Question

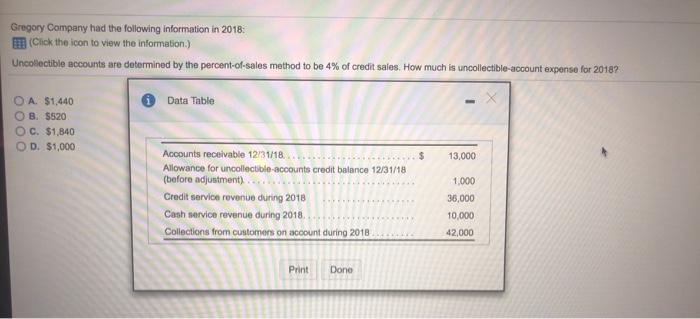

Gregory Company had the following information in 2018: (Click the icon to view the information.) Uncollectible accounts are determined by the percent-of-sales method to

Gregory Company had the following information in 2018: (Click the icon to view the information.) Uncollectible accounts are determined by the percent-of-sales method to be 4% of credit sales. How much is uncollectible-account expense for 20182 O A. $1,440 Data Table B. $520 OC. $1,840 OD. $1,000 Accounts receivable 12/31/18. %24 13,000 Allowance for uncollectible-accounts credit balance 12/31/18 (before adjustment) 1,000 Credit service revenue during 2018 36,000 Cash service revenue during 2018. 10,000 Collections from customens on account during 2018 42,000 Print Done

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution How much is un...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield

13th Edition

9780470374948, 470423684, 470374942, 978-0470423684

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App