Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Greenbriar Railcar Manufacturing of Lake Oswego has projected sales of $275 million next year. Costs (including depreciation) are expected to be 72 percent of

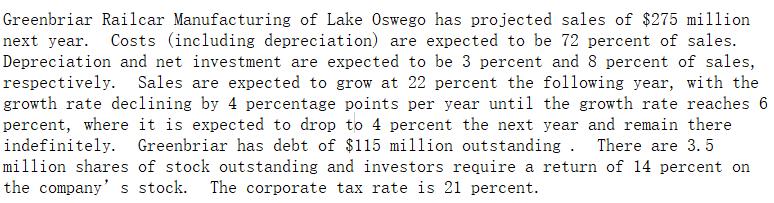

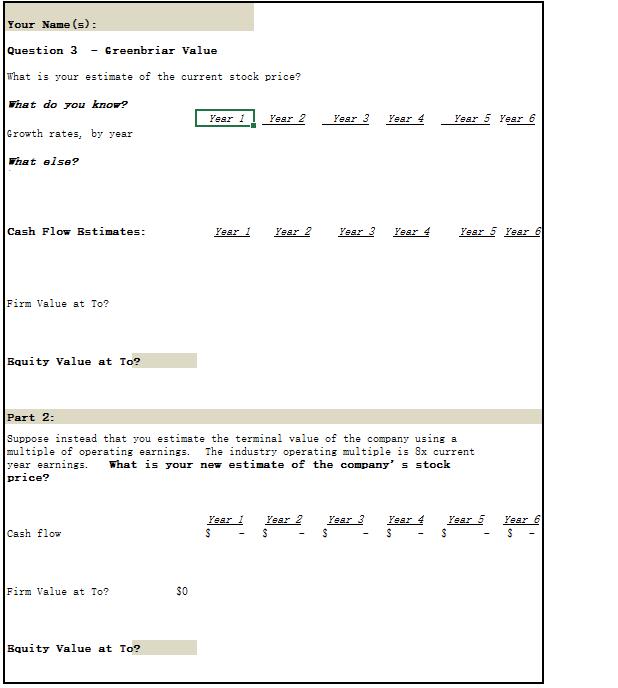

Greenbriar Railcar Manufacturing of Lake Oswego has projected sales of $275 million next year. Costs (including depreciation) are expected to be 72 percent of sales. Depreciation and net investment are expected to be 3 percent and 8 percent of sales, respectively. Sales are expected to grow at 22 percent the following year, with the growth rate declining by 4 percentage points per year until the growth rate reaches 6 percent, where it is expected to drop to 4 percent the next year and remain there indefinitely. Greenbriar has debt of $115 million outstanding . There are 3. 5 million shares of stock outstanding and investors require a return of 14 percent on the company's stock. The corporate tax rate is 21 percent. Your Name (s): Question 3 Greenbriar Value That is your estimate of the current stock price? Fhat do you know? Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Growth rates, by year That else? Cash Flow Bstimates: Year 1 Year Year 3 Year 4 Year 5 Year 6 Firm Value at To? Bquity Value at To? Part 2: Suppose instead that you estimate the terminal value of the company using a multiple of operating esrnings. year earnings. price? The industry operating multiple is 8x current What is your new estimate of the company' s stock Year 1 Year 2 Year 3 Fear 4 Year 5 Year 6 Cash flow Firm Value at To? Bquity Value at To?

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

A E F H 1 Particular Year 2 1 3 4 3 Growth rates 0 2200 1800 1400 1000 600 4 4 Debt 11500000000 5 Nu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started