Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Greensleves Inc. (Green) a publicly accountable entity has been publishing a collection of works by Holiday Corp. (Holly). Green purchased the copyright from Holly

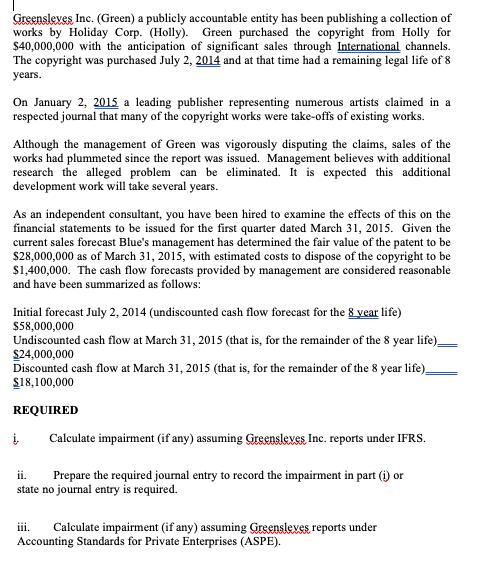

Greensleves Inc. (Green) a publicly accountable entity has been publishing a collection of works by Holiday Corp. (Holly). Green purchased the copyright from Holly for $40,000,000 with the anticipation of significant sales through International channels. The copyright was purchased July 2, 2014 and at that time had a remaining legal life of 8 years. On January 2, 2015 a leading publisher representing numerous artists claimed in a respected journal that many of the copyright works were take-offs of existing works. Although the management of Green was vigorously disputing the claims, sales of the works had plummeted since the report was issued. Management believes with additional research the alleged problem can be eliminated. It is expected this additional development work will take several years. As an independent consultant, you have been hired to examine the effects of this on the financial statements to be issued for the first quarter dated March 31, 2015. Given the current sales forecast Blue's management has determined the fair value of the patent to be $28,000,000 as of March 31, 2015, with estimated costs to dispose of the copyright to be $1,400,000. The cash flow forecasts provided by management are considered reasonable and have been summarized as follows: Initial forecast July 2, 2014 (undiscounted cash flow forecast for the 8 year life) $58,000,000 Undiscounted cash flow at March 31, 2015 (that is, for the remainder of the 8 year life)__ $24,000,000 Discounted cash flow at March 31, 2015 (that is, for the remainder of the 8 year life) $18,100,000 REQUIRED Calculate impairment (if any) assuming Greensleves, Inc. reports under IFRS. ii. Prepare the required journal entry to record the impairment in part (1) or state no journal entry is required. Calculate impairment (if any) assuming Greensleves reports under Accounting Standards for Private Enterprises (ASPE).

Step by Step Solution

★★★★★

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the impairment under IFRS International Financial Reporting Standards we need to compar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started