Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Greener Side Fertilizer, Inc. estimates that its total financing needs for the coming year will be $35 million. The firm's required financing payments on

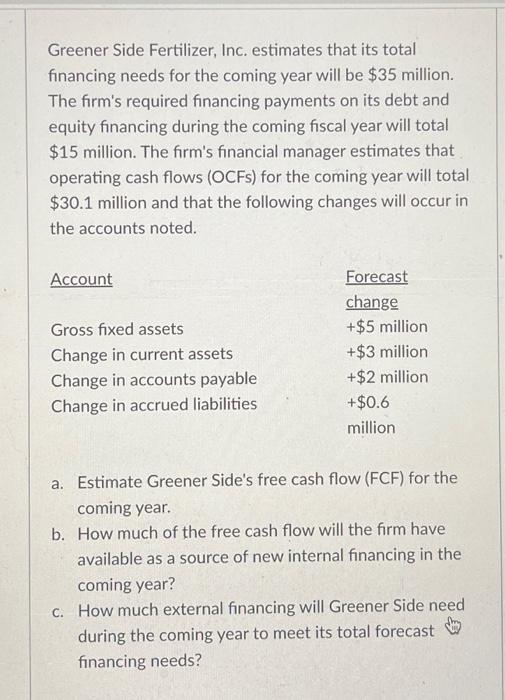

Greener Side Fertilizer, Inc. estimates that its total financing needs for the coming year will be $35 million. The firm's required financing payments on its debt and equity financing during the coming fiscal year will total $15 million. The firm's financial manager estimates that operating cash flows (OCFS) for the coming year will total $30.1 million and that the following changes will occur in the accounts noted. Account Gross fixed assets Change in current assets Change in accounts payable Change in accrued liabilities Forecast change +$5 million +$3 million +$2 million + $0.6 million a. Estimate Greener Side's free cash flow (FCF) for the coming year. b. How much of the free cash flow will the firm have available as a source of new internal financing in the coming year? c. How much external financing will Greener Side need during the coming year to meet its total forecast financing needs?

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a Free Cash Flow FCF Operating Cash Flows OCFs Required Fi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started