Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Greenland Company has two manufacturing departments-Milling and Assembly. The company uses job-order costing system and computes a predetermined overhead rate for each department. The

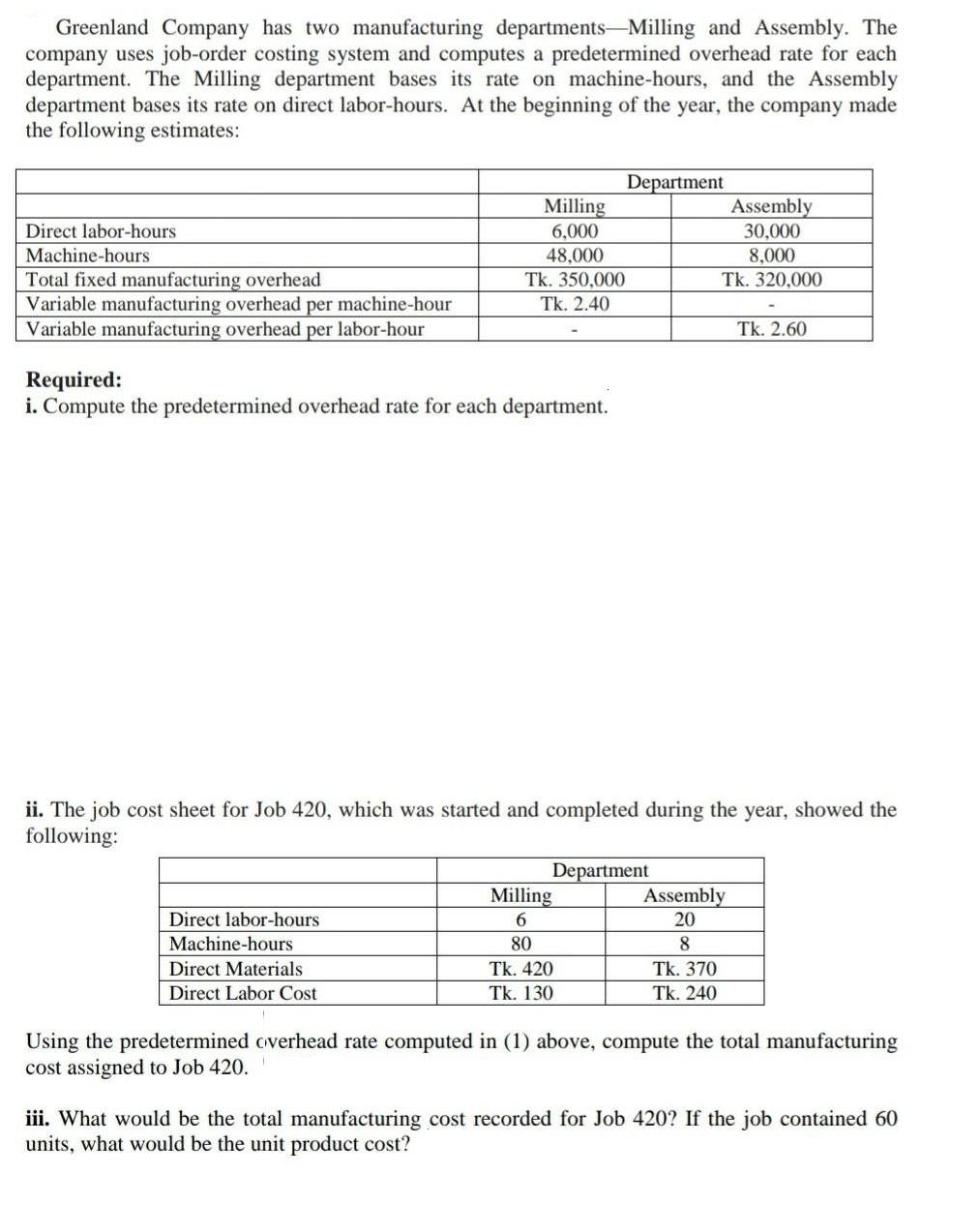

Greenland Company has two manufacturing departments-Milling and Assembly. The company uses job-order costing system and computes a predetermined overhead rate for each department. The Milling department bases its rate on machine-hours, and the Assembly department bases its rate on direct labor-hours. At the beginning of the year, the company made the following estimates: Department Assembly Milling 6,000 Direct labor-hours 30,000 Machine-hours 48,000 8,000 Total fixed manufacturing overhead Tk. 350,000 Tk. 320,000 Tk. 2.40 Variable manufacturing overhead per machine-hour Variable manufacturing overhead per labor-hour Tk. 2.60 Required: i. Compute the predetermined overhead rate for each department. ii. The job cost sheet for Job 420, which was started and completed during the year, showed the following: Department Milling 6 Assembly 20 Direct labor-hours Machine-hours 80 8 Direct Materials Tk. 420 Tk. 370 Direct Labor Cost Tk. 130 Tk. 240 Using the predetermined overhead rate computed in (1) above, compute the total manufacturing cost assigned to Job 420. iii. What would be the total manufacturing cost recorded for Job 420? If the job contained 60 units, what would be the unit product cost?

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 predetermined overhead rate estimated overheadsbase of allocatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started