount. Net sales E6-4 (Algo) Determining the Effects of Credit Sales, Sales Discounts, Credit Card Sales, and Sales Returns and Allowances on Income Statement Categories LO6-1 Griffin Shoe Company records Sales Returns and Allowances, Sales Discounts, and Credit Card Discounts as contra-revenues. July 12 Sold merchandise to customer at factory store who charged the $600 purchase on her American Express card. American Express charges a 2 percent credit card fee. Cost of goods sold was $475. July 15 Sold merchandise to Customer T at an invoice price of $5,600; terms 2/10, n/30. Cost of goods sold was $2,800. July 20 Collected cash due from Customer T. July 21 Before paying for the order, a customer returned shoes with an invoice price of $1,400; cost of goods sold was $840. Complete the following table by entering the amounts of the effects of each transaction, including the related cost of goods sold. Note: Indicate decreases with a minus sign. Transaction Net Sales Cost of Goods Sold Gross Profit July 12 July 15 July 20 July 21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started