Question

Greggs Shipping Supplies Ltd (GSSL) trades in the buying and selling of ship spares and has several branches within the Caribbean. Recently the company has

Greggs Shipping Supplies Ltd (GSSL) trades in the buying and selling of ship spares and has several branches within the Caribbean. Recently the company has seen a rapid increase in demand of its products across all branches and is therefore in need of additional financing to adequately boost its supply inventory. The corporate banking head of Bankers Choice Bank is requesting a full set of financial statements to ensure that granting the loan to GSSL would be financially feasible during a period when many businesses are facing financial challenges. The company financial year ends on June 30 each year and you have been tasked with the responsibility to prepare the financial information for the St. Kitts Branch.

4. Prepare the companys statement of owners equity at June 30, 2022.

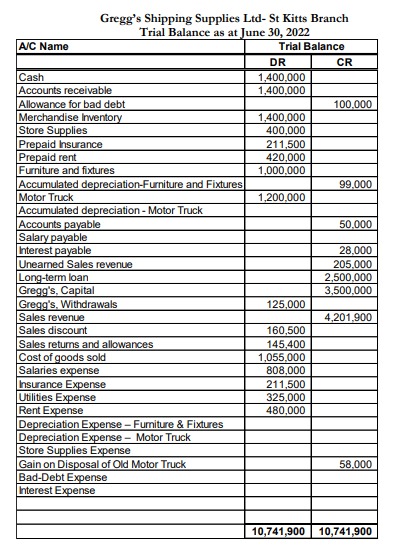

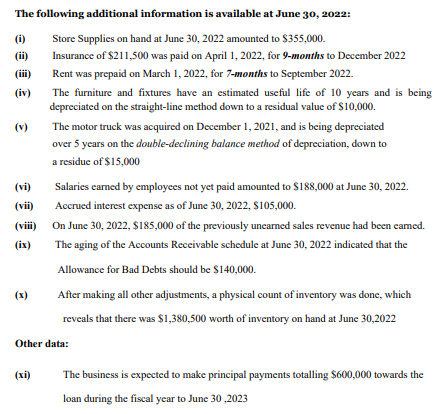

Gregg's Shipping Supplies Ltd- St Kitts Branch Trial Balance as at June 30, 2022 \begin{tabular}{|l|r|r|} \hline A/C Name & \multicolumn{2}{|c|}{ Trial Balance } \\ \hline & \multicolumn{1}{|c|}{ DR } & \multicolumn{1}{|c|}{ CR } \\ \hline \hline Cash & 1,400,000 & \\ \hline Accounts receivable & 1,400,000 & \\ \hline Allowance for bad debt & & 100,000 \\ \hline Merchandise Inventory & 1,400,000 & \\ \hline Store Supplies & 400,000 & \\ \hline Prepaid hsurance & 211,500 & \\ \hline Prepaid rent & 420,000 & \\ \hline Furniture and fixtures & 1,000,000 & \\ \hline Accumulated depreciation-Furniture and Fixtures & & 99,000 \\ \hline Motor Truck & 1,200,000 & \\ \hline Accumulated depreciation - Motor Truck & & \\ \hline Accounts payable & & 50,000 \\ \hline Salary payable & & \\ \hline Interest payable & & 28,000 \\ \hline Uneamed Sales revenue & & 205,000 \\ \hline Long-term loan & & 2,500,000 \\ \hline Gregg's, Capital & & 3,500,000 \\ \hline Gregg's, Withdrawals & 125,000 & \\ \hline Sales revenue & & 4,201,900 \\ \hline Sales discount & 160,500 & \\ \hline Sales retums and allowances & 145,400 & \\ \hline Cost of goods sold & 1,055,000 & \\ \hline Salaries expense & 808,000 & \\ \hline hsurance Expense & 211,500 & \\ \hline Utilities Expense & 325,000 & \\ \hline Rent Expense & 480,000 & \\ \hline Depreciation Expense - Furniture \& Fixtures & & \\ \hline Depreciation Expense - Motor Truck & & \\ \hline Store Supplies Expense & & \\ \hline Gain on Disposal of Old Motor Truck & & \\ \hline Bad-Debt Expense & & \\ \hline Interest Expense & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} The following additional information is available at June 30,2022 : (i) Store Supplies on hand at June 30, 2022 amounted to $355,000. (ii) Insurance of $211,500 was paid on April 1, 2022, for 9-months to December 2022 (iii) Rent was prepaid on March 1, 2022, for 7-months to September 2022. (iv) The furniture and fixtures have an estimated useful life of 10 years and is being depreciated on the straight-line method down to a residual value of $10,000. (v) The motor truck was acquired on December 1, 2021, and is being depreciated over 5 years on the double-declining balance method of depreciation, down to a residue of $15,000 (vi) Salaries earned by employees not yet paid amounted to $188,000 at June 30,2022 . (vii) Accrued interest expense as of June 30, 2022, $105,000. (viii) On June 30, 2022, $185,000 of