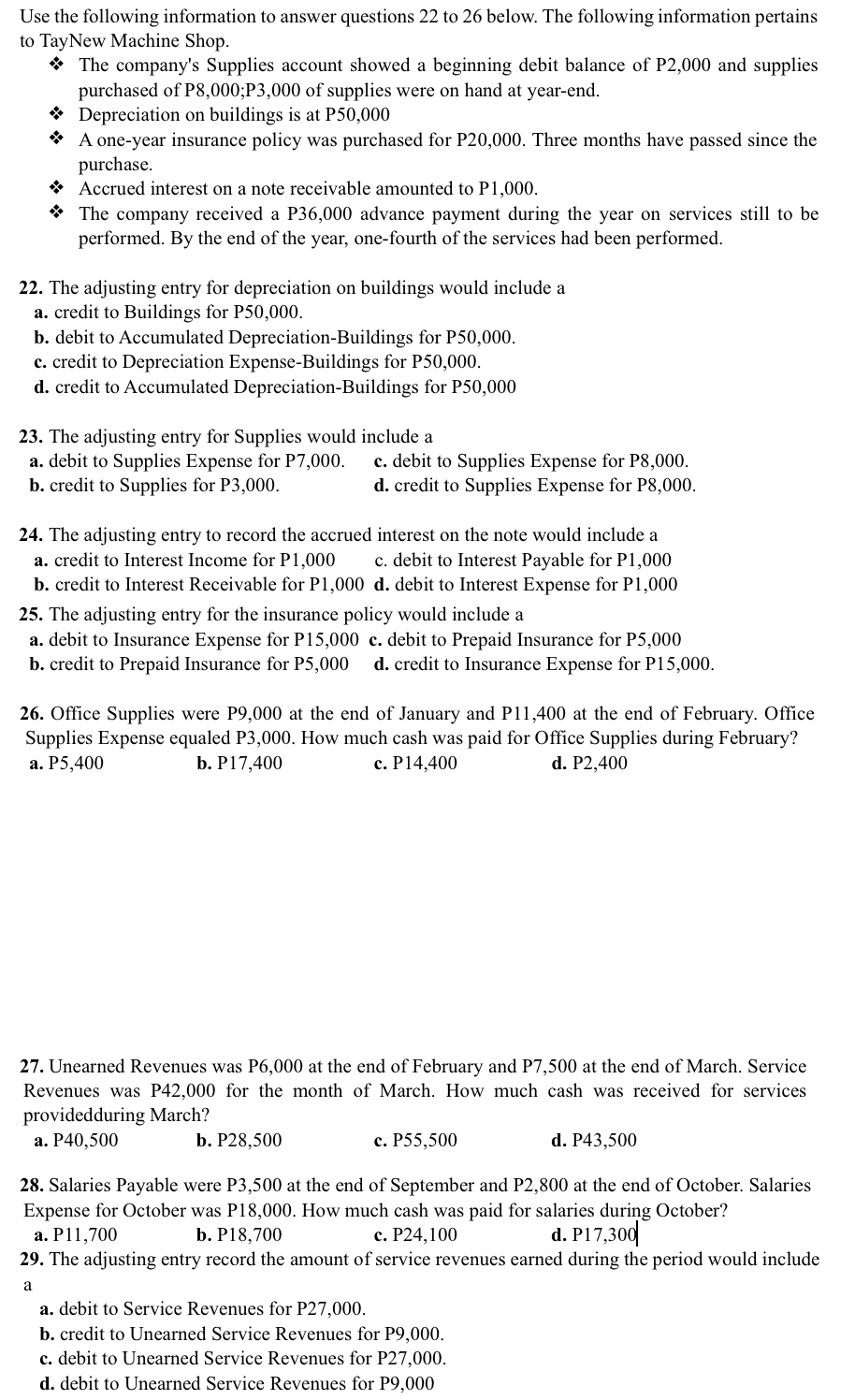

Greetings, I need help on the adjusting entry for the following questions (22-26) and also, for 27-29. I hope you can shed light on these. Thank you! :)

