Answered step by step

Verified Expert Solution

Question

1 Approved Answer

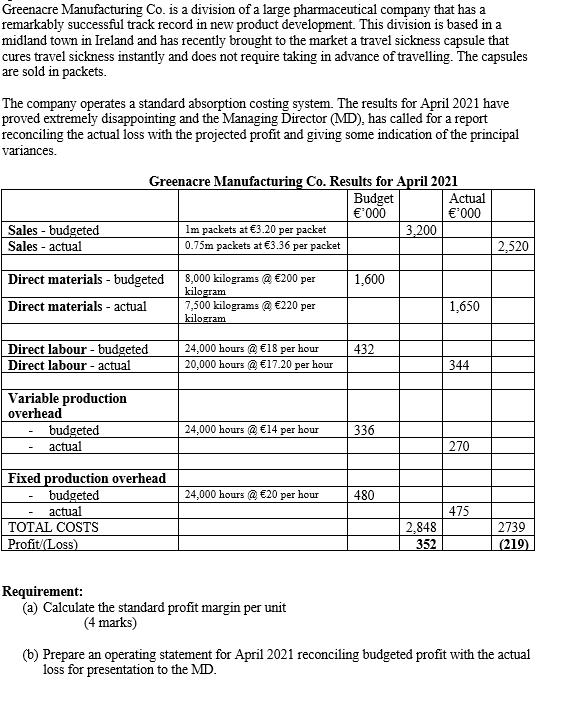

Greenacre Manufacturing Co. is a division of a large pharmaceutical company that has a remarkably successful track record in new product development. This division

Greenacre Manufacturing Co. is a division of a large pharmaceutical company that has a remarkably successful track record in new product development. This division is based in a midland town in Ireland and has recently brought to the market a travel sickness capsule that cures travel sickness instantly and does not require taking in advance of travelling. The capsules are sold in packets. The company operates a standard absorption costing system. The results for April 2021 have proved extremely disappointing and the Managing Director (MD), has called for a report reconciling the actual loss with the projected profit and giving some indication of the principal variances. Greenacre Manufacturing Co. Results for April 2021 Budget *000 Actual '000 Sales - budgeted Sales - actual Im packets at 3.20 per packet 3,200 0.75m packets at 3.36 per packet 2,520 Direct materials - budgeted 1,600 8,000 kilograms @ 200 per kilogram 7,500 kilograms @ 220 per kilogram Direct materials - actual 1,650 Direct labour - budgeted 24,000 hours @ 18 per hour 432 Direct labour - actual 20,000 hours @ 17.20 per hour 344 Variable production overhead 24,000 hours @ 14 per hour budgeted actual 336 270 Fixed production overhead budgeted actual TOTAL COSTS Profit/(Loss) 24,000 hours @ 20 per hour 480 475 2,848 352 2739 (219) Requirement: (a) Calculate the standard profit margin per unit (4 marks) (b) Prepare an operating statement for April 2021 reconciling budgeted profit with the actual loss for presentation to the MD. (Note: Detailed variances are required and all workings must be shown. Round to three decimal places where necessary). (17 marks) (c) After presenting the variances calculated to prepare the operating statement in (a) above at a management meeting one of the management team expresses the view that while he 'understands the reasons for the material and labour and sales variances he is confused about the fixed and variable overhead ygrainces Interpret and explain the reasons for the variable and fixed overhead variances that you have calculated for the benefit of the management team. (4 marks) TOTAL 25 MARKS

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation a Standard profit margin per unit Selling price per unit 320 Less Costs Direct material 80001000000200 1600 Direct labor 24000100000018 0432 Variable overhead 24000100000014 0336 Fi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started