the previously unearned sales revenue had been eamed. (ix) The aging of the Accounts Receivable schedule at June 30,2022 indicated that the Allowance for Bad Debts should be $140,000. (x) After making all other adjustments, a physical count of inventory was done, which reveals that there was $1,380,500 worth of inventory on hand at June 30,2022 Other data: (xi) The business is expected to make principal payments totalling $600,000 towards the loan during the fiscal year to June 30,2023 Gregg's Shipping Supplies Ltd- St Kitts Branch Trial Balance as at June 30, 2022 \begin{tabular}{|l|r|r|} \hline A/C Name & \multicolumn{2}{|c|}{ Trial Balance } \\ \hline & \multicolumn{1}{|c|}{ DR } & \multicolumn{1}{|c|}{ CR } \\ \hline \hline Cash & 1,400,000 & \\ \hline Accounts receivable & 1,400,000 & \\ \hline Allowance for bad debt & & 100,000 \\ \hline Merchandise Inventory & 1,400,000 & \\ \hline Store Supplies & 400,000 & \\ \hline Prepaid hsurance & 211,500 & \\ \hline Prepaid rent & 420,000 & \\ \hline Furniture and fixtures & 1,000,000 & \\ \hline Accumulated depreciation-Furniture and Fixtures & & 99,000 \\ \hline Motor Truck & 1,200,000 & \\ \hline Accumulated depreciation - Motor Truck & & \\ \hline Accounts payable & & 50,000 \\ \hline Salary payable & & \\ \hline Interest payable & & 28,000 \\ \hline Uneamed Sales revenue & & 205,000 \\ \hline Long-term loan & & 2,500,000 \\ \hline Gregg's, Capital & & 3,500,000 \\ \hline Gregg's, Withdrawals & 125,000 & \\ \hline Sales revenue & & 4,201,900 \\ \hline Sales discount & 160,500 & \\ \hline Sales retums and allowances & 145,400 & \\ \hline Cost of goods sold & 1,055,000 & \\ \hline Salaries expense & 808,000 & \\ \hline hsurance Expense & 211,500 & \\ \hline Utilities Expense & 325,000 & \\ \hline Rent Expense & 480,000 & \\ \hline Depreciation Expense - Furniture \& Fixtures & & \\ \hline Depreciation Expense - Motor Truck & & \\ \hline Store Supplies Expense & & \\ \hline Gain on Disposal of Old Motor Truck & & \\ \hline Bad-Debt Expense & & \\ \hline Interest Expense & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} The following additional information is available at June 30,2022 : (i) Store Supplies on hand at June 30, 2022 amounted to $355,000. (ii) Insurance of $211,500 was paid on April 1, 2022, for 9-months to December 2022 (iii) Rent was prepaid on March 1, 2022, for 7-months to September 2022. (iv) The furniture and fixtures have an estimated useful life of 10 years and is being depreciated on the straight-line method down to a residual value of $10,000. (v) The motor truck was acquired on December 1, 2021, and is being depreciated over 5 years on the double-declining balance method of depreciation, down to a residue of $15,000 (vi) Salaries earned by employees not yet paid amounted to $188,000 at June 30,2022 . (vii) Accrued interest expense as of June 30, 2022, $105,000. (viii) On June 30, 2022, $185,000 of the previously unearned sales revenue had been eamed. (ix) The aging of the Accounts Receivable schedule at June 30,2022 indicated that the Allowance for Bad Debts should be $140,000. (x) After making all other adjustments, a physical count of inventory was done, which reveals that there was $1,380,500 worth of inventory on hand at June 30,2022 Other data: (xi) The business is expected to make principal payments totalling $600,000 towards the loan during the fiscal year to June 30,2023Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started