Answered step by step

Verified Expert Solution

Question

1 Approved Answer

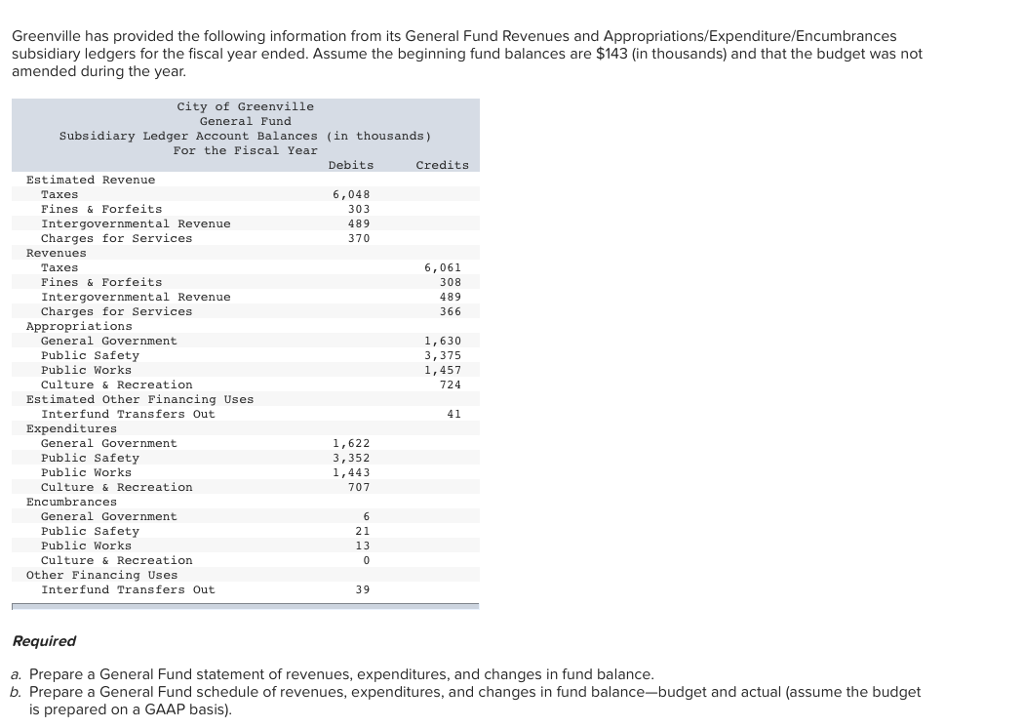

Greenville has provided the following information from its General Fund Revenues and Appropriations/Expenditure/Encumbrances subsidiary ledgers for the fiscal year ended. Assume the beginning fund balances