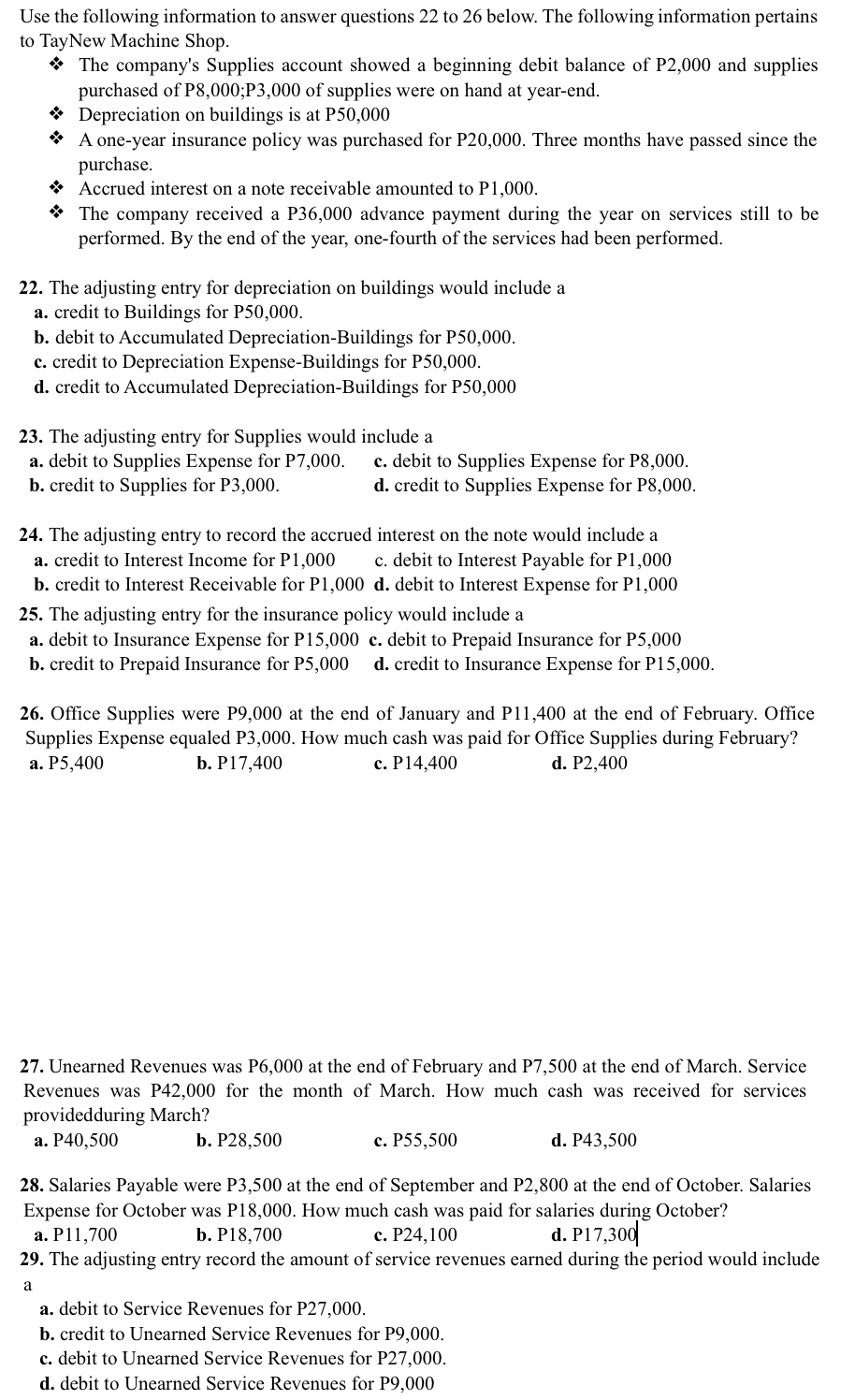

Use the following information to answer questions 22 to 26 below. The following information pertains to TayNew Machine Shop. * The company's Supplies account showed a beginning debit balance of P2,000 and supplies purchased of P8,000;P3,000 of supplies were on hand at year-end. * Depreciation on buildings is at P50,000 * A one-year insurance policy was purchased for P20,000. Three months have passed since the purchase. Accrued interest on a note receivable amounted to P1,000. * The company received a P36,000 advance payment during the year on services still to be performed. By the end of the year, one-fourth of the services had been performed. 22. The adjusting entry for depreciation on buildings would include a a. credit to Buildings for P50,000. b. debit to Accumulated Depreciation-Buildings for P50,000. c. credit to Depreciation Expense-Buildings for P50,000. d. credit to Accumulated Depreciation-Buildings for P50,000 23. The adjusting entry for Supplies would include a a. debit to Supplies Expense for P7,000. c. debit to Supplies Expense for P8,000. b. credit to Supplies for P3,000. d. credit to Supplies Expense for P8,000. 24. The adjusting entry to record the accrued interest on the note would include a a. credit to Interest Income for P1,000 c. debit to Interest Payable for P1,000 b. credit to Interest Receivable for P1,000 d. debit to Interest Expense for P1,000 25. The adjusting entry for the insurance policy would include a a. debit to Insurance Expense for P15,000 c. debit to Prepaid Insurance for P5,000 b. credit to Prepaid Insurance for P5,000 d. credit to Insurance Expense for P15,000. 26. Office Supplies were P9,000 at the end of January and P11,400 at the end of February. Office Supplies Expense equaled P3,000. How much cash was paid for Office Supplies during February? a. P5,400 b. P17,400 c. P14,400 d. P2,400 27. Unearned Revenues was P6,000 at the end of February and P7,500 at the end of March. Service Revenues was P42,000 for the month of March. How much cash was received for services providedduring March? a. P40,500 b. P28,500 c. P55,500 d. P43,500 28. Salaries Payable were P3,500 at the end of September and P2,800 at the end of October. Salaries Expense for October was P18,000. How much cash was paid for salaries during October? a. P11,700 b. P18,700 c. P24,100 d. P17,300 29. The adjusting entry record the amount of service revenues earned during the period would include a a. debit to Service Revenues for P27,000. b. credit to Unearned Service Revenues for P9,000. c. debit to Unearned Service Revenues for P27,000. d. debit to Unearned Service Revenues for P9,000