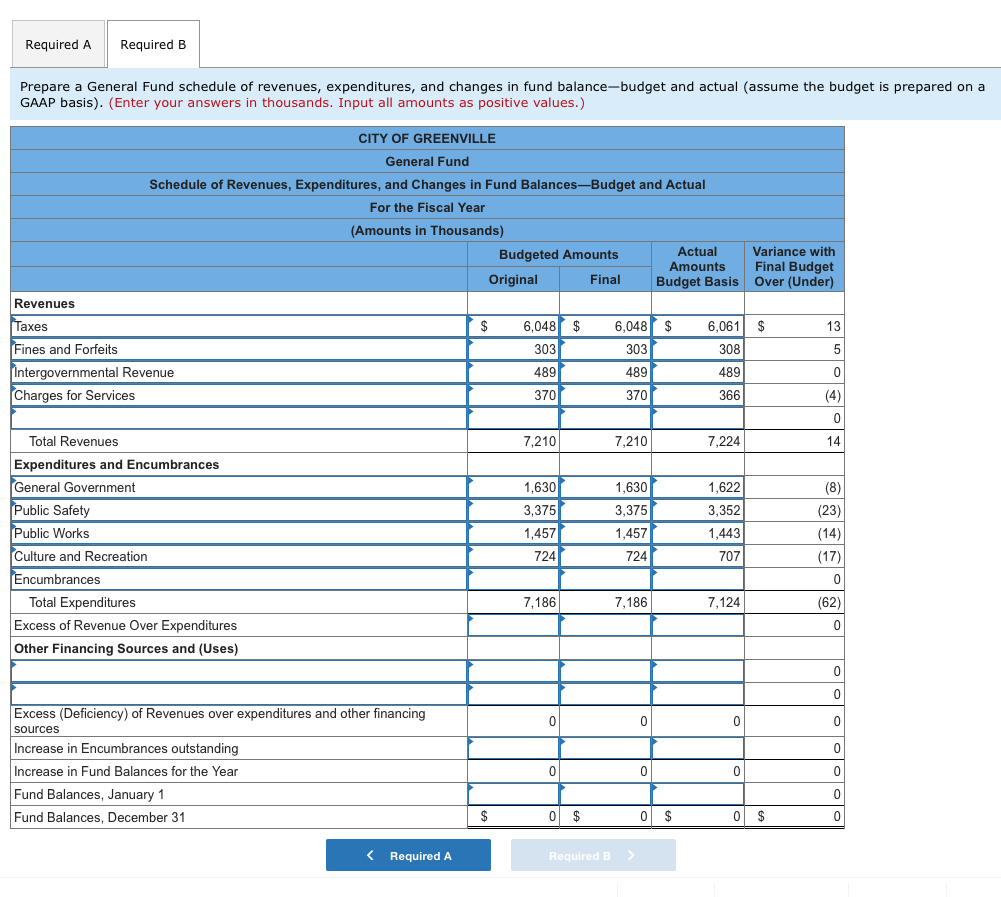

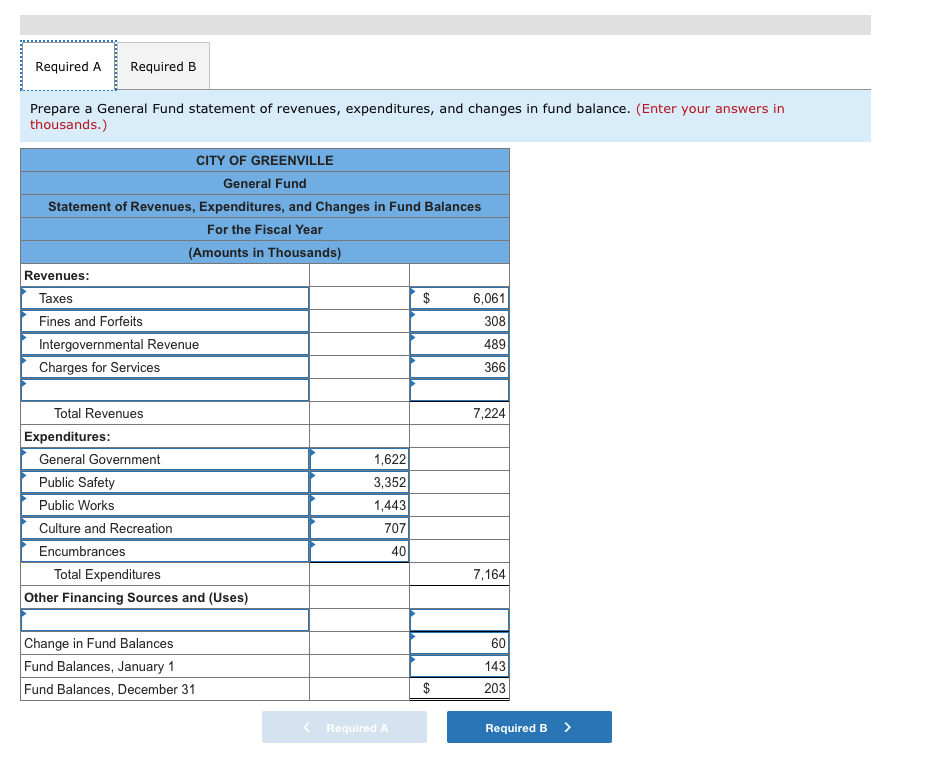

Greenville has provided the following information from its General Fund Revenues and Appropriations/Expenditure/Encumbrances subsidiary ledgers for the fiscal year ended. Assume the beginning fund balances are $143 (in thousands) and that the budget was not amended during the year City of Greenville General Fund Subsidiary Ledger Account Balances (in thousands) For the Fiscal Year Debits Credits Estimated Revenue Taxes Fines & Forfeits Intergovernmental Revenue Charges for Services 6,048 303 489 370 Revenues Taxes Fines & Forfeits Intergovernmental Revenue Charges for Services 6,061 308 489 366 Appropriations General Government Public Safety Public Works Culture & Recreation 1,630 3,375 1,457 724 Estimated Other Financing Uses Interfund Transfers Out 41 Expenditures General Government Public Safety Public Works Culture & Recreation 1,622 3,352 1,443 707 Encumbrances General Government Public Safety Public Works Culture & Recreation 2 1 13 other Financing Uses Interfund Transfers Out 39 Required a. Prepare a General Fund statement of revenues, expenditures, and changes in fund balance b. Prepare a General Fund schedule of revenues, expenditures, and changes in fund balance-budget and actual (assume the budget is prepared on a GAAP basis) RequiredA Required B Prepare a General Fund schedule of revenues, expenditures, and changes in fund balance-budget and actual (assume the budget is prepared on a GAAP basis). (Enter your answers in thousands. Input all amounts as positive values.) CITY OF GREENVILLE General Fund Schedule of Revenues, Expenditures, and Changes in Fund Balances-Budget and Actual For the Fiscal Year (Amounts in Thousands) Actual Amounts Budget Basis Variance with Final Budget Over (Under) Budgeted Amounts Original Final Revenues 6,048 6,048 $ 6,061 S 303 489 370 axes 13 303 489 370 308 489 366 ines and Forfeits Intergovernmental Revenue Charges for Services Total Revenues Expenditures and Encumbrances General Government Public Safety Public Works Culture and Recreation 7,210 7,210 7,224 14 1,630 3,375 1,457 724 1,630 3,375 1,457 724 1,622 3,352 1,443 707 (23) (14) (17) ncumbrances Total Expenditures 7,186 7,186 7,124 (62) e Over Expenditures Other Financing Sources and (Uses) Excess of Revenu Excess (Deficiency) of Revenues over expenditures and other financing sources Increase in Encumbrances outstanding Increase Fund Balances, January 1 Fund Balances, December 31 in Fund Balances for the Year K Required A Required B Required ARequired B Prepare a General Fund statement of revenues, expenditures, and changes in fund balance. (Enter your answers in thousands.) CITY OF GREENVILLE General Fund Statement of Revenues, Expenditures, and Changes in Fund Balances For the Fiscal Year Amounts in Thousands Revenues: Taxes Fines and Forfeits Intergovernmental Revenue Charges for Services 6,061 308 489 366 Total Revenues 7,224 Expenditures General Government Public Safety Public Works Culture and Recreatio Encumbrances 1,622 3,352 1,443 707 40 Total Expenditures 7,164 Other Financing Sources and (Uses) Change in Fund Balances Fund Balances, January 1 Fund Balances, December 31 60 143 203 Required A Required B >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started